金融方面英语

金融词汇汇集

big macs,big/large-cap stock,mega-issue 大盘股offering,list 上市

bourse 证交所

corporate champion 龙头企业

Shanghai Exchange 上海证交所

pension fund 养老基金

mutual fund 共同基金

hedge mutual fund 对冲式共同基金

share 股票

valuation 股价

underwriter 保险商

government bond 政府债券

saving account 储蓄帐户

equity market 股市

shareholder 股东

delist 摘牌

mongey-loser 亏损企业

inventory 存货

traded company,trading enterprise 上市公司stakeholder 利益相关者

transparency 透明度

Msnbc:Microsoft national broadcast 微软全国广播公司market fundamentalist 市场经济基本规则

damage-contral machinery 安全顾问

efficient market 有效市场

intellectual property 知识产权

opportunistic practice 投机行为

WorldCom 世通公司

bribery 行贿

entrepreneur 企业家

cook the book 做假帐

regulatory system 监管体系

audit 审计

accounting firm 会计事务所

Great Depression 大萧条

portfolio 投资组合

money-market 短期资本市场

capitual-market 长期资本市场

volatility 波动

diversification 多元化

commodity 期货

real estate 房地产

option 期权

call option 看涨期权

put option 看跌期权

merger 并购

arbitrage 套利

Securities&Exchange Commission 〈美〉证券交易委员会dollar standard 美元本位制

flight 贬值

budget 预算

deficit 赤字

bad debt 坏帐

output 产值

macroeconomic 宏观经济

fiscal stimulus 财政刺激

a store of value 保值

transaction currency 结算货币forward exchange 期货交易intervention currency 干预货币Treasury bond 财政部公债

currnt-account 经常项目

pickup in rice 物价上涨

Federal Reserve 美联储

inflation 通货膨胀

deflation 通货紧缩

tighter credit 紧缩信贷

monetary policy 货币政策

awash in excess capacity 生产力过剩foreigh exchange 外汇

spot transaction 即期交易

forward transaction 远期交易

option forward transaction 择期交易swap transaction 调期交易

quote 报价

settlment and delivery 交割

buying rate 买入价

selling rate 卖出价

spread 差幅

contract 合同

at par 平价

premium 升水

discount 贴水

direct quoation method 直接报价法indirect quoation method 间接报价法dividend 股息

domestic currency 本币

floating rate 浮动利率

parent company 母公司

credit swap 互惠贷款

venture capital 风险资本

virtual value 虚拟价值

physical good 物质产品

abstract good 抽象产品

Patent&Trademark Office 专利与商标局book value 帐面价值

physical capital 实际资本

IPO:initial public offering 新股首发

job machine 就业市场

welfare capitalism 福利资本主义

collective market cap 市场资本总值

golbal corporation 跨国公司

transnational status 跨国优势

transfer price 转让价格

General Accounting Office 〈美〉会计总会consolidation 兼并

leveraged 杠杆

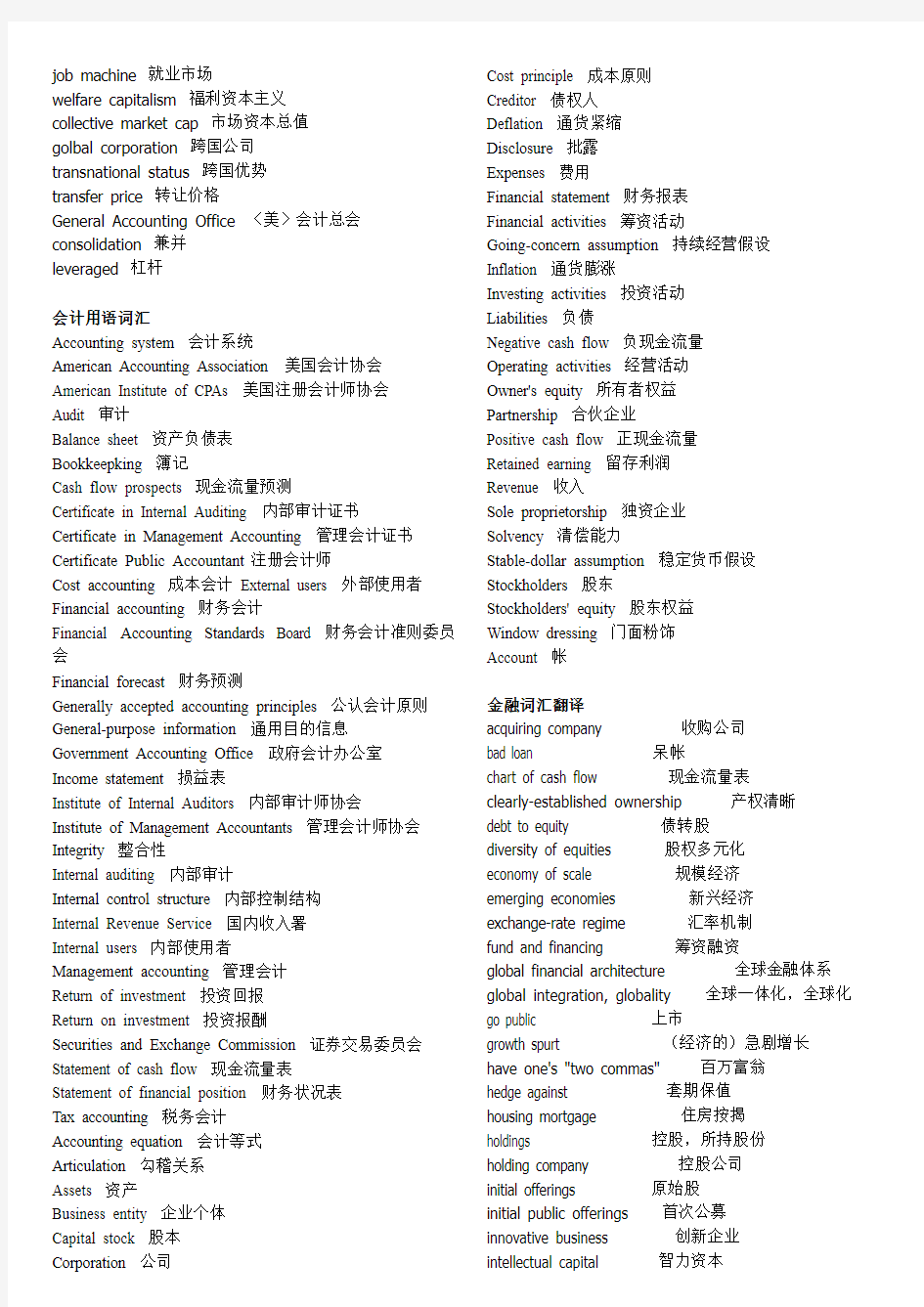

会计用语词汇

Accounting system 会计系统

American Accounting Association 美国会计协会American Institute of CPAs 美国注册会计师协会

Audit 审计

Balance sheet 资产负债表

Bookkeepking 簿记

Cash flow prospects 现金流量预测

Certificate in Internal Auditing 内部审计证书

Certificate in Management Accounting 管理会计证书Certificate Public Accountant注册会计师

Cost accounting 成本会计External users 外部使用者Financial accounting 财务会计

Financial Accounting Standards Board 财务会计准则委员会

Financial forecast 财务预测

Generally accepted accounting principles 公认会计原则General-purpose information 通用目的信息Government Accounting Office 政府会计办公室

Income statement 损益表

Institute of Internal Auditors 内部审计师协会

Institute of Management Accountants 管理会计师协会Integrity 整合性

Internal auditing 内部审计

Internal control structure 内部控制结构

Internal Revenue Service 国内收入署

Internal users 内部使用者

Management accounting 管理会计

Return of investment 投资回报

Return on investment 投资报酬

Securities and Exchange Commission 证券交易委员会Statement of cash flow 现金流量表

Statement of financial position 财务状况表

Tax accounting 税务会计

Accounting equation 会计等式

Articulation 勾稽关系

Assets 资产

Business entity 企业个体

Capital stock 股本

Corporation 公司Cost principle 成本原则

Creditor 债权人

Deflation 通货紧缩

Disclosure 批露

Expenses 费用

Financial statement 财务报表

Financial activities 筹资活动

Going-concern assumption 持续经营假设

Inflation 通货膨涨

Investing activities 投资活动

Liabilities 负债

Negative cash flow 负现金流量

Operating activities 经营活动

Owner's equity 所有者权益

Partnership 合伙企业

Positive cash flow 正现金流量

Retained earning 留存利润

Revenue 收入

Sole proprietorship 独资企业

Solvency 清偿能力

Stable-dollar assumption 稳定货币假设Stockholders 股东

Stockholders' equity 股东权益

Window dressing 门面粉饰

Account 帐

金融词汇翻译

acquiring company 收购公司

bad loan 呆帐

chart of cash flow 现金流量表

clearly-established ownership 产权清晰

debt to equity 债转股

diversity of equities 股权多元化

economy of scale 规模经济

emerging economies 新兴经济

exchange-rate regime 汇率机制

fund and financing 筹资融资

global financial architecture 全球金融体系global integration, globality 全球一体化,全球化go public 上市

growth spurt (经济的)急剧增长have one's "two commas" 百万富翁

hedge against 套期保值

housing mortgage 住房按揭

holdings 控股,所持股份

holding company 控股公司

initial offerings 原始股

initial public offerings 首次公募

innovative business 创新企业

intellectual capital 智力资本

inter-bank lending 拆借

internet customer 网上客户

investment payoff period 投资回收期

joint-stock 参股

mall rat 爱逛商店的年轻人

means of production 生产要素

(the)medical cost social pool for major diseases 大病医疗费用社会统筹

mergers and acquisitions 并购

mobile-phone banking 移动电话银行业moods 人气

net potato 网虫

non-store seling 直销

offering 新股

online-banking 网上银行业

online-finance 在线金融

online client (银行的)网上客户paper profit 帐面收益

physical assets 有形资产

project fund system 项目资本金制度pyramid sale 传销

recapitalize 资产重组

regional corrency blocks 地区货币集团regulate 调控

sell off 变现

share(stock) option 期权,股票认购权smart card 智能卡

slash prices 杀价

spare capacity 闲置的生产能力

strong growth 强劲的增长势头

switch trade 转手贸易

take…public上市

tap the idle assets 盘活存量资产transaction (银行的)交易

transfer payment from the exchequer

财政转移支付

venture-capital 风险资本

virtual bank 虚拟银行

wire transfer 电子转帐

金融词汇术语

A

安全网safety net

按可比口径on comparable basis

按轻重缓急to prioritize

暗补implicit subsidy

暗亏hidden loss

B 颁发营业执照to license;to grant a licence to

办理存款业务to take deposits

保护农民的生产积极性to protect farmers'incentive to

produce

备付金(超额准备金)excess reserves

本外币并账consolidation of domestic and foreign

currencyaccounts

本外币对冲操作sterilization operation

本位利益localized interest;departmentalism

奔小康to strive to prosper;to strive to become well-to-do

避税(请见“逃税”)tax avoidance

币种搭配不当currency mismatch

币种构成currency composition

变相社会集资disguised irregular(or illegal)fund raising 表外科目(业务)off-balance-sheet items(operation)

薄弱环节weaknesses;loopholes

不变成本fixed cost

不变价at constant price;in real terms

不动产real estate

不良贷款(资产)problem loans;non-performing loans (assets)

C

财务公司finance companies

财政赤字fiscal deficit

财政挤银行fiscal pressure on the central bank(over monetary policy)

财政政策与货币政策的配合coordination of fiscal and monetary policies

采取循序渐进的方法in a phased and sequenced manner

操作弹性operational flexibility

操纵汇率to manipulate exchange rate

产品构成product composition;product mix

产品积压stock pile;excessive inventory

产销率current period inventory;(即期库存,不含前期库存)sales/output ratio

产销衔接marketability

产业政策industrial policy

长期国债treasury bonds

敞口头寸open position

炒股to speculate in the stock market

承购包销underwrite(securities)

成套机电产品complete sets of equipment;complete plant(s)

城市信用社urban credit cooperatives(UCCs)

城市合作银行urban cooperative banks;municipal united banks

城市商业银行municipal commercial banks

城乡居民收入增长超过物价涨幅real growth in

household income

持续升温persistent overheating

重复布点duplicate projects

重置成本replacement cost

重组计划restructuring plan

筹资渠道funding sources;financ ing channels

初见成效initial success

出口统一管理、归口经营canalization of exports

出口退税export tax rebate

储蓄存款household deposits(不完全等同于西方的savingsdeposits,前者包括活期存款,后者不包括。)

储蓄分流diversion of household deposits

储源萎缩decline in the availability of household savings 传导机制transmission mechanism

从价税ad valorem tax

从紧控制tight control

存贷款比例loan/deposit ratio

存款保险体系deposit insurance system

存款货币银行deposit money banks

存款准备金required reserves

D

打白条issue IOU

大额存单certificate of deposit(CD)

大额提现withdraw deposits in large amounts

大面积滑坡wide-spread decline

大一统的银行体制(all-in-one)mono-bank system

呆账(请见“坏账”)bad loans

呆账准备金loan loss reserves(provisions)

呆滞贷款idle loans

贷款沉淀non-performing loans

贷款分类loan classification

贷款限额管理credit control;to impose credit ceiling

贷款约束机制credit disciplinary(constraint)mechanism 代理国库to act as fiscal agent

代理金融机构贷款make loans on behalf of other

institutions

戴帽贷款ear-marked loans

倒逼机制reversed transmission of the pressure for easing monetary condition

道德风险moral hazard

地区差别regional disparity

第一产业the primary industry

第二产业the secondary industry

第三产业the service industry;the tertiary industry

递延资产deferrable assets

订货不足insufficient orders

定期存款time deposits

定向募集raising funds from targeted sources

东道国(请见“母国”)host country 独立核算independent accounting

短期国债treasury bills

对冲操作sterilization operation;hedging

对非金融部门债权claims on non-financial sector

多种所有制形式diversified ownership

E

恶性通货膨胀hyperinflation

二级市场secondary market

F

发行货币to issue currency

发行总股本total stock issue

法定准备金required reserves;reserve requirement

法人股institutional shares

法人股东institutional shareholders

法治rule of law

房地产投资real estate investment

放松银根to ease monetary policy

非现场稽核off-site surveillance(or monitoring)

非银行金融机构non-bank financial institutions

非赢利性机构non-profit organizations

分税制assignment of central and local taxes;tax assignment system

分业经营segregation of financial business (services);division of business scope based on the type of financial institutions

风险暴露(风险敞口)risk exposure

风险管理risk management

风险意识risk awareness

风险资本比例risk-weighted capital ratios

风险资本标准risk-based capital standard

服务事业收入public service charges;user's charges

扶贫poverty alleviation

负增长negative growth

复式预算制double-entry budgeting;capital and current budgetary account

G

改革试点reform experimentation

杠杆率leverage ratio

杠杆收购leveraged buyout

高息集资to raise funds by offering high interest

个人股non-institutional shares

根本扭转fundamental turnaround(or reversal)

公开市场操作open market operations

公款私存deposit public funds in personal accounts

公用事业public utilities

公有经济the state-owned sector;the public sector

公有制public ownership

工业成本利润率profit-to-cost ratio

工业增加值industrial value added

供大于求supply exceeding demand;excessive supply

鼓励措施incentives

股份合作企业joint-equity cooperative enterprises

股份制企业joint-equity enterprises

股份制银行joint-equity banks

固定资产贷款fixed asset loans

关税减免tariff reduction and exemption

关税减让tariff concessions

关税优惠tariff incentives;preferential tariff treatment

规范行为to regularize(or standardize)…behavior

规模效益economies of scale

国计民生national interest and people's livelihood

国家对个人其他支出other government outlays to

individuals

国家风险country risk

国际分工international division of labor

国际收支balance of payments

国有独资商业银行wholly state-owned commercial banks 国有经济(部门)the state-owned(or public)sector

国有企业state-owned enterprises(SOEs)

国有制state-ownership

国有资产流失erosion of state assets

国债回购government securities repurchase

国债一级自营商primary underwriters of government

securities

过度竞争excessive competition

过度膨胀excessive expansion

过热迹象signs of overheating

H

合理预期rational expectation

核心资本core capital

合资企业joint-venture enterprises

红利dividend

宏观经济运营良好sound macroeconomic performance

宏观经济基本状况macroeconomic fundamentals

宏观调控macroeconomic management(or adjustment)宏观调控目标macroeconomic objectives(or targets)

坏账bad debt

还本付息debt service

换汇成本unit export cost;local currency cost of export earnings

汇兑在途funds in float

汇兑支出advance payment of remittance by the

beneficiary's bank

汇率并轨unification of exchange rates

活期存款demand deposits

汇率失调exchange rate misalignment 混合所有制diversified(mixed)ownership

货币政策态势monetary policy stance

货款拖欠overdue obligations to suppliers

J

基本建设投资investment in infrastructure

基本经济要素economic fundamentals

基本适度broadly appropriate

基准利率benchmark interest rate

机关团体存款deposits of non-profit institutions

机会成本opportunity cost

激励机制incentive mechanism

积压严重heavy stockpile;excessive inventory

挤提存款run on banks

挤占挪用unwarranted diversion of(financial)resources (from designated uses)

技改投资investment in technological upgrading

技术密集型产品technology-intensive product

计划单列市municipalities with independent planning status 计划经济planned economy

集体经济the collective sector

加大结构调整力度to intensify structural adjustment

加工贸易processing trade

加快态势accelerating trend

加强税收征管稽查to enhance tax administration

加权价weighted average price

价格放开price liberalization

价格形成机制pricing mechanism

减亏to reduce losses

简化手续to cut red tape;to simplify(streamline)procedures 交投活跃brisk trading

缴存准备金to deposit required reserves

结构扭曲structural distortion

结构失调structural imbalance

结构性矛盾突出acute structural imbalance

结构优化structural improvement(optimization)

结汇、售汇sale and purchase of foreign exchange

金融脆弱financial fragility

金融动荡financial turbulence

金融风波financial disturbance

金融恐慌financial panic

金融危机financial crisis

金融压抑financial repression

金融衍生物financial derivatives

金融诈骗financial fraud

紧缩银根to tighten monetary policy

紧缩政策austerity policies;tight financial policies

经常账户可兑换current account convertibility

经济特区special economic zones(SEZs)

经济体制改革economic reform

经济增长方式的转变change in the main source of economic growth(from investment expansion to efficiency gains)

经济增长减速economic slowdown;moderation in economic growth

经济制裁economic sanction

经营自主权autonomy in management

景气回升recovery in business activity

境外投资overseas investment

竞争加剧intensifying competition

局部性金融风波localized(isolated)financial disturbance

K

开办人民币业务to engage in RMB business

可维持(可持续)经济增长sustainable economic growth 可变成本variable cost

可自由兑换货币freely convertible currency

控制现金投放control currency issuance

扣除物价因素in real terms;on inflation-adjusted basis

库存产品inventory

跨国银行业务cross-border banking

跨年度采购cross-year procurement

会计准则accounting standard

L

来料加工processing of imported materials for export

离岸银行业务off-shore banking(business)

理顺外贸体制to rationalize foreign trade regime

利率杠杆的调节作用the role of interest rates in resource allocation

利润驱动profit-driven

利息回收率interest collection ratio

联行清算inter-bank settlement

连锁企业franchise(businesses);chain businesses

良性循环virtuous cycle

两极分化growing income disparity;polarization in income

distribution

零售物价指数retail price index(RPI)

流动性比例liquidity ratio

流动资产周转率/流通速度velocity of liquid assets

流动资金贷款working capital loans

流通体制distribution system

流通网络distribution network

留购(租赁期满时承租人可购买租赁物)hire purchase 垄断行业monopolized industry(sector)

乱集资irregular(illegal)fund raising

乱收费irregular(illegal)charges

乱摊派unjustified(arbitrary)levies

M 买方市场buyer's market

卖方市场seller's market

卖出回购证券matched sale of repo

贸易差额trade balance

民间信用non-institutionalized credit

免二减三exemption of income tax for the first two years ofmaking profit and 50% tax reduction for thefollowing three years

明补explicit subsidy

明亏explicit loss

名牌产品brand products

母国(请见“东道国”)home country

N

内部控制internal control

内部审计internal audit

内地与香港the mainland and Hong Kong

内债domestic debt

扭亏为盈to turn a loss-making enterprise into a profitable one

扭曲金融分配distorted allocation of financial resources

农副产品采购支出outlays for agricultural procurement

农村信用社rural credit cooperatives(RCCs)

P

泡沫效应bubble effect

泡沫经济bubble economy

培育新的经济增长点to tap new sources of economic growth

片面追求发展速度excessive pursuit of growth

平衡发展balanced development

瓶颈制约bottleneck(constraints)

平稳回升steady recovery

铺底流动资金initial(start-up)working capital

普遍回升broad-based recovery

配套改革concomitant(supporting)reforms

配套人民币资金local currency funding of…

Q

企业办社会enterprises burdened with social responsibilities

企业集团战略corporate group strategy

企业兼并重组company merger and restructuring

企业领导班子enterprise management

企业所得税enterprise(corporate)income tax

企业效益corporate profitability

企业资金违规流入股市irregular flow of enterprise funds into the stock market

欠税tax arrears

欠息overdue interest

强化税收征管to strengthen tax administration

强制措施enforcement action

翘尾因素carryover effect

切一刀partial application

清理收回贷款clean up and recover loans

(破产)清算liquidation

倾斜政策preferential policy

区别对待differential treatment

趋势加强intensifying trend

全球化globalization

权益回报率returns on equity(ROE)

缺乏后劲unsustainable momentum

R

绕规模贷款to circumvent credit ceiling

人均国内生产总值per capita GDP

人均收入per capita income

人民币升值压力upward pressure on the Renminbi (exchange rate)

认缴资本subscribed capital

软贷款soft loans

软预算约束soft budget constraint

软着陆soft landing

S

三角债chain debts;inter-enterprise arrears

善政廉政good governance

商业贷款commercial loans

上市公司(publicly)listed corporations

设备利用capacity utilization

社会保障social safety net;social security(insurance)

深层次矛盾deep-rooted structural imbalance

审批金融机构to license financial institutions

审慎监管prudential supervision

生产能力闲置unutilized capacity

生息资产interest-bearing assets

实际利用外资disbursement of foreign capital;actual inflow of foreign investment

实际有效汇率real effective exchange rate

实时real time

实收资本paid-in capital

实现利润realized profit

市场分割market segmentation

市场经济market economy

市场占有率(市场份额)market share

市场准入market access(指商品和劳务的进入);market entry(指机构的审批)

市价总值market capitalization

适度从紧appropriately tight

适时调节timely adjustment 收回对金融机构贷款to recall central bank loans (to financial institutions)

税后还贷amortization(repayment of loans)after tax

税收流失tax erosion

税源不足weak tax base

私营经济(私人经济)the private sector

私有制private ownership

所有者权益owner's equity

T

逃税(请见“避税”)tax evasion

套汇(1)指合法:currency swap;arbitrage(2)指非法:illegal purchase of foreign exchange

剔除季节性因素seasonally adjusted

调节流动性to influence liquidity level

贴现窗口discount window

同比on year-on-year basis;over the same period of the previous year

同业拆借(放)inter-bank borrowing(lending)

同业拆借市场利率(中国)CHIBOR(China inter-bank offered rate)

同业融通票据inter-bank financing bills

同业往来inter-bank transactions

透支overdraft

退税tax refund(rebate)

头寸position

吞吐基础货币adjustment of monetary base

脱媒现象disintermediation

W

外部审计external audit

外国直接投资foreign direct investment (FDI)

外汇储备foreign exchange reserves

外汇调剂foreign exchange swap

外汇占款the RMB counterpart of foreign exchange

reserves;the RMB equivalent of offcial foreign exchange

holdings

外向型经济export-oriented economy

外债external debt

外资企业foreign-funded enterprises

完善现代企业制度to improve the modern enterprise

system

完税凭证tax payment documentation

违法经营illegal business

委托存款entrusted deposits

稳步增长steady growth

稳健的银行系统 a sound banking system

稳中求进to make progress while ensuring stability

无纸交易book-entry(or paperless/scriptless)transaction 物价监测price monitoring

X

吸纳流动性to absorb liquidity

稀缺经济scarcity economy

洗钱money laundering

系统内调度fund allocation within a bank

系统性金融危机systemic financial crisis

下岗工人laid-off employees

下游企业down-stream enterprises

现场稽核on-site examination

现金滞留(居民手中)cash held outside the banking system 乡镇企业township and village enterprises(TVEs)

消费物价指数consumer price index(CPI)

消费税excise(consumption)tax

消灭财政赤字to balance the budget;to eliminate fiscal

deficit

销货款回笼reflow of corporate sales income to the banking system

销售平淡lackluster sales

协议外资金额committed amount of foreign investment

新经济增长点new sources of economic growth

新开工项目new projects;newly started projects

新增贷款incremental credit; loan increment; credit growth; credit expansion

新增就业位置new jobs;new job opportunities

信贷规模考核review the compliance with credit ceilings

信号失真distorted signals

信托投资公司trust and investment companies

信息不对称information asymmetry

信息反馈feedback(information)

信息共享系统information sharing system

信息披露information disclosure

信用扩张credir expansion

信用评级credit rating

姓“资”还是姓“社”pertaining to socialism or

capitalism;socialist orcaptialist

行政措施administrative measures

需求膨胀demand expansion; excessive demand

虚伪存款window-dressing deposits

削减冗员to shed excess labor force

寻租rent seeking

迅速反弹quick rebound

Y

养老基金pension fund

一刀切universal application;non-discretionary implementation

一级市场primary market

应收未收利息overdue interest 银行网点banking outlets

赢利能力profitability

营业税business tax

硬贷款(商业贷款)commercial loans

用地审批to grant land use right

有管理的浮动汇率managed floating exchange rate

证券投资portfolio investment

游资(热钱)hot money

有市场的产品marketable products

有效供给effective supply

诱发新一轮经济扩张trigger a new round of economic

expansion

逾期贷款overdue loans;past-due loans

与国际惯例接轨to become compatible with internationally accepted

与国际市场接轨to integrate with the world market

预算外支出(收入)off-budget (extra-budgetary)

expenditure(revenue)

预调pre-emptive adjustment

月环比on a month-on-month basis; on a monthly basis

Z

再贷款central bank lending

在国际金融机构储备头寸reserve position in international financial institutions

在人行存款deposits at (with)the central bank

在途资金fund in float

增加农业投入to increase investment in agriculture

增势减缓deceleration of growth;moderation of growthmomentum

增收节支措施revenue-enhancing and expenditure control

measures

增长平稳steady growth

增值税value-added tax(V A T)

涨幅偏高higher-than-desirable growth rate;excessive growth

账外账concealed accounts

折旧depreciation

整顿retrenchment;consolidation

政策工具policy instrument

政策性业务policy-related operations

政策性银行policy banks

政策组合policy mix

政府干预government intervention

证券交易清算settlement of securities transactions

证券业务占款funding of securities purchase

支付困难payment difficulty

支付能力payment capacity

直接调控方式向to increase the reliance on indirect policy instruments

间接调控方式转变职能转换transformation of functions

职业道德professional ethics

指令性措施mandatory measures

指令性计划mandatory plan;administered plan

制定和实施货币政策to conduct monetary policy;to formulate and implement monetary policy

滞后影响lagged effect

中介机构intermediaries

中央与地方财政delineation of fiscal responsibilities

分灶吃饭重点建设key construction projects;key investment project

周期谷底bottom(trough)of business cycle

周转速度velocity

主办银行main bank

主权风险sovereign risk

注册资本registered capital

逐步到位to phase in;phased implementation

逐步取消to phase out

抓大放小to seize the big and free the small(to maintain close oversight on the large state-ownedenterprises and subject smaller ones to market competition)

专款专用use of funds as ear-marked

转贷on-lending

转轨经济transition economy

转机turnaround

转折关头turning point

准财政赤字quasi-fiscal deficit

准货币quasi-money

资本不足under-capitalized

资本充足率capital adequacy ratio

资本利润率return on capital

资本账户可兑换capital account convertibility

资不抵债insolvent;insolvency

资产负债表balance sheet

资产负债率liability/asset ratio;ratio of liabilities to assets 资产集中asset concentration

资产贡献率asset contribution factor

资产利润率return on assets (ROA)

资产质量asset quality

资产组合asset portfolio

资金成本cost of funding;cost of capital;financing cost

资金到位fully funded (project)

资金宽裕to have sufficient funds

资金利用率fund utilization rate

资金缺口financing gap

资金体外循环financial disintermediation

资金占压funds tied up

自筹投资项目self-financed projects

自有资金equity fund

综合国力overall national strength(often measured by GDP)

综合效益指标overall efficiency indicator

综合治理comprehensive adjustment (retrenchment);over-haul

总成交额total contract value

总交易量total amount of transactions

总成本total cost

最后贷款人lender of last resort

bear market(熊市)

blue chips(蓝筹股,绩优股)

opening/closing price(开/收盘价)

listed firm(上市公司)

initial share(原始股)

daily limit(每日停板限额)

retail / private investor(散户)

broker/dealer(券商)

debt-for-equity swap(债权转股权)

PE ratio=price/earnings ratio(市盈率)

sell-off(抛售)

dip/edge down/slip lower (小幅下跌)

crash/collapse/crumble/slump(大幅快速下跌)

open low(低开)

描写金融英语的实用句子

描写金融英语的实用句子 学习好英语最重要的就是积累,所以我们一定要好好学习,下面小编就给大家整理了金融英语句子,有机会可以学习一下哦 一 1.By their very nature financial institution attract criticism:banks would not be doing their jobs if their did not turn down some requests for loans, and those who are denied funds sometimes feel hard done by and are vociferous in their complains. 1.金融系统天生就容易招致批评:银行家如果不拒绝某些贷款要求,那就没有尽职尽责;而那些被决绝的借款人有时会觉得十分委屈,甚至因大为光火而抱怨不停。 2.If you have a checking account, the bank sends you your canceled checks along with your monthly statement. These checks can be used instead of receipts. They can be used as proof that payment has been made. 2.如果你有支票账户,银行每月把你的付讫支票连同月度清单送给你。这些支票可以代替收据,当作付款的证据。 3.How do the clearing banks meet these requirements? Their first concern is to see that they always have sufficient notes and coin in their tills, or in reserve, to meet instantly all the demands for cash that may be made upon them. 3.清算银行是怎样满足这些需要的呢?他们最关心的是确保钱柜里,或储备有足够的钞票,迅速应付可能发生的各种现金支取。 4.It's hard to imagine that people could do business without the services of a bank. 4.很难想象出人们在没有银行服务的情况下做生意的情形。 5.As the business matures, an initial public offering(IPO) may take place, or the business merged or sold, or other sources of capital found. 5.随着公司经营的成熟,可以通过公开发行股票,公司合并或者出售,或用其他方式的获得资本。 6.The most widely held liquid security is the Treasury bill, which is commonly issued by the ministry of finance. 6.最为广泛持有的流动性债券是国库券,通常由财政部发行。

金融专业英语阅读(答案)

Lesson One Translate the following passage into Chinese 1.紧缩性货币政策和扩张性货币政策都涉及到改变一个国家的货币供应量水平。 扩张性货币政策增加货币供应量,而紧缩性货币政策会减少货币供应量。 2.当联邦储备体系在公开市场上购买有价证券,会引起证券价格上涨。债券价格 和利率成反比关系。联邦贴现率就是一种利率,因此降低联邦利率实际上就是 降低利率。如果联邦储备系统决定降低法定储备要求,那么银行能够进行投资 的资金会增加。这会引起投资比如债券价格的上涨,因此利率会降低。无论联 邦储备体系用何种方法来增加货币供应量,利率都会降低,债券价格会上涨。 Translate the following sentences into English 1. China would maintain a stable currency and prudent monetary policy, and expected to stay within its growth and inflation targets this year 2.China would also maintain a prudent monetary policy to support economic development while preventing inflationary pressure and financial risks 3. China’s economy continued to grow steadily and rapidly in the first quarter, with investment in fixed assets slowing and domestic consumption accelerating. 4.because of China’s large increase in its trade surplus and foreign exchange reserves in the first quarter, the effectiveness of its monetary policy — used to help control inflation — was facing “serious challenges.” 5. The central bank would seek to further streamline its foreign exchange system to facilitate the orderly outflow of funds. At the same time, it would tighten the management of foreign exchange inflows and settlement. —Three Translation: Translate the following passage into Chinese 1.外汇交易当然是指两种不用货币之间的交易了。每一组货币的交易或“买卖”都包含两个部分。一个是即期市场,在这个市场中支付(交付)需在交易时立即进行(在实际操作中一般是在第二个交易日进行),另一个就是远期市场。远期市场的汇率是在交易的时候就先确定了,但实际的交易,或交付则是在未来的某个特定时间进行的。 2.外汇交易期权是指一种货币和另一种货币在未来进行交付的一个合同,在此合同中,

金融英语词汇

常见银行英文词汇 储蓄 银行及金融机构 会计 经济政策 金融债券 FORFAITING 储蓄(save) account number帐目编号depositor存户 pay-in slip存款单 a deposit form存款单 a banding machine自动存取机to deposit存款 deposit receipt存款收据private deposits私人存款certificate of deposit存单deposit book,passbook存折credit card信用卡 principal本金 overdraft,overdraw透支 to counter sign双签 to endorse背书 endorser背书人 to cash兑现 to honor a cheque兑付 to dishonor a cheque拒付 to suspend payment止付cheque,check支票 cheque book支票本 order cheque记名支票 bearer cheque不记名支票crossed cheque横线支票 blank cheque空白支票 rubber cheque空头支票cheque stub,counterfoil票根cash cheque现金支票 traveler's cheque旅行支票cheque for transfer转帐支票outstanding cheque未付支票canceled cheque已付支票

forged cheque伪支票 Bandar's note庄票,银票 银行及金融机构(Banks and financial organizations) banker银行家 president行长 savings bank储蓄银行 Chase Bank大通银行 National City Bank of New York花旗银行 Hongkong Shanghai Banking Corporation汇丰银行 Chartered Bank of India,Australia and China麦加利银行 Banque de I'IndoChine东方汇理银行 central bank,national bank,banker's bank中央银行 bank of issue,bank of circulation发行币银行 commercial bank商业银行,储蓄信贷银行 member bank,credit bank储蓄信贷银行 discount bank贴现银行 exchange bank汇兑银行 requesting bank委托开证银行 issuing bank,opening bank开证银行 advising bank,notifying bank通知银行 negotiation bank议付银行 confirming bank保兑银行 paying bank付款银行 associate banker of collection代收银行 consigned banker of collection委托银行 clearing bank清算银行 local bank本地银行 domestic bank国内银行 overseas bank国外银行 unincorporated bank钱庄 branch bank银行分行 trustee savings bank信托储蓄银行 trust company信托公司 financial trust金融信托公司 unit trust信托投资公司 trust institution银行的信托部 credit department银行的信用部 commercial credit company(discount company)商业信贷公司(贴现公司)neighborhood savings bank,bank of deposit街道储蓄所 credit union合作银行 credit bureau商业兴信所

常用金融英语词汇的翻译知识讲解

常用金融英语词汇的 翻译

常用金融英语词汇的翻译 acquiring company 收购公司 bad loan 呆帐 chart of cash flow 现金流量表 clearly-established ownership 产权清晰 debt to equity 债转股 diversity of equities 股权多元化 economy of scale 规模经济 emerging economies 新兴经济 exchange-rate regime 汇率机制 fund and financing 筹资融资 global financial architecture 全球金融体系 global integration, globality 全球一体化,全球化 go public 上市 growth spurt (经济的)急剧增长 have one's "two commas" 百万富翁 hedge against 套期保值 housing mortgage 住房按揭 holdings 控股,所持股份 holding company 控股公司 initial offerings 原始股 initial public offerings 首次公募 innovative business 创新企业 intellectual capital 智力资本 inter-bank lending 拆借 internet customer 网上客户 investment payoff period 投资回收期 joint-stock 参股 mall rat 爱逛商店的年轻人 means of production 生产要素 (the)medical cost social pool for major diseases 大病医疗费用社会统筹mergers and acquisitions 并购

英语银行金融类试译文_20200607

原文:银行金融类 “主承信用债尽职调查”,指的是我行作为主承销商,应当遵循勤勉尽责、诚实信用原则,通过各种有效方法和步骤,对发行人进行充分调查,掌握其主体资格、资产权属、债权债务等重大事项的法律状态,以及企业的业务、管理及财务状况等,对发行人的还款意愿和还款能力作出判断,以合理确信注册文件的真实性、准确性和完整性的行为。 尽职调查是投行业务流程中的最重要环节,尽调人员在尽调基础上编制的尽责调查报告(包括工作底稿),是判断项目可信性的基本依据,是考察项目尽调人员是否勤勉尽责的书面证明。 译文: Banking and financial " Due diligence of Main contractor in Credit bond” It means that we are as main contractor need to follow the rule of diligent, responsible, honest and trustworthy.Through various effective methods and steps,investigating the issuer,mastering the legal status of major matters such as the subject qualification、assets ownership、credit and debt,etc. Meanwhile we need master business process and management and financial situation of the issuer. The main contractor need to make judgments of the issuer about ability or willingness to repay, with reasonable confidence in the act of authenticity, accuracy, and completeness of registration document . Due diligence is very importance in business process of investment bank. The team member of due diligence should make a due diligence report after investigating the issuer(include work draft ).It is the basic to judge the credibility of this project . This is also a documentary evidence as the worker of due diligence that investigate the program diligent and responsible.

金融英语句子翻译

Chapter 1 1. However, research has shown that countries often reversed the steps mentioned above and sterilized gold flows, that is sold domestic assets when foreign reserves were rising and bought domestic assets as foreign reserves fell. Government interference with private gold exports also undermined the system. The picture of smooth and automatic balance of payments adjustment before World War I therefore did not always match reality. 然而,研究表明各国经常反道而行之,他们制止黄金的流动,也就是说,当外国储备升高时他们售出国内资产,而当外国储备下降时,他们购买国内资产。政府对私人黄金出口的干预也破坏了该体系。第一次世界大战前平衡自动的国际收支调整情形常常与现实不相吻合。2. The gold standard regime has conventionally been associated with three rules of the game. The first rule is that in each participating country the price of the domestic currency must be fixed in terms of gold. Since the gold content in one unit of each currency was fixed, exchange rates were also fixed. This was called the mint parity. The second rule is that there must be a free import and export of gold. The third rule is that the surplus country which is gaining gold, should allow its volume of money to increase while the deficit country, which is losing gold, should allow its volume of money to fall. 金本位制按惯例与三条规则有关联。第一条规则是每个参加国其国内货币价格以黄金来确定。由于每一货币单位的黄金含量是固定的,所以汇率也是不变的。这叫做铸币平价。第二条规则是黄金须自由进出口。第三条规则为顺差国,即得到黄金的国家应允许其货币量增加,而逆差国,即失去黄金的国家则允许其货币量减少。 3. Central banks experiencing persistent gold out flows were motivated to contract their domestic asset holdings for the fear of becoming unable to meet their obligation to redeem currency notes. Thus domestic interest rates were pushed up and capital would flow in from abroad. Central banks gaining gold had much weaker incentives to eliminate their own imports of the metal. The main incentive was the greater profitability of interest-bearing domestic assets compared with “barren” gold. 经历持续黄金输出的央行为了避免不能履行其兑换现钞的职责而趋于减少其国内资产的拥有量。这样国内的利率会提高,资金会从国外流入。而获得黄金的央行取消自己黄金进口的动机要弱得多。其主要动机在于与“贫瘠”的黄金相比,有利可图的国内资产具有巨大的获利性。 4. Given the prices of currencies fixed in terms of gold, the price levels within gold standard countries did not rise as much between 1870 and 1914 as over the period after World war II, but national price levels moved unpredictably over shorter horizons as periods of inflation and deflation followed each other. 因为是根据黄金储备而确定货币的价格,在金本位制国家内部的价格水平在1870年到1914年间并未像第二次世界大战后时期那样上涨。但是,全国的价格水平在短时期内出现了像通货膨胀和通货紧缩相互交替时期的不可预见的波动。 Chapter 2 1. They thought a devaluation was a sign of national weakness and a revaluation would reduce the competitiveness of a country. 他们(这些发达国家)认为,货币贬值表示一个国家经济不景气(疲软),而货币升值则会削弱一个国家的竞争能力。 2. The unwillingness of industrial nations to change their par values as a matter of policy when in

英文版国际金融试题和答案

PartⅠ.Decide whether each of the following statements is true or false (10%)每题1分,答错不扣分1. If perfect markets existed, resources would be more mobile and could therefore be transferred to those countries more willing to pay a high price for them. ( T ) 2. The forward contract can hedge future receivables or payables in foreign currencies to insulate the firm against exchange rate risk. ( T ) 3. The primary objective of the multinational corporation is still the same primary objective of any firm, i.e., to maximize shareholder wealth. ( T ) 4. A low inflation rate tends to increase imports and decrease exports, thereby decreasing the current account deficit, other things equal. ( F ) 5. A capital account deficit reflects a net sale of the home currency in exchange for other currencies. This places upward pressure on that home currency’s value. ( F ) 6. The theory of comparative advantage implies that countries should specialize in production, thereby relying on other countries for some products. ( T ) 7. Covered interest arbitrage is plausible when the forward premium reflect the interest rate differential between two countries specified by the interest rate parity formula.( F ) 8.The total impact of transaction exposure is on the overall value of the firm. ( F ) 9. A put option is an option to sell-by the buyer of the option-a stated number of units of the underlying instrument at a specified price per unit during a specified period. ( T ) 10. Futures must be marked-to-market. Options are not. ( T ) PartⅡ:Cloze (20%)每题2分,答错不扣分 1. If inflation in a foreign country differs from inflation in the home country, the exchange rate will adjust to maintain equal( purchasing power ) 2. Speculators who expect a currency to ( appreciate ) could purchase currency futures contracts for that currency. 3. Covered interest arbitrage involves the short-term investment in a foreign currency that is covered by a ( forward contract ) to sell that currency when the investment matures. 4. (Appreciation/ Revalue )of RMB reduces inflows since the foreign demand for our goods is reduced and foreign competition is increased. 5. ( PPP ) suggests a relationship between the inflation differential of two countries and the percentage change in the spot exchange rate over time. 6. IFE is based on nominal interest rate ( differentials ), which are influenced by expected inflation. 7. Transaction exposure is a subset of economic exposure. Economic exposure includes any form by which the firm’s ( value ) will be affected. 8. The option writer is obligated to buy the underlying commodity at a stated price if a ( put option ) is exercised 9. There are three types of long-term international bonds. They are Global bonds , ( eurobonds ) and ( foreign bonds ). 10. Any good secondary market for finance instruments must have an efficient clearing system. Most Eurobonds are cleared through either ( Euroclear ) or Cedel. PartⅢ:Questions and Calculations (60%)过程正确结果计算错误扣2分 1. Assume the following information: A Bank B Bank Bid price of Canadian dollar $0.802 $0.796 Ask price of Canadian dollar $0.808 $0.800 Given this information, is locational arbitrage possible?If so, explain the steps involved in locational arbitrage, and compute the profit from this arbitrage if you had $1,000,000 to use. (5%) ANSWER: Yes!One could purchase New Zealand dollars at Y Bank for $.80 and sell them to X Bank for $.802.With $1 million available, 1.25 million New Zealand dollars could be purchased at Y Bank.These New Zealand dollars could then be sold to X Bank for $1,002,500, thereby generating a profit of $2,500. 2. Assume that the spot exchange rate of the British pound is $1.90.How will this spot rate adjust in two years if the United Kingdom experiences an inflation rate of 7 percent per year while the United

金融英语词汇表

unit one division of labor 劳动分工 commodity money 商品货币 legal tender 法定货币 fiat money 法定通货 a medium of exchange交换媒介 legal sanction法律制裁 face value面值 liquid assets流动资产 illiquidl assets非流动资产 the liquidity scale 流动性指标 real estate 不动产 checking accounts,demand deposit,checkable deposit 活期存款time deposit 定期存款 negotiable order of withdrawal accounts 大额可转让提款单money market mutual funds 货币市场互助基金 repurchase agreements 回购协议 certificate of deposits存单 bond 债券 stock股票 travelers'checks 旅行支票 small-denomination time deposits小额定期存款 large-denomination time deposits大额定期存款 bank overnight repurchase agreements 银行隔夜回购协议 bank long-term repurchase agreements 银行长期回购协议 thrift institutions 存款机构 financial institution 金融机构 commercial banks商业银行 a means of payment 支付手段 a store of value储藏手段 a standard of value价值标准 unit two reserve 储备 note 票据 discount贴现 circulate流通 central bank 中央银行 the Federal Reserve System联邦储备系统 credit union 信用合作社 paper currency 纸币 credit creation 信用创造 branch banking 银行分行制 unit banking 单一银行制

金融专业英语词汇表

金融专业英语词汇表 accelerated depreciation 加速折旧 acceptor 承兑人;受票人;接受人 accommodation paper 融通票据;担保借据 accounts payable 应付帐款 accounts receivable 应收帐款 accrual basis 应计制;权责发生制 accrued interest 应计利息 accredited investors 合资格投资者;受信投资人 指符合美国证券交易委员(sec)条例,可参与一般美国非公开(私募)发行的部份机构和高净值个人投资者 accredit value 自然增长值 ace 美国商品交易所 acid test ratio 酸性测验比率;速动比率 across the board 全面一致;全盘的 acting in concert 一致行动;合谋 active assets 活动资产;有收益资产 active capital 活动资本 actual market 现货市场 actuary 精算师;保险统计专家 adb 亚洲开发银行

adr 美国存股证;美国预托收据;美国存托凭证 ad valorem 从价;按值 affiliated company 关联公司;联营公司 after date 发票后,出票后 after-market 后市 agm 周年大会 agreement 协议;协定 all-or-none order 整批委托 allocation 分配;配置 allotment 配股 alpha (market alpha) 阿尔法;预期市场可得收益水平 alternative investment 另类投资 american commodities exchange 美国商品交易所 american depository receipt 美国存股证;美国预托收据;美国存托凭证 (简称“adr ”参见adr栏目) american depository share 美国存托股份 amercian stock exchange 美国证券交易所 american style option 美式期权 amex 美国证券交易所 amortizable intangibles 可摊销的无形资产 amortization 摊销

常用金融英语词汇大全必备单词

常用金融英语词汇大全必备单词 在英语的学习中,词汇量的积累无疑是很重要的,有关金融方面的英语单词你知道多少呢,下面是学习啦小编整理的一些常用金融英语词汇,希望对大家有帮助。 常用金融英语词汇:H 合理预期 rational expectation 核心资本 core capital 合资企业 joint-venture enterprises 红利 dividend 宏观经济运营良好 sound macroeconomic performance 宏观经济基本状况 macroeconomic fundamentals 宏观调控 macroeconomic management(or adjustment) 宏观调控目标 macroeconomic objectives(or targets) 坏账 bad debt 还本付息 debt service 换汇成本 unit export cost;local currency cost of export earnings 汇兑在途 funds in float 汇兑支出 advance payment of remittance by the beneficiary's bank 汇率并轨 unification of exchange rates 活期存款 demand deposits 汇率失调 exchange rate misalignment 混合所有制 diversified(mixed)ownership 货币政策态势 monetary policy stance 货款拖欠 overdue obligations to suppliers 常用金融英语词汇:J 基本建设投资 investment in infrastructure 基本经济要素 economic fundamentals 基本适度 broadly appropriate 基准利率 benchmark interest rate

金融英语单词

equilibrium theory 均衡理论 mechanical models of the economy 机械经济模型macroeconomic management 宏观经济管理 demand management 需求管理 nationalization 国有化 social security 社会保障 unemployment benefit 失业救济 counter-cyclical monetary and fiscal policies 反周期-货币与财政政策time lags 时滞 Monetarism 货币学派 trade unions 工会 aggregate demand 总需求 conventional wisdom 普遍流行观点 Keynesianism 凯恩斯主义 economic behavior 经济行为 economic model 经济模式 the principle of comparative advantage 比较优势法则 the theory of income determination 收入决定论 the circular flow model 循环流向图 fiscal policy 财政政策 merchant capitalism 商业资本主义 Industrial Revolution 工业革命 the Great Depression 大萧条 imperfect competition 不完全竞争 possibilities frontier (生产)可能性界限 exchange rate 汇率 checking account 经常账户支票账户 savings and loan association 储蓄与贷款协会 foreign exchange rate 外汇汇率 junk bond crisis 垃圾债券危机 bank failure 银行倒闭 savings and loan crisis 储蓄贷款危机 Federal Reserve System 联邦储备银行系统 personal finance 个人理财 business finance 公司财务 international finance 国际金融 public finance 公共财政 risk of loss 亏损的风险 medium of exchange 交换手段 fiat money 法币 legal tender 法定货币 IOU 借据欠条 business day 工作日 electronic means of payment 电子支付手段

金融专业英语实用句子

金融专业英语实用句子(一) 1.The money which a bank obtains from its customers is generally known as its “deposits”and represents the balances which customers keep on their accounts with their banks. These accounts are of two main kinds: current accounts on which customers can draw check but receive no interest, and deposit and savings accounts on which the banks pay interest for the use of the money. 1.银行从其客户那里得到的钱,一般被称为“存款”,代表客户在银行账户上持有的余额。这些账户主要有两种:一种是活期存款,客户可以对其开出支票,但没有利息,另一种是储蓄存款账户,银行使用账上的资金要支付利息。 2.But the shareholders' money is only a small part of the total amount of money which the clearing banks have at their command. Who provided the rest of this enormous sum? The banks' customers. Banks, in effect, borrow from their customers as well as lend to them. 2.但是,股东的资金仅仅是资金总额中的一小部分,并由清算银行控制。其余的大量资金由谁来提供呢?由银行的客户来提供。实际上,银行从客户那里借来资金,并向他们提供贷款。 3.Shareholders of the banks, or their predecessors, provided the money to set up the banks and to enlarge them. This money is known as a bank’s capital.

《金融专业英语》习题答案

Chapter One Functions of Financial Markets 一.Translate the following sentences into Chinese. 1.China’s banking industry is now supervised by the PBC and CBRC. In addition, the MOF is in charge of financial accounting and taxation part of banking regulation and management. 目前中国银行业主要由中国人民银行和银监会进行监管。此外,财政部负责银行业监管的财务会计及税收方面。 2.Currently Chinese fund management companies are engaged in the following business: securities investment fund, entrusted asset management, investment consultancy, management of national social security funds, enterprise pension funds and QDII businesses. 目前中国的基金管理公司主要从事以下业务:证券投资基金业务、受托资产管理业务、投资咨询业务、社保基金管理业务、企业年金管理业务和合格境内机构投资者业务等。 3.China's economy had 10% growth rate in the years before the world financial crisis of 2008. That economic expansion resulted from big trade surpluses and full investment. Now China is seeking to move away from that growth model. The country is working to balance exports with demand at home. 在2008年世界经济危机之前的那些年,中国经济增长速度曾达到10%。这一经济增长源于巨额贸易盈余和大量投资。中国现在正在寻求改变这一增长模式。中国正致力于平衡出口和国内需求。 二.Translate the following sentences into English 1.中国商业银行监管的程序是市场准入监管、市场运营监管和市场退出监管。 Regulatory procedures of China’s commercial banks are market access regulation, market operation regulation and market exit regulation. 2.国务院关于推进资本市场改革开放和稳定发展的若干意见。 Some opinions of the State Council on promoting the reform, opening and steady growth of the capital market 3.只有建立合理的股权结构,才能保证公司取得好的经营业绩。 Only establishing reasonable ownership structure can guarantee perfect corporate performance. 4.该公司股票暴跌,被伦敦交易所摘牌。 The company’s stock nosedived and it was delisted from the London exchange.