江 铃B:2010年年度报告摘要(英文版) 2011-03-18

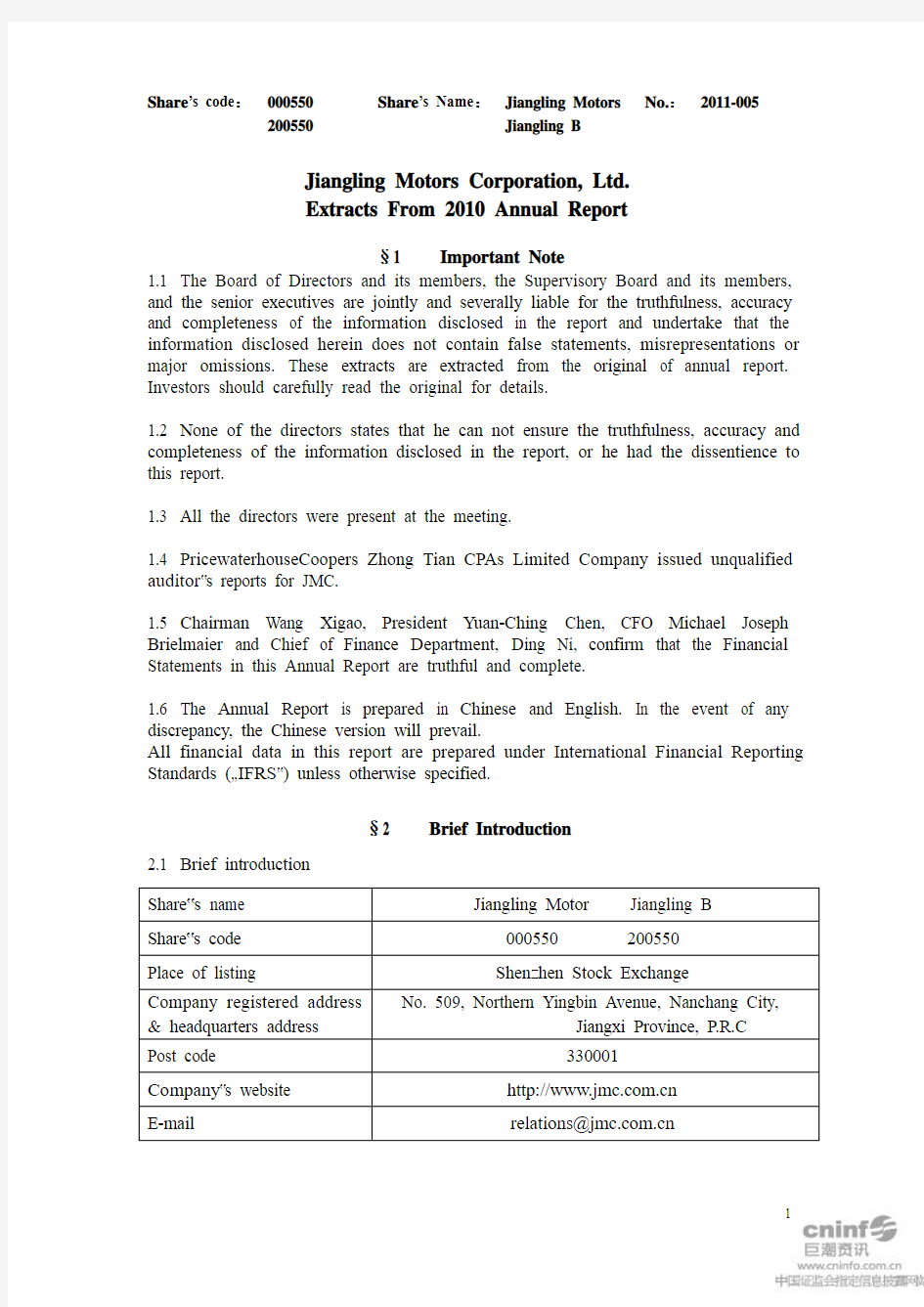

Share’s code:000550 Share’s Name:Jiangling Motors No.:2011-005 200550 Jiangling B

Jiangling Motors Corporation, Ltd.

Extracts From 2010 Annual Report

§1 Important Note

1.1 The Board of Directors and its members, the Supervisory Board and its members, and the senior executives are jointly and severally liable for the truthfulness, accuracy and completeness of the information disclosed in the report and undertake that the information disclosed herein does not contain false statements, misrepresentations or major omissions. These extracts are extracted from the original of annual report. Investors should carefully read the original for details.

1.2 None of the directors states that he can not ensure the truthfulness, accuracy and completeness of the information disclosed in the report, or he had the dissentience to this report.

1.3 All the directors were present at the meeting.

1.4 PricewaterhouseCoopers Zhong Tian CPAs Limited Company issued unqualified auditor?s reports for JMC.

1.5 Chairman Wang Xigao, President Yuan-Ching Chen, CFO Michael Joseph Brielmaier and Chief of Finance Department, Ding Ni, confirm that the Financial Statements in this Annual Report are truthful and complete.

1.6 The Annual Report is prepared in Chinese and English. In the event of any discrepancy, the Chinese version will prevail.

All financial data in this report are prepared under International Financial Reporting Standards (…IFRS?) unless otherwise specified.

§2 Brief Introduction

2.1 Brief introduction

2.2 Contact persons and contact details

§3 Operating Highlight

3.1 Main accounting data Unit: RMB (000)

3.2Main financial indexes

Share capital change due to new shares issuance, shares allotment, exercising granted stock incentive, repurchasing shares, which causes the change of total equity

□Applicable ■Not Applicable

3.3 Difference between net profits per China General Acceptable Accounting Principles (…

China GAAP ?) and per International Financial Reporting Standards (…IFRS?)

■Applicable □Not Applicable

* Based on the financial statements audited by PwC Zhong Tian per the China GAAP.

§4 Share Capital Changes & Shareholders 4.1 Table on the changes of shareholding structure

4.2 Total shareholders, top ten shareholders, and top ten shareholders holding

4.3 Controlling Shareholders and actual controller

4.3.1 Changes of controlling shareholders and actual controller □Applicable ■Not Applicable

4.3.3 Ownership and

control relations between the Company and the actual controlling parties

4.3.4. Trust or other assets management mode to control the Company made by actual controller

□Applicable ■Not Applicable

§5 Directors, Supervisors and Senior Management

5.1 Shareholding Changes and compensation of Directors, Supervisors and Senior Management

8

Granted shares or derivative securities held by the directors, supervisors and senior executives

□Applicable ■Not Applicable

*Note: JMC pays annual compensation for Ford-seconded senior management personnel to Ford in accordance with the revised Personnel Secondment Agreement signed between JMC and Ford and Ford Affiliates. In 2010, JMC should pay US$ 375 thousand to Ford for Director & President Yuan-Ching Chen, CFO Michael Joseph Brielmaier and VP Peter Dowding, RMB 750 thousand for VP Zhong Wanli,. These payments made by JMC to Ford do not reflect the actual salaries earned by Ford-seconded senior management.

**Note: The total compensation included the long-term incentive of about RMB 920 thousand deferred from the previous years.

Abbreviations:

EVP Executive Vice President

CFO Chief Financial Officer

VP Vice President

9

§6 Report of the Board of Directors

6.1 Discussions and analysis on operating results during the reporting period

(1) Operating Results

JMC?s core business is production and sales of light commercial vehicles and related components. Its major products include JMC series light truck and pickup and Transit series commercial bus. The Company also produces engines, castings and other components.

In 2010, JMC achieved record sales volume of 178,999 units including 66,224 JMC brand light trucks, 60,417 JMC brand pickups and SUVs, and 52,358 Ford Transit commercial vehicles. Total sales volume was up 56% from same period last year. Total production volume was 182,954 units, including 67,627 JMC brand light trucks, 61,688 JMC brand pickups and SUVs, and 53,639 Transits.

The Company?s sales increase is prima rily explained by industry and market share growth. JMC brand light truck sales volume increased 43% compared with same period last year, JMC brand pickup and SUV sales volume increased 73%, Transit sales volume increased 56%.

In 2010, the Company achieve d a share of 1.0% of China?s total vehicle industry, up 0.2 percentage point from a year ago (In 2010, the Company achieved a share of 2.7% of China?s commercial vehicle industry, up 0.5 percentage point compared with 2009). JMC light trucks (including pickup) accounted for 6.6% of the light truck market, up 1.6 percentage points from a year ago. Transit, along with the JMC brand Yunba microbus, achieved about 20.5% of the light bus market, and increase of 5.4 percentage points from last year?s level. (Data source for above analysis: China Association of Automobile

Manufacturers and the Company sales records)

(3) Main Suppliers and Customers

The total value of purchases from the top 5 suppliers was RMB 2,585 million, accounting for 23% of JMC?s total annual buy. The total sale value to the top 5 customers was RMB 2,313 million, accounting for 15% of JMC?s total turnover.

(4) Operational Challenges and Resolutions

In 2010, the Company continued to face competitive challenges with new product entries, intensifying cost pressures, and capacity constraint. The Company focused on initiating new product development and expanding production capacity, with appropriate assessment of the existing market conditions and future trend analysis.

With regard to competition, the Company continued to experience market share pressure from competitive new product and pricing actions in all of its segments. In response, the Company tactically lowered price for N600 light truck in the first quarter and 07 model pickup and Transit classic logistic models in the third quarter and introduced a brand new N350 SUV Yusheng in the fourth quarter. Additionally, the Company also initiated proactive marketing programs and accelerated network expansion in the tier 2 markets that helped to boost sales.

To pursue steady growth, the company continued to focus on (1) enhancing sales promotion programs to support sales and market share of present and new products, (2) reducing component costs for all car line, (3) balancing management of controllable expenses, including operating, capacity-related, and new product development-related spending, while ensuring achievement of company?s annual volume/profit targets a nd long term growth objectives, (4) ensuring steady cash flow, and (5) strengthening corporate governance and application of appropriate risk assessment and control mechanisms.

The Company anticipates continued market pressures in the near future, including competitive new product entries in selected market segments, competitive pricing penetration, raw material prices and labor cost increases, and government policy revisions and more stringent regulatory requirements. To combat these challenges, the Company continues to leverage previously established processes and work groups to reduce existing product costs and eliminate operating waste throughout the enterprise. Additionally, we are maximizing part sourcing localization and cost reduction for new produ cts. The company?s management also specifically focused on (1) improving quality and customer satisfaction to protect core product sales and market share, (2) introducing new products to penetrate into new segments to gain sales and profit growth, and (3) expanding production capacity to meet market demand. Moreover, the Company continued to execute several approved major projects with the support of our technology partners. These programs include the N350 Pick-up project, the N800 project (the next generation truck product which is a self

developed product), and the JX4D24, E802 engine manufacturing projects which support our vehicles with engines to meet future regulatory requirements. These actions will introduce competitive and profitable products to ensure the Company's steady volume and profit growth in the future.

Finally, the company is continuing its efforts to strengthen dealer network development and pursue export and OEM sales growth.

(5) Product Development

As a result of intensified efforts to develop and implement new vehicle programs, product development efforts are focused on responding to market needs as well as regulatory compliance. The N900, N350 and N800 programs will reflect market driven improvements including increased payloads, new styling, improved powertrain, etc. The JX4D24, JX493, and E802 projects will further expand the Company's engine development capability, engine manufacturing capacity and ensure the Company is compliance with stringent emission regulations.

(6) Financial Results

Revenue in 2010 was RMB 15,768 million, up 51% from last year; net profit was RMB 1,706 million (per International Accounting Standards), up 62% from last year. Distribution cost was up RMB 249 million, up 32% from last year, primarily reflecting volume-related changes including vehicle delivery costs, warranty, promotion expenses and advertisement expenditure. Administrative expenses increased by RMB 229 million, up 38% from same period last year, primarily reflecting higher research and development fees.

Cash flow from operations was positive RMB 2,716 million, reflecting favorable profit and operating-related working capital changes. Cash flow from investing activities was negative RMB 373 million, reflecting primarily spending for capital goods such as facilities, equipment and tooling. Financing cash flow was negative RMB 444 million, primarily explained by dividend payment.

At the end of 2010, the Company held a total of RMB 5,813 million in cash and cash equivalents, increasing RMB 1,899 million from the end of 2009. The balance of bank borrowing was RMB 32 million; decreasing about RMB 1 million from 2009 year end.

Total assets were RMB 11,238 million, up 35% from RMB 8,294 million at year end 2009. The improvement primarily reflects higher cash and cash equivalents as a result of higher profits generated from operating activities and improved working capital.

Total liabilities, were RMB 4,995 million, up 49% from RMB 3,347 million at year end 2009. This reflects mainly an increase in accounts payables associated with volume growth. Shareholder equity was RMB 6,243 million at December 31, 2010, up RMB 1,296 million from year-end 2009. This increase is mainly explained by net profit earned in the reporting period and dividend payments partially offset the equity increase.

(7) 2011 Year Plan

The Company is projecting revenue at RMB 20,000 million for 2011. The intensified competition resulting from new market entries and the launch of news models will require increased levels of marketing expense to support volume and market share growth. Additionally, R&D and capital expenditures are projected to be higher as we progress with

new product programs and capacity expansion actions.

In 2011, the Company will continue to focus on achieving sales and profit targets, enhancing formulation of new product development strategies and executing plans for future growth. Specific actions include:

i.Accelerate efforts to strengthen our brands through enhancing the Company's

distribution network, including brand-specific shop expansion and development of JMC Cares service strategy to achieve volume and market share targets.

ii.Improve product quality and customer satisfaction.

iii.Increase product cost reduction efforts and improve operating efficiencies to achieve cost targets.

iv.Solidify product cycle plan, timely deliver new product/engine programs and capacity projects.

v.Deliver recruiting, retention and training objectives that help to strengthen employees' overall competence to support future growth.

6.2 Table below breaks down Revenue & Cost of Goods Sold from Core Business.

Unit: RMB ?000

6.3 Details pertaining to core business classified according to region

■Applicable □Not Applicable

Unit: RMB ?000

6.4 Items applying to fair value accounting policy

□Applicable ■Not Applicable

6.5 Raised fund use

□Applicable ■Not Applicable

Changed projects

□Applicable ■Not Applicable

6.6 Non-raised fund use

■Applicable □Not Applicable

6.7 Causses and explanation of the Board of Directors on the changes of accounting policy, accounting estimates or the correction of major accounting errors

□Applicable ■Not Applicable

6.8 Explanation of the Board of Directors to abnormal opinions from accounting firm

□Applicable ■Not Applicable

6.9 The proposals on year 2010 profit distribution and transferring capital surplus reserve to

Table of cash dividend in the past three years

The Company did not put forward a cash dividend proposal while the Company achieved positive profit in the reporting period

□Applicable ■Not Applicable

6.10. Foreign currency constitution of financial assets available-for-sale

§7 Major events

7.1 Acquirement of operation

□Applicable ■Not Applicable

7.2 Sales of operation

□Applicable ■Not Applicable

7.3 Major guarantee

■Applicable □Not Applicable

7.4 Major related party transactions

7.4.1 Related party transactions relating to routine operation

In the reporting period, the related party transactions with controlling shareholder and its subsidiaries, to whom the Company sold goods and provided labour services, was RMB 58,654 thousand.

7.4.2 Creditor?s rights and liabilities between listing company and related parties

□Applicable ■Not Applicable

7.4.3 Settlement of non-operating funding of major shareholder and its affiliates in the reporting period

□Applicable ■Not Applicable

7.5 Trust investment

□Applicable ■Not Applicable

7.6 Implementation of commitments

Commitments of the Company as well as its Directors, Supervisors and senior executives, the shareholder holding 5% or more of JMC?s shares or actual parties during the reporting period

*JMH, which holds 41.03% of JMC total shares, issued letters of commitment, and declared and promised the following:

(1)according to the requirements of Rules on Implementing the Full Tradable Share

Reform of the Listed Companies, legal commitments will be fulfilled in accordance with provisions of the stock exchange laws and regulations;

(2)the promisor ensures that it will compensate losses resulting from partial or complete

non-fulfillment of its promises to other shareholders; and

(3)the promisor will fulfill its commitments faithfully and accept relevant legal

responsibility, and it will not transfer its shares unless the transferee agrees and accepts liability to undertake the responsibility of the promise.

JMH promises specifically to pay the consideration on behalf of the unlisted-share holders who oppose the Share Reform or did not express their opinions. The above-mentioned unlisted-share holders should repay the consideration paid by JMH and the interest, or obtain written consent from JMH, if they want to list their shares.

7.7 Major litigation and arbitration

□Applicable ■Not Applicable

7.8 Analysis and Explanations on other major events & its impact and settlement

7.8.1 Securities Investments

□Applicable ■Not Applicable

7.8.2 Equity in other listed companies

□Applicable ■Not Applicable

7.8.3 Equity in the companies to be listed and non-listed financial companies

□Applicable ■Not Applicable

7.8.4 Share trading for other listed companies

□Applicable ■Not Applicable

7.8.5 Other comprehensive income

□Applicable ■Not Applicable

§8 Report of Supervisory Board

□Applicable ■Not Applicable

§9 Financial Statements 9.1 Auditor?s opinion

国际营销英文文献

International private enterprises external constraints and the Government Service Innovation Abstract: In the opening to the outside world situation growing, private enterprises can not be separated from the internationalization of the rational power of the Government. This paper analyzes the internationalization of private enterprises of the external constraints, a private enterprise internationalization of innovation need to government services. Keywords: private enterprises of the external factors of international service innovation With the world economy, increasing globalization, China has become the world's fourth-largest economy, including private enterprises in economic development by increasing the role. Private enterprises are faced with not only the competitiveness of domestic firms and foreign multinational companies are faced with challenges. Therefore, expanding the opening up of the situation, the private enterprises to develop and grow, not only to make use of domestic markets and resources, but also going out to implement the strategy and the internationalization of private enterprises, in a broader competitive environment to meet the challenge. Towards world-class enterprise can not be separated from the support of the Government, the Government should be private enterprise to provide a good environment, strengthening innovation services. International private enterprises external constraints At present, the development of private enterprises in China has made great achievements, but our small and medium-sized private enterprises still dominated the majority of private enterprises through the first start of the primitive accumulation period, being the second business, the implementation of international strategy, international operations, enterprises must create a certain degree of accumulation and the capacity and conditions. However, the internationalization of private enterprises of the potential hindering the external environment, so that many companies fall into the plight of the development. (A) financial bottlenecks encountered At present, private enterprises, especially those in the survival of small and medium-sized financial institutions from the public it is difficult to obtain adequate financing for development. These enterprises can apply for loans to small, low visibility due to take the way of external financing is very difficult. Most of them only through self-financing and non-formal channels of access to capital financing. High-risk and cost of financing and financial situation of the shortage of channels for private enterprises has seriously hampered the pace of foreign trade, and even lead to business in the international competition of mortality. Small and medium-sized private

公司理财(英文版)题库2

CHAPTER 2 Financial Statements & Cash Flow Multiple Choice Questions: I. DEFINITIONS BALANCE SHEET b 1. The financial statement showing a firm’s accounting value on a particular date is the: a. income statement. b. balance sheet. c. statement of cash flows. d. tax reconciliation statement. e. shareholders’ equity sheet. Difficulty level: Easy CURRENT ASSETS c 2. A current asset is: a. an item currently owned by the firm. b. an item that the firm expects to own within the next year. c. an item currently owned by the firm that will convert to cash within the next 12 months. d. the amount of cash on hand the firm currently shows on its balance sheet. e. the market value of all items currently owned by the firm. Difficulty level: Easy LONG-TERM DEBT b 3. The long-term debts of a firm are liabilities: a. that come due within the next 12 months. b. that do not come due for at least 12 months. c. owed to the firm’s suppliers. d. owed to the firm’s shareholders. e. the firm expects to incur within the next 12 months. Difficulty level: Easy NET WORKING CAPITAL e 4. Net working capital is defined as: a. total liabilities minus shareholders’ equity. b. current liabilities minus shareholders’ equity. c. fixed assets minus long-term liabilities. d. total assets minus total liabilities. e. current assets minus current liabilities. Difficulty level: Easy LIQUID ASSETS d 5. A(n) ____ asset is on e which can be quickly converted into cash without significant loss in value.

(2008.1.25)2007年度年终总结会议纪要

会议纪要 --宋城集团2007年度工作总结暨2008年重点工作布置会议 宋城集团总裁办二OO八年元月二十五日印发 2008年元月25日上午9:30分,宋城集团在第一世界大酒店中国渔村会议室召开“2007年度工作总结暨2008年重点工作布臵”会议,出席会议的集团领导有黄巧灵、黄巧龙、刘萍、马根木、周竞夫、张娴、沈和生、邱晓军、尉建、张建坤、刘卫东。集团总部各部门、所属各公司总助以上管理人员参加了会议,会议由集团总裁马根木主持。 会议共分三大议程,一是听取集团副总裁以上高管人员2007年度的个人工作总结;二是听取集团总裁关于宋城集团2007年度的工作报告;三是由集团董事长黄巧灵阐述2008年的发展战略并布臵重点工作。 会议在总结成绩、查找不足、求真务实的氛围中进行。会议首先听取了公司副总裁以上高管人员2007年度个人工作总结以及2008年的工作打算,会议认为,2007年是集团公司发生质变的一年,各板块工作扎实,成功丰硕,值得肯定。 会议听取了马根木总裁关于2007年度宋城集团工作总结的报告,报告从八个板块对2007年的工作进行了全面的回顾。 第一、经营更加成熟,所属各公司全面完成《2007年度经济目标责任制》。 2007年初,集团与所属各公司签订了《2007年度经济目标责任制》,统计结果表明,在广大员工的共同努力下,2007年度各项经济指标圆满完成,营业额、费用控制、利润指标等都符合年初责任制的要求,这标志着各企业经营水平日益成熟,实现了集团从投资型向经营型转变的战略决策。这一事实表明,集团及各公司经营班子在日常工作中措施得力,执行到位,付出了巨大努力。 第二、企业形象和知名度大幅度上升,业务关系良性发展。 通过对各大旅行社的调研显示,集团下属各景区几乎是各大旅行社的业

国际市场营销论文英文版

《国际营销》期末论文 班级:Z0902 姓名:于涛学号:09 The Role of Government Abstract: The purpose of the passage is to describe the role of government in the market. Key words: Government market role develop The word’s markets are overseen by governments. Ideally, those governments set polices based on what they believe will serve the greatest number of their people to the greatest extent. The maintenance of nation borders is the single most important element that separates international trade from domestic trade. While consumers and producers make most decisions that mold the economy, government activities have a powerful effect on the market. Incubate special research, business and development, such as small businesses, space research, job training, unemployment insurance and more. Perhaps most importantly, the federal government guides the overall pace of economic activity, attempting to maintain steady growth, high levels of employment, and price stability. It can slow down or speed up the economy's rate of growth -- in the process, affecting the level of prices and employment. It is supposed to create and administer laws which are fair and equitable. Imagine any team sport without rules or referees. Experience has shown that neither the teams nor the fans find this acceptable. Without an independent referee disputes in a game could not be resolved. Most fans and teams are willing to put up with the occasional bad call rather than no calls at all. The same thing applies in government. Lately there has been a great deal of discussion about the power of the free market to regulate itself or the "invisible hand" to sort things out. Hundreds of years of experience had shown this not to work. Time and again markets have become unstable, either with bubbles such as the famous tulip mania or the "South Sea Island" bubble, or have become overly concentrated such as the standard oil trust. This leads inefficiency, since prices are distorted and resources are diverted from innovation and expansion of socially useful tasks. Without a referee the situation eventually fails anyway, but later and with more social damage than a well regulated society would provide. Modern society is going to continue to have government perform all functions. These have developed because there was a need, and because they worked more often than they failed. Progress will be made when the critics stop trying to turn the clock back to an imaginary past and devote their energies to optimizing what we have. "Liberals" can also do their part by focusing the discussion on the roles listed above and proposing improvements targeted to each sector. In fact, government plans important roles in the market. Government can protect and regulate the sustainable use of natural resources. Enforce and regulate fair and responsible business practices. Included in this is monitoring monetary policy, giving consumer protection and regulating banking practices. Determine and enforce civil laws of property and conduct. This includes the freedoms of the press, religion and rights of property. Provide public goods and services for the well-being of the community as a whole, such as infrastructure, vaccination programs, disaster relief, fireworks shows, public parks, basic healthcare, subsidized housing,

词七首虞美人雨霖铃念奴娇一剪梅永遇乐扬州慢鹊桥仙

词七首虞美人雨霖铃念奴娇一剪梅永遇乐 扬州慢鹊桥仙 教学目标 1、理解七首词各不同的表现特点,体会婉约、豪放派各异的风格。 2、分析掌握含义深刻的词句。品味词中含蓄精警,形象而富于表现力的词句。 3、理解写景、咏史、抒情相结合;景中见情、层层铺叙;用典化句,借古喻今等表现手法的作用。 4、理解《赤壁怀古》一词中写景、咏史、抒情相结合的方法。评价其对历史和人生的认识。 5、了解《雨霖铃》一词中景中见情、以情带景、尽情铺叙的写作特点。 6、理解《京口北固亭怀古》一词运用典故,借古喻今的写作特点。 7、了解辛弃疾抗敌救国的雄图壮志和为国效劳的爱国热情。 8、了解《扬州慢》了词寓情于景、化用杜牧诗句含蓄婉曲的风格。 重点难点 1、提高诗歌鉴赏的能力,了解宋词豪放派的风格特点。 2、体会婉约派词的风格,学会鉴别和扬弃哀伤缠绵的情感。 3、能熟练背诵七首词。

教学过程 虞美人 一、背景材料 这首词是南唐后主李煜被俘,软禁宋都汴京,春花秋月使他触景伤情,回想昔日南唐的宫廷生活,愁苦万分,写下的一首词。 李煜(937—978),初名从嘉,字重光,号钟隐,莲峰居士等,五代时南唐中主李王景的第六子,史称南唐后主,在位十五年。 李煜政治无能,文艺上却以史诗文无所不通,擅长书画,精于鉴赏,妙解音律,尤工于词。早期词作以反映自己帝王、宫廷生活为主,思想意义不大,被俘后,词作抒发亡国之痛,及其对屈辱的囚徙生活的愤懑、感伤,有动人的艺术力量,语音清新,形象丰满,意境深沉。 《虞美人》,唐玄宗是时教坊曲名,后用为词调。小令,双调。 二、谋篇立意 此词相传是李煜的绝笔。这首词通过不堪回首故国的景物情事以及前后生活的对比,抒发了李煜对囚居宋朝的屈辱生活的无比深长的悉恨和悲痛心情。 三、层次结构 上阕一句写眼前实景,春花秋月并不因为人事变迁而有丝毫

期末论文之国际营销英文版

2006学年第一学期期末论文 International Marketing Plan ——Hisense Group

课程名称:国际营销 任课教师:韩广义 学生姓名:许康 I Company Profit: Hisense brand was recognized as a Famous Trademark in China by the State Administration of Industry and Commerce on January 5, 1999. Founded as Qingdao No.2 Radio Factory in 1969.Hisense in Chinese connotes an ocean-like broad vision and credibility that Hisense always values. The English name Hisense is composed of “high” and “sense”, which connote Hisense’s persistent pursuit of high technology, high quality and high taste.Hisense has now developed into a multibillion dollar global conglomerate, which has two listed companies (Hisense Electric Co., Ltd. (600060), on the Shanghai Stock Exchange, and Hisense Kelon Electrical Holdings Company Ltd. (000921), on the Shenzhen and Hong Kong Stock Exchanges)。owns three famous trademarks (Hisense, Kelon and Ronshen)。and provides a wide range of products and services includin g “multimedia”, “homeappliances”, “telecommunications” and ”information technology”. Adhering to its development strategies stressing sound technological foundation and robust operation, Hisense expands its business into high-end industries and also into the top tiers of those industries through continuous technological research and development. It is making unremitting efforts and developing successive innovations together with its 60,000 employees around the world for the same dream---developing Hisense into an enduring enterprise and global brand. Around the world,Hisense has production bases

国际营销简答英文版

1 ? 2010 Cengage Learning. All Rights Reserved. This edition is intended for use outside of the U.S. only, with content that may be different from the U.S. Edition. May not be scanned, copied, duplicated, or posted to a publicly accessible website, in whole or in part. chapter1 What are the recent trends in world trade? Will expansion of world trade in the future follow these trends? Global Linkages: Global linkages bind countries, institutions, and individuals more closely than ever. World trade opens up entirely new business horizons (界限,范围). Domestic Policy Repercussions(影响): Exchange rates have begun to determine the level of trade. The global market imposes increasingly tight limits on national economic regulation and sovereignty(国家主权). Chapter2 1. List and briefly describe the five elements of success that are required for an international marketer to take advantage of and thrive in developing markets. Research - learn about the needs, aspirations, and habits of targeted populations. Creating Buying Power - allowing consumers with no collateral to borrow money. Tailoring Local Solutions - combine advanced technology with local insights. Improving Access - by providing access, it could lead to a thriving business. Shaping Aspirations - ideally suited products to match consumer demand. 2.From the international marketer's point of view, what are the opportunities and problems caused by increased urbanization in developing countries? Wu Chapter4: 1.List and briefly describe the elements of culture. a) Language b) Nonverbal Language c) Religion d) Values and Attitudes e) Manners and Customs f) Material Elements g) Aesthetics h) Education i) Social Institutions j) Sources of Cultural Knowledge 2.List and briefly describe the dimensions of culture used in Cultural Analysis a) Individualism-“I ” consciousness versus “we ” consciousness; b) Power distance- level of equality in a society; c) Uncertainty avoidance- need for formal rules and regulations d) Masculinity- attitudes toward achievement, roles of men and women.

雨霖铃

粤教版必修3 第四单元古典诗歌(2) 《雨霖铃》导学案 编写:张剑茹审核:龙福刚 【学习目标】 1、仔细品味词的语言,理解词的内容。 2、知人论世,揣摩词的主旨和感情。 3、学习分析词的艺术手法,会判断情与景的关系。 【学法指导】 1、自主赏析法 2、自主诵读法 【课文助读】 1、走近作者 柳永:(约987--约1053年),北宋词人婉约词派创始人。原名三变,后改名永,字耆卿,福建崇安人。排行第七,又称柳七郎。他少年时代到汴京应试,屡试不中,后流连于秦楼楚馆,常为歌伎填词作曲,和她们生活在一起,放荡不羁。最后,他在饱受世态炎凉,“怪胆狂情”逐渐消退时,才改名柳永,47岁考取进士,官屯田员外郎,世称柳屯田。柳永死之日,家无余财,群伎合金葬之于南门外。著有《乐章集》,时人称“凡有井水饮处,皆能歌柳词”。 2、写作背景 当时柳永由于仕途失意,心情郁闷,决定离开京城到外地去,于是与恋人痛别。本词正是他当时心境的体现。 3、词的相关知识: ①词的起源:产生于唐,盛行于宋。词即歌词,指可以和乐歌唱的诗体。也称“长短句”、“诗余”、“曲子词”、“曲词”。 ②词牌和标题:词牌是一首词词调的名称;标题是词的主要内容的集中体现。如: 《念奴娇·赤壁怀古》,念奴娇是词牌,赤壁怀古是词题。 ③词的分类: A.按字数:小令(58字以内)、中调(59-90字)、长调(90字以上) B.按段:单调、双调、三叠、四叠(段落叫“阙”或“片”) C.按作家的流派风格: 婉约派:婉约派为中国宋词流派。婉约,即婉转含蓄。其特点主要是内容侧重儿女 风情,结构深细缜密,音律婉转和谐,语言圆润清丽,有一种柔婉之美。婉约派的 代表人物有李煜、柳永、晏殊、欧阳修、秦观、周邦彦、李清照。 豪放派:苏轼、辛弃疾等(题材广,境界开阔,风格雄浑,不受音律束缚。) 4、景情关系

完整word版公司理财英文版题库8

CHAPTER 8 Making Capital Investment Decisions I. DEFINITIONS INCREMENTAL CASH FLOWS a 1. The changes in a firm's future cash flows that are a direct consequence of accepting a project are called _____ cash flows. a. incremental b. stand-alone c. after-tax d. net present value e. erosion Difficulty level: Easy EQUIVALENT ANNUAL COST e 2. The annual annuity stream o f payments with the same present value as a project's costs is called the project's _____ cost. a. incremental b. sunk c. opportunity d. erosion e. equivalent annual Difficulty level: Easy SUNK COSTS c 3. A cost that has already been paid, or the liability to pay has already been incurred, is a(n): a. salvage value expense. b. net working capital expense. c. sunk cost. d. opportunity cost. e. erosion cost. Difficulty level: Easy OPPORTUNITY COSTS d 4. Th e most valuable investment given up i f an alternative investment is chosen is a(n): a. salvage value expense. b. net working capital expense.

英文版罗斯公司理财习题答案

CHAPTER 8 MAKING CAPITAL INVESTMENT DECISIONS Answers to Concepts Review and Critical Thinking Questions 1. In this context, an opportunity cost refers to the value of an asset or other input that will be used in a project. The relevant cost is what the asset or input is actually worth today, not, for example, what it cost to acquire. 2. a.Yes, the reduction in the sales of the company’s other products, referred to as erosion, and should be treated as an incremental cash flow. These lost sales are included because they are a cost (a revenue reduction) that the firm must bear if it chooses to produce the new product. b. Yes, expenditures on plant and equipment should be treated as incremental cash flows. These are costs of the new product line. However, if these expenditures have already occurred, they are sunk costs and are not included as incremental cash flows. c. No, the research and development costs should not be treated as incremental cash flows. The costs of research and development undertaken on the product during the past 3 years are sunk costs and should not be included in the evaluation of the project. Decisions made and costs incurred in the past cannot be changed. They should not affect the decision to accept or reject the project. d. Yes, the annual depreciation expense should be treated as an incremental cash flow. Depreciation expense must be taken into account when calculating the cash flows related to a given project. While depreciation is not a cash expense that directly affects c ash flow, it decreases a firm’s net

雨霖铃与念奴娇

《雨霖铃》与《念奴娇?赤壁怀古》 比较阅读教案 省淳中田春艳 教学课题:《雨霖铃》、《念奴娇?赤壁怀古》 教学目标: 1、初步了解宋词的特点。 2、豪放派和婉约派著名词人作品的风格 教学重难点 鉴赏不同风格的词作品。 教学时间:一课时 教学方法:讨论、鉴赏、背诵 教学步骤和过程: 一、导入:幻灯投影: 东坡在玉堂(官署名),有幕士善歌,(苏轼)因问:“我词何如柳七(柳永)?”对曰:“柳郎中(柳永)词,只合十七八女郎,执红牙板,歌‘杨柳岸晓风残月’;学士(苏轼)词须关西大汉,铜琵琶,铁绰板,唱‘大江东去’。东坡为之绝倒。——俞文豹《吹剑录》幕士的回答形象地概括了婉约词和豪放词的不同风格,婉约词柔美奇丽;豪放词雄奇豪放。这节课我们就通过比较阅读柳永和苏轼的代表作品进一步做深刻体会。

二、柳永、苏轼简介:幻灯投影 柳永 (约980--约1053年),原名三变,字耆卿,福建崇安人。柳永大约在公元1 0 1 7 年,宋真宗天禧元年时到京城赶考。以自己的才华他有充分的信心金榜题名,而且幻想着有一番大作为。谁知第一次考试没有考上,他不在乎,轻轻一笑,填词道:“富贵岂由人,时会高志须酬。”等了5 年,第二次开科又没有考上,这回他忍不住要发牢骚了,便写了那首著名的《鹤冲天》,里面有“忍把浮名,换了浅斟低唱。”的词句,柳永这首牢骚歌不胫而走,传到了宫里,宋仁宗一听大为恼火,并记在心里。柳永在京城又挨了三年,参加了下一次考试,这次好不容易通过了,但临到皇帝圈点放榜时,宋仁宗说:“且去浅斟低唱,何要浮名? ”又把他给勾掉了。这次打击实在太大,柳永就更深地扎到市民堆里去写他的歌词,并且不无解嘲地说:“我是奉旨填词。”之后柳永流落于汴京、苏州、杭州等地,每到一地都流连于秦楼楚馆,为歌伎填词作曲。最后,他在饱受世态炎凉,“怪胆狂情”逐渐消退时,才改名柳永,至景佑元年(1034年)54岁时方才考取进士,官屯田员外郎,世称柳屯田、柳郎中。柳永终客死襄阳,家无余财,群伎合金葬之南门外。 苏轼( 1036 一 1101),字子瞻,自号东坡居上,眉州眉山人。他的政治思想比较保守,宋神宗时,王安石当政,行新法,他极力反对,出任杭州等处地方官。又因作诗得罪朝廷,被捕入狱,贬为黄州团练副使。宋哲宗时,旧党当权,召还为翰林学士;新党再度秉政后,又贬惠州,远徙琼州,后死于常州。 苏轼的词意境和风格都比前人提高一步。他作词不纠缠于男女之间的绮靡之情,也不喜欢写那些春愁秋恨的滥调,一扫晚唐五代以来文人词的柔靡纤细的气息,创造出高远清新的意境和豪迈奔放的风格。 苏轼的词强烈地反映着入世和出世的世界观的矛盾。他政治上长期失意,一生经历坎坷不平,但仍能保持乐观豪迈的精神,不时发出健旺爽朗的笑声;另一方面作者在达观潇洒的风度里潜伏着一种浓厚的,逃避现实追求解脱的老庄思想,用来寄托自己对政治现实不满的心情。 三、学习鉴赏《雨霖铃》 1、教师范读,学生朗读,初步感知 这首词写的是什么内容?感情基调如何? 上片写词人和他情人在都门外分别时依依不舍的情景;(实写) 下片是词人想象别后羁旅生活的情状。(虚写) 低沉:作者仕途上失意,不得不离开京师远行,这种抑郁心情和失去爱情慰藉的痛苦交织在一起。作者把不想离别,又不能不离别,都有所爱,都不能得其所爱,又都不能忘其所爱的这种离情别意表达得淋漓尽致,又感人至深。

工商银行2007年年报

中国工商银行股份有限公司 (股票代码:601398) 2007年年度报告摘要 1.重要提示 中国工商银行股份有限公司董事会、监事会及董事、监事、高级管理人员保证本报告所载资料不存在任何虚假记载、误导性陈述或者重大遗漏,并对其内容的真实性、准确性和完整性承担个别及连带责任。 本行第一届董事会第三十三次会议于2008年3月25日审议通过了本行《2007年年度报告》正文及摘要。本行全体董事出席了会议。 本行按中国会计准则和国际财务报告准则编制的2007年度财务报告已经安永华明会计师事务所和安永会计师事务所分别根据中国和国际审计准则审计,并出具标准无保留意见的审计报告。 中国工商银行股份有限公司董事会 二○○八年三月二十五日 本行法定代表人姜建清、主管财会工作负责人杨凯生及财会机构负责人谷澍声明并保证年度报告中财务报告的真实、完整。

2.公司基本情况简介 2.1基本情况简介 股票简称 工商银行(A股) 工商银行(H股) 股票代码 601398 1398 上市交易所 上海证券交易所 香港联合交易所有限公司 注册地址和办 中国北京市西城区复兴门内大街55号 公地址 邮政编码 100032 https://www.wendangku.net/doc/7f12453749.html,, https://www.wendangku.net/doc/7f12453749.html, 公司国际 互联网网址 电子信箱 ir@https://www.wendangku.net/doc/7f12453749.html, 2.2联系人和联系方式 董事会秘书 姓名 潘功胜 联系地址 中国北京市西城区复兴门内大街55号 电话 86-10-66108608 传真 86-10-66106139 电子信箱 ir@https://www.wendangku.net/doc/7f12453749.html,

3.财务概要 (本年度报告摘要所载财务数据及指标按照中国会计准则编制,除特别说明 外,为本行及本行所属子公司合并数据,以人民币标价。) 3.1财务数据 2007 2006 2005 全年经营成果(人民币百万元)(经重述)(未经重述) 利息净收入224,465163,542 147,993 手续费及佣金净收入34,38416,344 10,546 营业收入254,157180,705 162,378 业务及管理费87,63164,469 61,293 资产减值损失37,40632,189 27,014 营业利润(1)113,18570,912 64,652 税前利润115,11471,621 62,876 税后利润81,99049,436 37,869 归属于母公司股东的净利润81,25648,819 37,405 扣除非经常损益后归属于母公司股东的净 利润(2)80,08248,369 38,591 经营活动产生的现金流量净额296,129382,271 367,494 于报告期末(人民币百万元) 资产总额8,684,2887,509,489 6,457,239 客户贷款及垫款总额4,073,2293,631,171 3,289,553 贷款减值准备115,68797,193 83,692 证券投资净额3,107,4142,860,865 2,307,334 负债总额8,140,0367,037,685 6,196,255 客户存款6,898,4136,326,390 5,736,866 同业及其他金融机构存放款项727,609367,494 201,550 拆入资金77,56532,824 31,360 归属于母公司股东的权益538,947467,267 256,947 资本净额576,741530,805 311,844 核心资本净额484,085462,019 255,586 附属资本94,64869,650 56,846 加权风险资产(3)4,405,3453,779,170 3,152,206 每股计(人民币元) 归属于母公司股东的每股净资产 1.61 1.40 1.04