answer4

Solutions to Problem Set4

EC379.01-Financial Economics Peter Ireland Boston College,Department of Economics Fall2014

Due Thursday,February27

1.Interpreting Measures of Risk Aversion

With vN-M expected utility and Bernoulli utility function

u(Y)=Y1?γ?1 1?γ

and initial wealth Y0=10,expected utility from accepting the lottery(0.1,?0.1,π?)is

π?

10.11?γ?1

1?γ

+(1?π?)

9.91?γ?1

1?γ

while expected utility from rejecting the lottery is just

101?γ?1

1?γ

.

Hence,if the investor is indi?erent between accepting and rejecting

π?

10.11?γ?1

1?γ

+(1?π?)

9.91?γ?1

1?γ

=

101?γ?1

1?γ

or,more simply,

π?(10.11?γ)+(1?π?)(9.91?γ)=101?γ. Rearranging this last expression yields an exact formula forπ?:

π?=

101?γ?9.91?γ10.11?γ?9.91?γ

,

and for any setting forγ,this exact value can be compared to the value implied by the

approximation

π?≈1

2

+

γh

4

where h=0.01.Results from the calculations con?rm that more risk averse investors require a higher value ofπ?and also con?rm the accuracy of the appoximation:

γExactπ?Approximateπ?

1/20.50130.5012

20.50500.5050

30.50750.5075

100.52500.5250

1000.73120.7500

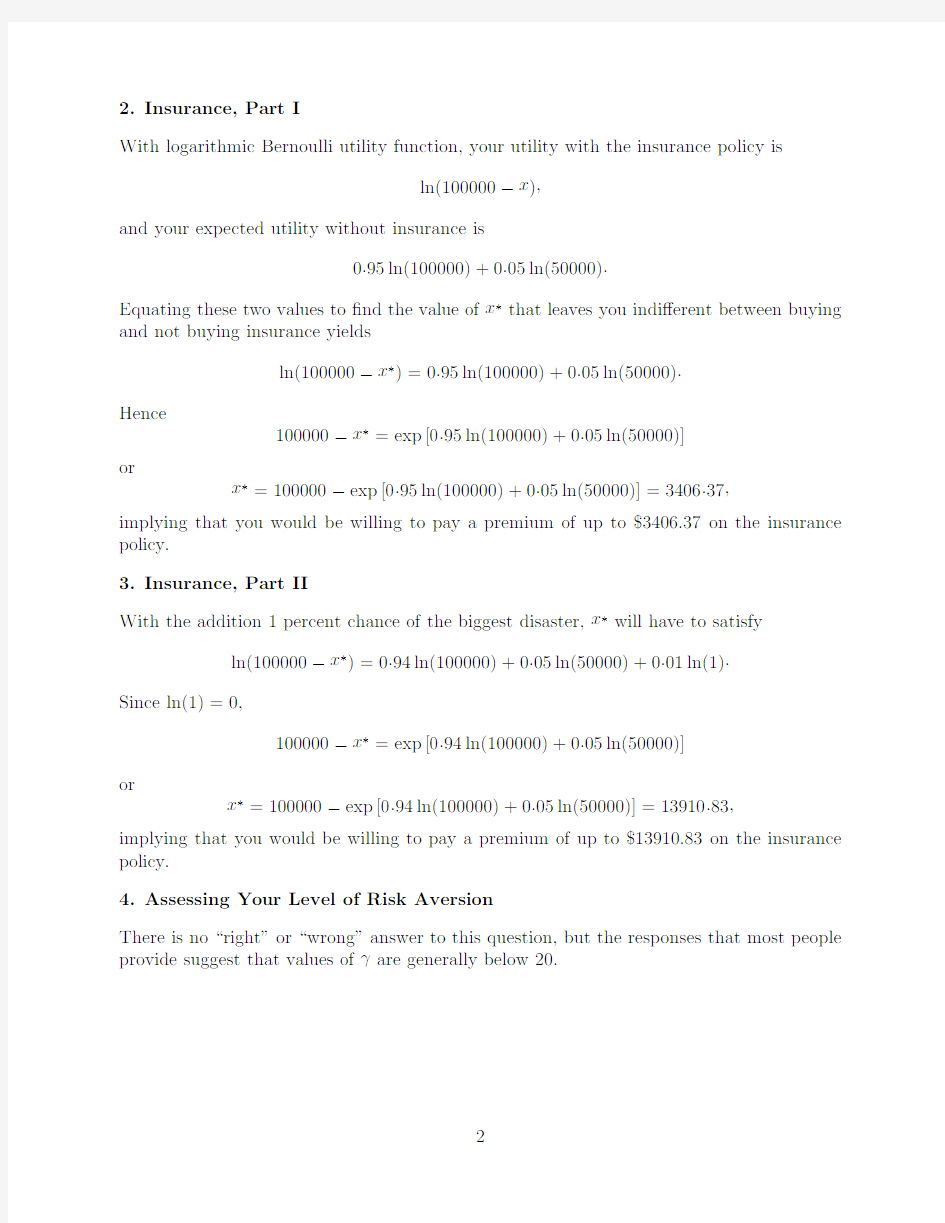

2.Insurance,Part I

With logarithmic Bernoulli utility function,your utility with the insurance policy is

ln(100000?x),

and your expected utility without insurance is

0.95ln(100000)+0.05ln(50000).

Equating these two values to?nd the value of x?that leaves you indi?erent between buying and not buying insurance yields

ln(100000?x?)=0.95ln(100000)+0.05ln(50000).

Hence

100000?x?=exp[0.95ln(100000)+0.05ln(50000)]

or

x?=100000?exp[0.95ln(100000)+0.05ln(50000)]=3406.37,

implying that you would be willing to pay a premium of up to$3406.37on the insurance policy.

3.Insurance,Part II

With the addition1percent chance of the biggest disaster,x?will have to satisfy

ln(100000?x?)=0.94ln(100000)+0.05ln(50000)+0.01ln(1).

Since ln(1)=0,

100000?x?=exp[0.94ln(100000)+0.05ln(50000)]

or

x?=100000?exp[0.94ln(100000)+0.05ln(50000)]=13910.83,

implying that you would be willing to pay a premium of up to$13910.83on the insurance policy.

4.Assessing Your Level of Risk Aversion

There is no“right”or“wrong”answer to this question,but the responses that most people provide suggest that values ofγare generally below20.