财务英语

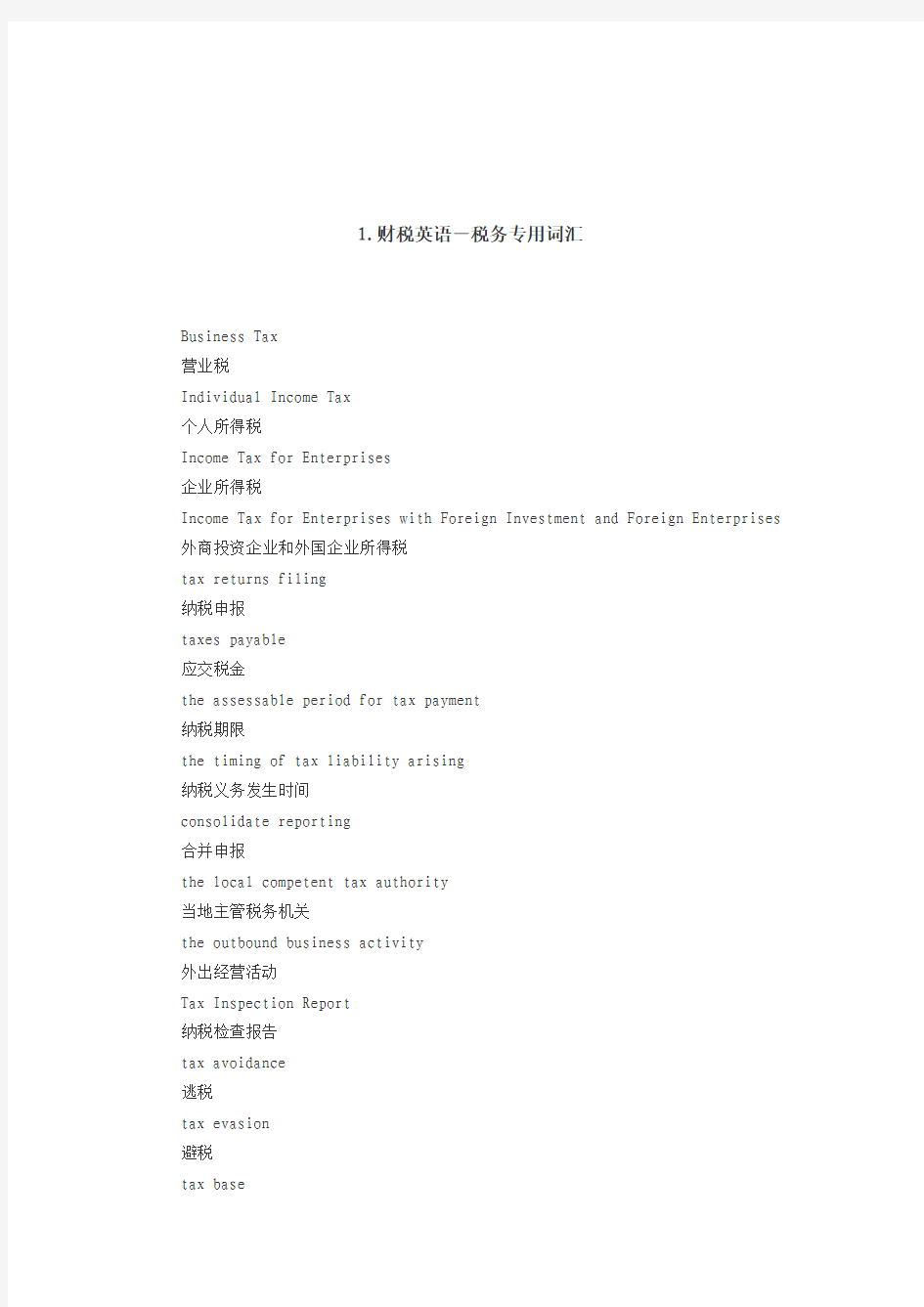

1.财税英语-税务专用词汇

Business Tax

营业税

Individual Income Tax

个人所得税

Income Tax for Enterprises

企业所得税

Income Tax for Enterprises with Foreign Investment and Foreign Enterprises 外商投资企业和外国企业所得税

tax returns filing

纳税申报

taxes payable

应交税金

the assessable period for tax payment

纳税期限

the timing of tax liability arising

纳税义务发生时间

consolidate reporting

合并申报

the local competent tax authority

当地主管税务机关

the outbound business activity

外出经营活动

Tax Inspection Report

纳税检查报告

tax avoidance

逃税

tax evasion

避税

tax base

税基

refund after collection

先征后退

withhold and remit tax

代扣代缴

collect and remit tax

代收代缴

income from authors remuneration

稿酬所得

income from remuneration for personal service 劳务报酬所得

income from lease of property

财产租赁所得

income from transfer of property

财产转让所得

contingent income

偶然所得

resident

居民

non-resident

非居民

tax year

纳税年度

temporary trips out of

临时离境

flat rate

比例税率

withholding income tax

预提税

withholding at source

源泉扣缴

State Treasury

国库

tax preference

税收优惠

the first profit-making year

第一个获利年度

refund of the income tax paid on the reinvested amount

再投资退税

export-oriented enterprise

出口型企业

technologically advanced enterprise

先进技术企业

Special Economic Zone

经济特区

2.注会英语:财务比率英文术语

Accounts Payable: Sales: Accounts Payable pided by Annual Sales, measuring the speed with which a company pays vendors relative to sales. Numbers higher than typical industry ratios suggest that the company is using suppliers to float operations.

Assets: Sales: Total Assets pided by Net Sales, indicating whether a company is handling too high a volume of sales in relation to investment. Very low percentages relative to industry norms might indicate overly conservative sales efforts or poor sales management.

Current Liabilities: Inventory: Current Liabilities pided by Inventory: A high ratio, relative to industry norms, suggests over-reliance on unsold goods to finance operations.

Current Liabilities: Net Worth: Current Liabilities pided by Net Worth, reflecting a level of security for creditors. The larger the ratio relative to industry norms, the less security there is for creditors.

Current Ratio: Current Assets pided by Current Liabilities, measuring current assets available to cover current liabilities, a test of near-term solvency. The ratio indicates to what extent cash on hand and disposable assets are enough to pay off near term liabilities.

Fixed Assets:Net Worth: Fixed Assets pided by Net Worth. High ratios relative

to the industry can indicate low working capital or high levels of debt.

Gross Profit:Sales: Pre-tax profits pided by Annual Sales. This is the profit ratio before product and sales costs, as well as taxes. This ratio can indicate the "play" in other expenses which could be adjusted to increase the Net Profit margin.

Net Profit:Sales: After tax profits pided by Annual Sales. This is the key profit ratio, indicating how much is put in the company's pocket for each $100 of sales.

Quick Ratio: Cash plus Accounts Receivable, pided by Current Liabilities, indicating liquid assets available to cover current debt. Also known as the Acid Ratio. This is a harsher version of the Current Ratio, which balances short-term liabilities against cash and liquid instruments.

Return on Assets: Net After Tax Profit pided by Total Assets, a critical indicator of profitability. Companies which use their assets efficiently will tend to show a ratio higher than the industry norm.

Return on Net Worth:Net After Tax Profit pided by Net Worth, this is the 'final measure' of profitability to evaluate overall return. This ratio measures return relative to investment in the company. Put another way, Return on Net Worth indicates how well a company leverages the investment in it.

Return on Sales: Net After Tax Profit pided by Annual Net Sales, indicating the level of profit from each dollar of sales. This ratio can be used as a predictor of the company's ability to withstand changes in prices or market conditions.

Sales: Inventory: Annual Net Sales pided by Inventory value. This gives a picture of how quickly inventory turns over. Ratios below the industry norm suggest high levels of inventory. High ratios could indicate product levels insufficient to satisfy demand in a timely manner.

Sales:Net Working Capital: Sales pided by Net Working Capital (current assets minus current liabilities). Ratios higher than industry norms may indicate a strain on available liquid assets, while low ratios may suggest too much liquidity.

Total Liabilities: Net Worth: Total liabilities pided by Net Worth. This ratio helps to clarify the impact of long-term debt, which can be seen by comparing this ratio with Current Liabilities: Net Worth. Creditors are concerned to the extent that total liability levels exceed Net Worth. The impact of long-term debt Turnover Ratios:Sales pided by various line items (cash, accounts receivable, accounts payable, inventory, current assets, total assets, fixed assets).These turnover rations measure operating characteristics of firms. Higher is better for Asset line items. Lower is better for Accounts Payable Turnover. Turnover ratios

create a series of operating efficiency indicators relative to sales.

3.常用资产类科目的英文名称

现金:Cash and cash equivalents

银行存款:Bank deposit

应收账款:Account receivable

应收票据:Notes receivable

应收股利:Dividend receivable

应收利息:Interestreceivable

其他应收款:Other receivables

原材料:Raw materials

在途物资:Materials in transport

库存商品:inventory

存货跌价准备:provision forthe declinein value ofinventories

坏账准备:Bad debt provision

待摊费用:Prepaid expense

交易性金融资产:Trading financial assets

持有至到期投资:held-to-maturity investment

可供出售金融资产:Available-for-sale financial assets

短期投资:Short-term investment

长期股权投资:Long-term equity investment

固定资产:Fixed assets

累计折旧:Accumulated depreciation

在建工程:Construction-in-process

固定资产减值准备:provision for the decline in value of fixed assets 无形资产:Intangible assets

累计摊销:Accumulated amortization

商誉:Goodwill

递延所得税资产:deferred tax assets (DTA )

4.固定资产的相关单词

常见的固定资产

building 建筑物

plant 厂房

machinery 机械

equipment 设备

vehicles 车辆

fixture 固定设施

Acquisition cost 购置成本

acquire v. 获得,取得

purchase price 买价

transportation cost 运费

installation cost 安装费用

tax 税金等

historical cost:原始成本

fair value 公允价值

market value 市场价值

depreciation n. 折旧,损耗(有些资产)

amortization 摊销(无形资产)

accumulated depreciation 累积折旧

depreciation expense 折旧费用

depreciation base 折旧基数

book value /carrying value 账目价值(=historical cost –accumulated depreciation)

estimated residual value/ estimated salvage value 预计净残值

estimated useful life 预计使用年限(No.of years)/(No.of production units)useful life 使用寿命,使用年限

固定资产提折旧的方法

a.straight-line method 直线折旧法,平均年限法

b.units of production method 工作量法

Accelerated depreciation 加速折旧法:

c.double-declining balance method 双倍余额递减法

d.sum-of-the-years' digits method 年数总和法

journal entry 与折旧有关的会计分录

Dr.depreciation expense 折旧费用

Cr.accumulated depreciation 累计折旧

5.存货相关的英文单词

Inventory n. 存货,库存

inventory turnover 存货周转率

inventory control 存货控制

beginning inventory 初始存货

ending inventory 期末存货

take a physical inventory 盘库

Merchandise inventory 商品存货

Raw materials 原材料

Work in process(WIP)(处在生产过程中的)在制品,半成品Finished goods 成品

Inventory valuation 存货的价值计量

cost n. 成本,费用

direct costs 直接成本

indirect costs 间接成本

fixed costs 固定成本

cost accounting 成本会计

unit cost 单个成本

total cost 总成本

cost of sales (COS) = cost of goods sold(CGS)销货成本sales revenue 销售收入

purchase(price)采购成本

freight 运费

storing cost 存储

insurance 保险费

tax 税费

loading and unloading cost 装卸费

Lower of cost or market rule (LCM rule)成本与市场孰低法market value (fair value)公允价值

carrying value 账面成本

net realizable value 可变现净值

estimated sale price 估计售价

related costs and tax 估计销售费用和税金

contract price 合同价格

sales price 销售价格

6.注会英语中的基础分录

1)purchases of inventory in cash for RMB¥3,000(现金人民币3,000元购买存货)Dr.inventory 3,000

Cr.cash 3,000

借:存货 3,000

贷:库存现金 3,000

2)sales on account of US$10,000 (赊销方式销售,收入10,000美元)

Dr.account receivable 10,000

Cr.sales revenue 10,000

借:应收账款 10,000

贷:销售收入 10,000

3)paid RMB¥50,000 in salaries & wages(支付工资人民币50,000元)

Dr.wages & salaries expense 50,000

Cr.bank deposit 50,000

借:职工薪酬 50,000

贷:银行存款 50,000

4)cash sale of US$1,180(销售收入现金1,180美元)

Dr.cash 1,180

Cr.sales revenue 1,180

借:库存现金 1,180

贷:销售收入1,180

5)pre-paid insurance for US$12,000 (预付保险费12,000美元)

Dr.prepaid insurance 12,000

Cr.bank deposit 12,000

借:预付保险 12,000

贷:银行存款 12,000

7.注会英语考试基础单词

2010-09-14 14:30来源:中华会计网校

我要纠错|打印 | 大 | 中 | 小

1.accounting n.会计;会计学

e.g.T-account: T型账户;account payable 应付账款 account receivable 应收账款;

accountant n.会计人员,会计师 CPA (certified public accountant)注册会计师

2.Accounting concepts会计的基本前提

1)accounting entity 会计主体;entity 实体,主体

2)going concern 持续经营

3)accounting period 会计分期

financial year/ fiscal year 会计年度(financial adj.财务的,金融的; fiscal adj.财政的)

4)money measurement 货币计量

人民币 RMB¥美元 US$ 英镑£法国法郎 FFr

权责发生制 accrual basis

accrual n.本身是应计未付的意思,

accrue v.应计未付,应计未收,

e.g.accrued liabilities,应计未付负债

3.Quality of accounting information会计信息质量要求

(1)可靠性reliability

(2)相关性 relevance

(3)可理解性 understandability

(4)可比性 comparability

(5)实质重于形式 substance over form

(6)重要性 materiality

(7)谨慎性 prudence

(8)及时性 timeliness

4.Elements of accounting会计要素

1)Assets: 资产

current assets 流动资产

cash and cash equivalents 现金及现金等价物(bank deposit)

inventory 存货 receivable 应收账款 prepaid expense 预付费用

non-current assets 固定资产

property (land and building)不动产, plant 厂房, equipment 设备(PPE)

e.g.The total assets owned by Wilson company on December 31, 2006 was US$1,500,000.

2)Liabilities: 负债

funds provided by the creditors. creditor 债权人,赊销方

current liabilities 当期负债

non-current liabilities 长期负债

total liabilities

account payable 应付账款 loan 贷款 advance from customers 预收款

bond 债券(由政府发行, government bond /treasury bond政府债券,国库券)

debenture 债券(由有限公司发行)

3)Owners’ equity: 所有者权益(Net assets)

funds provided by the investors. Investor 投资者

paid in capital (contributed capital)实收资本

shares /capital stock (u.s.)股票

retained earnings 留存收益

dividend 分红

beginning retained earnings ending retained earnings

reserve 储备金(资产重估储备金,股票溢价账户)

e.g.The company offered/issued 10,000 shares at the price of US$2.30 each.

4)Revenue: 收入

sales revenue 销售收入 interest revenue 利息收入 rent revenue 租金收入

5)Expense: 费用

cost of sales 销售成本, wages expense 工资费用

6)Profit (income, gain):利润 net profit, net income

5.Financial statement财务报表

1)balance sheet 资产负债表

2)income statement 利润表

3)statement of retained earnings 所有者权益变动表

4)cash flow statement 现金流量表

6.Accounting cycle

1)journal entries 日记账 general journal 总日记账

general ledger 总分类账 trial balance 试算平衡表

adjusting entries 调整分录 adjusted trial balance 调整后的试算平衡表Financial statements 财务报表 closing entry 完结分录

2)Dr.—Debit 借 Cr.—Credit 贷

Double-entry system 复式记账

8.会计科目及术语中英对照

2009-12-25 11:53来源:

我要纠错|打印 | 大 | 中 | 小

Inventor y存货

Long-term equity investment 长期股权投资

Investment property 投资性房地产

Fixed assets 固定资产

Biological assets 生物资产

Intangible assets 无形资产

Exchange of non-monetary assets 非货币性资产

Impairment of assets 资产减值

Employee compensation 员工薪酬

Enterprise annuity fund 企业年金基金

Share-based payment 股份支付

Debt restructurings 债务重组

Contingences 或有事项

Revenue 收入

Construction contracts 建造合同

Government grants 政府补助

Borrowing costs 借款费用

Income taxes 所得税

Foreign currency translation 外币折算

Business combination 企业合并

Lease 租赁

Recognition and measurement of financial instruments 金融工具确认和计量Transfer of financial assets 金融资产转移

Hedging 套期保值

Direct insurance contracts 原保险合同

Re-insurance contracts 再保险合同

Extraction of petroleum and natural gas 石油天然气开采

Changes in accounting policies and estimates, and correction of errors 会计政策、会计估计变更和差错更正

Events after the balance sheet date 资产负债表日后事项

Presentation of financial statements 财务报表列报

Cash flow statements 现金流量表

Interim financial reporting 中期财务报告

Consolidated financial statements 合并财务报表

Earnings per share 每股收益

Segment reporting 分部报告

Related party disclosure 关联方披露

Presentation of financial instruments 金融工具列报

9.审计常用词汇

2009-10-08 13:26来源:读者上传

我要纠错|打印 | 大 | 中 | 小

1.Assurance engagements and external audit

鉴证业务和外部审计

Materiality, true and fair presentation, reasonable assurance

重要性,真实、公允反映,合理保证

Appointment, removal and resignation of auditors

注册会计师的聘用,解聘和辞职

Types of opinion: unmodified opinion, modified opinion, adverse opinion,disclaimer of opinion

审计意见类型:无保留意见,保留意见,否定意见,无法表示意见

Professional ethics: independence, objectivity, integrity, professional competence, due care, confidentiality,

professional behavior

职业道德:独立、客观和公正,专业胜任能力,应有的关注,保密性,职业行为

Engagement letter

审计业务约定书

2.Planning and risk assessment

审计计划和风险评估

General principles

一般原则

Plan and perform audits with an attitude of professional skepticism 计划和执行审计业务应保持应有的职业怀疑态度

Audit risks = inherent risk ×control risk ×detection risk

审计风险=固有风险×控制风险×检查风险

Risk-based approach

风险导向型审计

Understanding the entity and knowledge of the business

了解被审单位

Assessing the risks of material misstatement and fraud

估计重大错报或舞弊的风险

Materiality (level), tolerable error

重要性水平,可容忍误差

Analytical procedures

分析性复核程序

Planning an audit

制定审计计划

Audit documentation: working papers

审计记录:工作底稿

The work of others

利用其他人的工作

Rely on the work of experts

利用专家工作

Rely on the work of internal audit

利用内部审计人员的工作

3.Internal control

内部控制

The evaluation of internal control systems

内部控制系统评价Tests of control

控制测试

Substantive procedures (time, nature, extent)

实质性程序(时间,性质,范围)

Transaction cycles: revenue, purchases, inventory, etc.

4.Audit evidence

审计证据

Obtain sufficient, appropriate audit evidence

获取充分、适当的审计证据

Assertions contained in the financial statements: completeness, occurrence,existence, measurement,

presentation and disclosure, rights and obligations

财务报表所包含的认定:完整性,发生,存在,计价,表达和披露,权利和义务

The audit of specific items

具体项目的审计

Receivables: confirmation

应收账款:函证

Inventory: counting, cut-off, confirmation of inventory held by third parties 存货:盘点,截止测试,对第三方持有存货进行函证Payables: supplier statement reconciliation, confirmation

应付账款:供应商对账,函证

Bank and cash: bank confirmation

货币资金:银行函证

Auditing sampling

审计抽样

5.Review

复核

Subsequent events

期后事项

Going concern

持续经营

Management representations

管理层声明

Audit finalization and the final review: unadjusted differences

终结审计和最后复核:未调整差异

会计英语的常用术语

会计英语的常用术语 1.accounting n.会计;会计学 account n..账,账目a/c;账户 e.g.T-account: T型账户;account payable应付账款receivable 应收账款);accountant n.会计人员,会计师CPA (certified public accountant)注册会计师 2.Accounting concepts 会计的基本前提 1)accounting entity 会计主体;entity 实体,主体 2)going concern 持续经营 3)accounting period 会计分期 financial year/ fiscal year 会计年度(financial adj.财务的,金融的;fiscal adj.财政的)4)money measurement货币计量 人民币RMB¥美元US$ 英镑£法国法郎FFr *权责发生制accrual basis. accrual n.本身是应计未付的意思, accrue v.应计未付,应计未收, e.g.accrued liabilities,应计未付负债 3.Quality of accounting information 会计信息质量要求 (1)可靠性reliability (2)相关性relevance (3)可理解性understandability (4)可比性comparability (5)实质重于形式substance over form (6)重要性materiality (7)谨慎性prudence (8)及时性timeliness 4.Elements of accounting会计要素 1)Assets: 资产 –current assets 流动资产 cash and cash equivalents 现金及现金等价物(bank deposit) inventory存货receivable应收账款prepaid expense 预付费用 –non-current assets 固定资产 property (land and building)不动产, plant 厂房, equipment 设备(PPE) e.g.The total assets owned by Wilson company on December 31, 2006 was US$1,500,000. 2)Liabilities: 负债 funds provided by the creditors. creditor债权人,赊销方 –current liabilities 当期负债 non-current liabilities 长期负债 total liabilities account payable应付账款loan贷款advance from customers 预收款 bond债券(由政府发行, government bond /treasury bond政府债券,国库券)debenture债券(由有限公司发行) 3)Owners’equity: 所有者权益(Net assets) funds provided by the investors. Investor 投资者

(财务会计)会计英语词汇

会计科目英文 会计系统 Accounting system 美国会计协会 American Accounting Association 美国注册会计师协会 American Institute of CPAs 审计 Audit 资产负债表 Balance sheet 簿记 Bookkeeping 现金流量预测 Cash flow prospects 内部审计证书Certificate in Internal Auditing 管理会计证书 Certificate in Management Accounting 注册会计师Certificate Public Accountant 成本会计Cost accounting 外部使用者External users 财务会计Financial accounting 财务会计准则委员会Financial Accounting Standards Board 财务预测Financial forecast 公认会计原则Generally accepted accounting principles 通用目的信息 General-purpose information 政府会计办公室Government Accounting Office 损益表 Income statement 内部审计师协会Institute of Internal Auditors 管理会计师协会Institute of Management Accountants 整合性Integrity 内部审计Internal auditing 内部控制结构Internal control structure 国内收入署Internal Revenue Service 内部使用者 Internal users 管理会计Management accounting 投资回报Return of investment 投资报酬Return on investment 证券交易委员会 Securities and Exchange Commission 现金流量表Statement of cash flow 财务状况表Statement of financial position 税务会计 Tax accounting 会计等式Accounting equation 勾稽关系 Articulation 资产 Assets 企业个体Business entity 股本Capital stock 公司Corporation 成本原则Cost principle 债权人Creditor 通货紧缩 Deflation 批露Disclosure 费用Expenses 财务报表Financial statement 筹资活动Financial activities 持续经营假设Going-concern assumption 通货膨涨 Inflation 投资活动Investing activities 负债Liabilities 负现金流量Negative cash flow 经营活动Operating activities 所有者权益Owner’s equity 合伙企业Partnership 正现金流量Positive cash flow 留存利润Retained earning 收入Revenue 独资企业Sole proprietorship 清偿能力Solvency 稳定货币假设Stable-dollar assumption 股东Stockholders

财务分析常用英语词组

财务分析常用英语词组 A 1,Acceptable products completed, percentage of, 合格产品比率。 2,Accounting department, 会计部门 3,Ratios for analysis of accounting department, 关于会计部门的比率分析 4,Role of accounting department, 会计部门的角色 5,Accounts payable 应付账款 6,Days needed to pay 进行支付需要的天数 7,Shrinking funding provided by (as symptom)accounts payable 由应付账款提供的融资减少(症状) 8,Turnover of accounts payable 应付账款周转率 9,Auditing 审计 10,Accounts receivable

应收账款 11,Collectibility of accounts receivable 应收账款的可回收性 12,Days needed to collect 应收账款周转天数 13,Increasing investment in (as symptom)accounts receivable 在应收账款上的投资增加(症状) 14,Overdue accounts receivable 过期应收账款 15,Accounts receivable as proportion of sales 应收账款占销售的百分比 16,Accounts receivable and working capital 应收账款和营运资本 17,Accrued interest 应计利息 18,Accrued liabilities 应计负债 19,Calculating 计算 20,Acquisition analysis 并构分析

会计专业英语重点词汇大全

?accounting 会计、会计学 ?account 账户 ?account for / as 核算 ?certified public accountant / CPA 注册会计师?chief financial officer 财务总监?budgeting 预算 ?auditing 审计 ?agency 机构 ?fair value 公允价值 ?historical cost 历史成本?replacement cost 重置成本?reimbursement 偿还、补偿?executive 行政部门、行政人员?measure 计量 ?tax returns 纳税申报表 ?tax exempt 免税 ?director 懂事长 ?board of director 董事会 ?ethics of accounting 会计职业道德?integrity 诚信 ?competence 能力 ?business transaction 经济交易?account payee 转账支票?accounting data 会计数据、信息?accounting equation 会计等式?account title 会计科目 ?assets 资产 ?liabilities 负债 ?owners’ equity 所有者权益 ?revenue 收入 ?income 收益

?gains 利得 ?abnormal loss 非常损失 ?bookkeeping 账簿、簿记 ?double-entry system 复式记账法 ?tax bearer 纳税人 ?custom duties 关税 ?consumption tax 消费税 ?service fees earned 服务性收入 ?value added tax / VAT 增值税?enterprise income tax 企业所得税?individual income tax 个人所得税?withdrawal / withdrew 提款、撤资?balance 余额 ?mortgage 抵押 ?incur 产生、招致 ?apportion 分配、分摊 ?accounting cycle会计循环、会计周期?entry分录、记录 ?trial balance试算平衡?worksheet 工作草表、工作底稿?post reference / post .ref过账依据、过账参考?debit 借、借方 ?credit 贷、贷方、信用 ?summary/ explanation 摘要?insurance 保险 ?premium policy 保险单 ?current assets 流动资产 ?long-term assets 长期资产 ?property 财产、物资 ?cash / currency 货币资金、现金

常用财务英语

account 账户 accountpayable应付账款?annualreport 年度报告?assets资产?audit审计?auditor’s opinion审计意见书 balance sheet 资产负债表 balance sheetequation资产负债表等式 capital资本 capital stock certificate股本证明书?certified publicaccountant(CPA) 注册会计师 common stock 普通股 compound entry 复合分录?corporation 公司?creditor 债权人 debtor 债务人 entity 主体(会计主体) financialaccounting财务会计 GAAP一般公认会计原则 generallyacceptedaccounting principles一般公认会计原则?independent opinion独立意见书?inventory存货 liabilities负债 limited liability 有限责任 management accounting管理会计 notes payable 应付票据 open account ①未清账;②赊账,指赊购和记账交易 owners’equity所有者权益?paid-in capital 投入资本(缴入股本) paid-incapital inexcessof par value超面值缴入股本 partnership 合伙企业?parvalue 票面价值?privately accounting企业会计?privately owned私有公司 publicaccounting公共会计?publicly owned 国有企业?reliability可靠性 shareholders’ equity 股东权益?sole proprietorship 独资企业?stated valu e股本 statementoffinancial condition财务状况表 statementof financial position 财务状况表?stock certificate股票凭证?stockholders’ equity 股东权益?transaction交易 Accounting PrincipleBoard (APB) (美国)会计准则委员会?accrual basis 权责发生制(应计制) AICPA美国注册会计师协会 APB Opinions 会计准则委员会意见书?cash basis收付实现制(现金收付制)?cash dividends 现金股利 cash flow statement 现金流量表 cost of goodssold销售成本 cost of sales 销售成本?costrecovery 成本收回 depreciation折旧 earnings 收益(利润)?expenses费用 Financial Accounting Standards Board(FASB)(美国)财务会计准则委员会?FASB Statement 财务会计委员会公告?fiscal year①会计年度(财务年度);②财政

财务会计英语

1Accounting会计is an information system.it measures data into reports,and communicates results to people 2Financial accounting财务会计(外部)the branch of accounting that provides information to people outside the firm Management accounting管理会计(内部)the branch of decision makers of a business,such as top executives. 3流动资产包括current assets Cash and Cash equivalents现金及其等价物short-term investments短期投资Inventories存货 Accounts (notes) receivable应收账款(票据)prepaid expenses and other current assets预付账款(其他流动资产) 4The account账户the record of the changes that have occurred in a particular asset liability,or stockholders’ equity during a period. 5Assets资产(cash,accouts receivable,notes expense,land buildings,equipment furniture fixtures) Liabilites负债(notes payable,accounts payable,accrued liabilities

常用会计英语词汇

常用会计英语词汇 基本词汇 A (1)account 账户,报表 A (2)accounting postulate 会计假设 A (3)accounting valuation 会计计价 A (4)accountability concept 经营责任概念 A (5)accountancy 会计职业 A (6)accountant 会计师 A (7)accounting 会计 A (8)agency cost 代理成本 A (9)accounting bases 会计基础 A (10)accounting manual 会计手册 A (11)accounting period 会计期间 A (12)accounting policies 会计方针 A (13)accounting rate of return 会计报酬率 A (14)accounting reference date 会计参照日 A (15)accounting reference period 会计参照期间 A (16)accrual concept 应计概念 A (17)accrual expenses 应计费用 A (18)acid test ratio 速动比率(酸性测试比率) A (19)acquisition 收购 A (20)acquisition accounting 收购会计 A (21)adjusting events 调整事项 A (22)administrative expenses 行政管理费 A (23)amortization 摊销 A (24)analytical review 分析性复核 A (25)annual equivalent cost 年度等量成本法 A (26)annual report and accounts 年度报告和报表 A (27)appraisal cost 检验成本 A (28)appropriation account 盈余分配账户 A (29)articles of association 公司章程细则 A (30)assets 资产 A (31)assets cover 资产担保 A (32)asset value per share 每股资产价值 A (33)associated company 联营公司 A (34)attainable standard 可达标准 A (35)attributable profit 可归属利润 A (36)audit 审计 A (37)audit report 审计报告 A (38)auditing standards 审计准则 A (39)authorized share capital 额定股本 A (40)available hours 可用小时 A (41)avoidable costs 可避免成本 B (42)back-to-back loan 易币贷款 B (43)backflush accounting 倒退成本计算B (44)bad debts 坏帐 B (45)bad debts ratio 坏帐比率 B (46)bank charges 银行手续费 B (47)bank overdraft 银行透支 B (48)bank reconciliation 银行存款调节表 B (49)bank statement 银行对账单 B (50)bankruptcy 破产 B (51)basis of apportionment 分摊基础 B (52)batch 批量 B (53)batch costing 分批成本计算 B (54)beta factor B (市场)风险因素B B (55)bill 账单 B (56)bill of exchange 汇票 B (57)bill of lading 提单 B (58)bill of materials 用料预计单 B (59)bill payable 应付票据 B (60)bill receivable 应收票据 B (61)bin card 存货记录卡 B (62)bonus 红利 B (63)book-keeping 薄记 B (64)Boston classification 波士顿分类 B (65)breakeven chart 保本图 B (66)breakeven point 保本点 B (67)breaking-down time 复位时间 B (68)budget 预算 B (69)budget center 预算中心 B (70)budget cost allowance 预算成本折让 B (71)budget manual 预算手册 B (72)budget period 预算期间 B (73)budgetary control 预算控制 B (74)budgeted capacity 预算生产能力 B (75)business center 经营中心 B (76)business entity 营业个体 B (77)business unit 经营单位 B (78)by-product 副产品 C (79)called-up share capital 催缴股本 C (80)capacity 生产能力 C (81)capacity ratios 生产能力比率 C (82)capital 资本 C (83)capital assets pricing model 资本资产计价模式C (84)capital commitment 承诺资本 C (85)capital employed 已运用的资本 C (86)capital expenditure 资本支出 C (87)capital expenditure authorization 资本支出核准C (88)capital expenditure control 资本支出控制 C (89)capital expenditure proposal 资本支出申请

会计英语常用词汇

一、企业财务会计报表封面 FINANCIAL REPORT COVER 报表所属期间之期末时间点 Period Ended 所属月份 Reporting Period 报出日期 Submit Date 记账本位币币种 Local Reporting Currency 审核人 Verifier 填表人 Preparer 二、资产负债表 Balance Sheet 资产 Assets 流动资产 Current Assets 货币资金 Bank and Cash 短期投资 Current Investment 一年内到期委托贷款 Entrusted loan receivable due within one year 减:一年内到期委托贷款减值准备 Less: Impairment for Entrusted loan receivable due within one year 减:短期投资跌价准备 Less: Impairment for current investment 短期投资净额 Net bal of current investment 应收票据 Notes receivable 应收股利 Dividend receivable 应收利息 Interest receivable 应收账款 Account receivable 减:应收账款坏账准备 Less: Bad debt provision for Account receivable 应收账款净额 Net bal of Account receivable 其他应收款 Other receivable 减:其他应收款坏账准备 Less: Bad debt provision for Other receivable 其他应收款净额 Net bal of Other receivable 预付账款 Prepayment 应收补贴款 Subsidy receivable 存货 Inventory 减:存货跌价准备 Less: Provision for Inventory 存货净额 Net bal of Inventory 已完工尚未结算款 Amount due from customer for contract work 待摊费用 Deferred Expense 一年内到期的长期债权投资 Long-term debt investment due within one year 一年内到期的应收融资租赁款 Finance lease receivables due within

常用财务英语

account 账户 account payable 应付账款 annual report 年度报告 assets 资产 audit 审计 auditor’s opinion 审计意见书 balance sheet 资产负债表 balance sheet equation 资产负债表等式 capital 资本 capital stock certificate 股本证明书 certified public accountant(CPA) 注册会计师 common stock 普通股 compound entry 复合分录 corporation 公司 creditor 债权人 debtor 债务人 entity 主体(会计主体) financial accounting 财务会计 GAAP 一般公认会计原则 generally accepted accounting principles 一般公认会计原则independent opinion 独立意见书 inventory 存货 liabilities负债 limited liability 有限责任 management accounting 管理会计 notes payable 应付票据 open account ①未清账;②赊账,指赊购和记账交易owners’ equity 所有者权益 paid-in capital 投入资本(缴入股本) paid-in capital in excess of par value 超面值缴入股本partnership 合伙企业 par value 票面价值 privately accounting 企业会计 privately owned 私有公司 public accounting 公共会计 publicly owned 国有企业 reliability 可靠性 shareholders’ equity 股东权益 sole proprietorship 独资企业 stated value 股本 statement of financial condition 财务状况表 statement of financial position 财务状况表 stock certificate 股票凭证 stockholders’ equit y 股东权益