澳洲公司税法案例

Take Home Exam

● What is David’s residency status in 2013/2014?

David is non-resident of Australia on tax purpose in 2013/2014.

Section 6(1) ITAA36 defines a “resident” for Australian tax purpose. Considering David’s residency status in 2013/2014, the domicile test can be applicable here. Applying FCT v Applegate and FCT v Jenkins, it can be concluded that David is non-resident of Australia. David has been working in London since 1 July 2013, and he intends to back to Australia after 3 years in early 2016. During his absence, he lives with his mother who is a permanent immigration of UK since 2000, which means that David has a permanent abode outside Australia in 2013/2014 and also he has a family tie in UK to some extent. According to Ruling IT 2650, David is non-resident of Australia on tax purpose in 2103/2014.

● What amounts are assessable income and what outgoings constitute allowable deductions?

Section 6-1(1) ITAA97 provides that assessable income comprises ordinary income and statutory income. As for David’s assessable income and allowable deductions, there are some analysis as follows.

Section 6 ITAA97 requires that non-residents should have their ordinary and statutory income derived from all Australian sources taxed. Due to David’s non-residency of Australia on tax purpose in 2013/2014, the salary of £150,000 from his London employment is excluded in his assessable income.

Although David never worked on his family farm and either registered as a shareholder, he also made substantial financial contributions toward farm assets and technology, and shared in the farm profits. Under Section 43B(1)(b) of the ITAA 1936, holders of “equity interest” are treated in the same way as shareholder. Considering the definition of dividend in Section 6(1) of the ITAA 1936 as well, David’s share of $100,000 in the company’s profit should be treated as dividends and is assessable as statutory income under Section 44 of ITAA 1936.

As for the outgoings David provided to purchase new machinery for the farm and to fix the fence that had broken, different treatments are applied. Applying the 3 tests in distinguishing capital and revenue expense: the “once and for all” test derived from Vallambrosa Rubber Co Ltd v Farmer (1910) 5 TC 529, the “enduring benefit test” der ived from British Insulated & Helsby Cables Ltd v Atherton[1926] AC 205, and the “business entity” test derived from Sun Newspaper v FCT (1938) 61 CLR 337, the amount of$200,000 is incurred as a “one off” and produced an asset of lasting value, therefore meet the first negative limb under Section 8-1(2) of ITAA 1997, which means that it was capital in nature and thus can not be deducted on tax purpose. However, another outgoing of $4,000 was used to fix the fence that had broken, so that it should be treated as a deduction for

expenditure incurred on repairs for income-producing purpose, according to Section 25-10 of ITAA 1997.

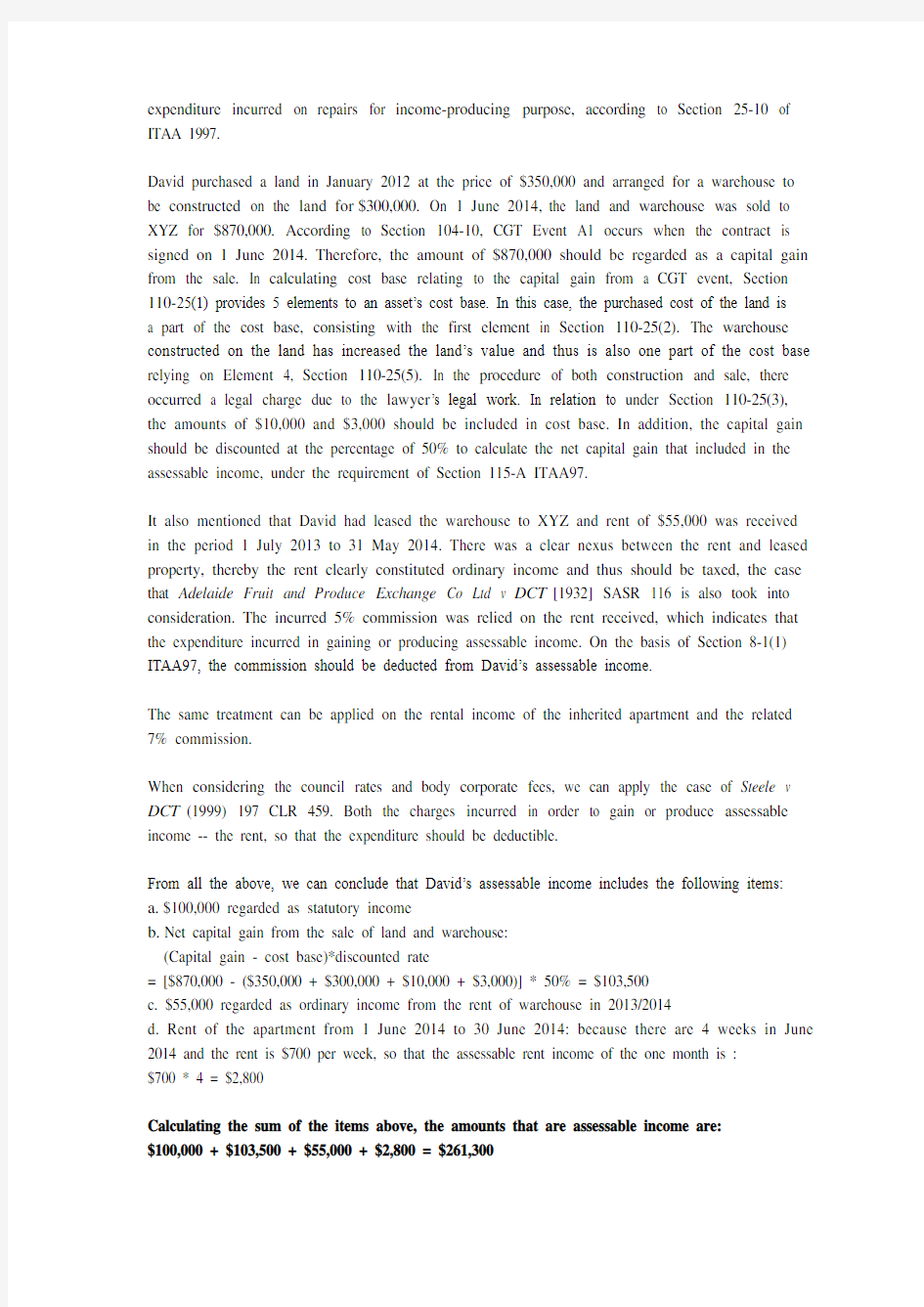

David purchased a land in January 2012 at the price of $350,000 and arranged for a warehouse to be constructed on the land for$300,000. On 1 June 2014, the land and warehouse was sold to XYZ for $870,000. According to Section 104-10, CGT Event A1 occurs when the contract is signed on 1 June 2014. Therefore, the amount of $870,000 should be regarded as a capital gain from the sale. In calculating cost base relating to the capital gain from a CGT event, Section 110-25(1) provides 5 elements to an asset’s cost base. In this case, the purchased cost of the land is a part of the cost base, consisting with the first element in Section 110-25(2). The warehouse constructed on the land has increased the land’s value and thus is also one part of the cost base relying on Element 4, Section 110-25(5). In the procedure of both construction and sale, there occurred a legal charge due to the lawyer’s legal work. In relation to under Section 110-25(3), the amounts of $10,000 and $3,000 should be included in cost base. In addition, the capital gain should be discounted at the percentage of 50% to calculate the net capital gain that included in the assessable income, under the requirement of Section 115-A ITAA97.

It also mentioned that David had leased the warehouse to XYZ and rent of $55,000 was received in the period 1 July 2013 to 31 May 2014. There was a clear nexus between the rent and leased property, thereby the rent clearly constituted ordinary income and thus should be taxed, the case that Adelaide Fruit and Produce Exchange Co Ltd v DCT[1932] SASR 116 is also took into consideration. The incurred 5% commission was relied on the rent received, which indicates that the expenditure incurred in gaining or producing assessable income. On the basis of Section 8-1(1) ITAA97, the commission should be deducted from David’s assessable income.

The same treatment can be applied on the rental income of the inherited apartment and the related 7% commission.

When considering the council rates and body corporate fees, we can apply the case of Steele v DCT(1999) 197 CLR 459. Both the charges incurred in order to gain or produce assessable income -- the rent, so that the expenditure should be deductible.

From all the above, we can conclude that David’s assessable income includes the following items:

a.$100,000 regarded as statutory income

https://www.wendangku.net/doc/665516127.html, capital gain from the sale of land and warehouse:

(Capital gain - cost base)*discounted rate

= [$870,000 - ($350,000 + $300,000 + $10,000 + $3,000)] * 50% = $103,500

c. $55,000 regarded as ordinary income from the rent of warehouse in 2013/2014

d. Rent of the apartment from 1 June 2014 to 30 June 2014: because there are 4 weeks in June 2014 and the rent is $700 per week, so that the assessable rent income of the one month is : $700 * 4 = $2,800

Calculating the sum of the items above, the amounts that are assessable income are: $100,000 + $103,500 + $55,000 + $2,800 = $261,300

Besides, David’s allowable deductions include the following items:

a.$4,000 regarded as the repair expense

b.5% commission of the rent of warehouse:

5% * $55,000 = $2,750

c. 7% commission of the rent of apartment:

7% * $700 * 4 = $196

d. Council rates ($300 per quarter) and body corporate fees ($800 per quarter) :

($300 + $800) * 4 = $4,400

Calculating the sum of the items above, the amounts that are allowance deductions are: $4,000 + $2,750 + $196 + $4,400 = $11,346

● David’s final tax liabilit y for 2013/2014

In this case, because David was non-resident of Australia in 2013/2014, so that he has no need to bear medicare levy as well as medicare levy surcharge, according to Section 251T and 251U of ITAA 1936. And also, his income should be taxed based on the non-residents income tax rates, under the Income Tax Rates Act 1986, Schedule 7.

Therefore, the tax formula applied on this would be:

Tax liability = Income Tax.

= Taxable income * Tax Rate

= (Assessable Income - Deductions) * Tax Rate

From the information above, the Taxable income is : $261,300 - $11,346 = $249,954

The calculation is performed in the following form:

Taxable Income Rate Tax Liability Total Tax Liability $0 - $80,000 32.5% $26,000

$80,000 - $180,000 37% $37,000

$180,000 - $249,954 45% $31,479.3 $94,479.3

Above all, David’s final tax liability for 2013/2014 is $94,479.3.