公司理财第10章

Chapter 10: Return and Risk: The Capital-Asset-Pricing Model (CAPM) Concept Questions - Chapter 10

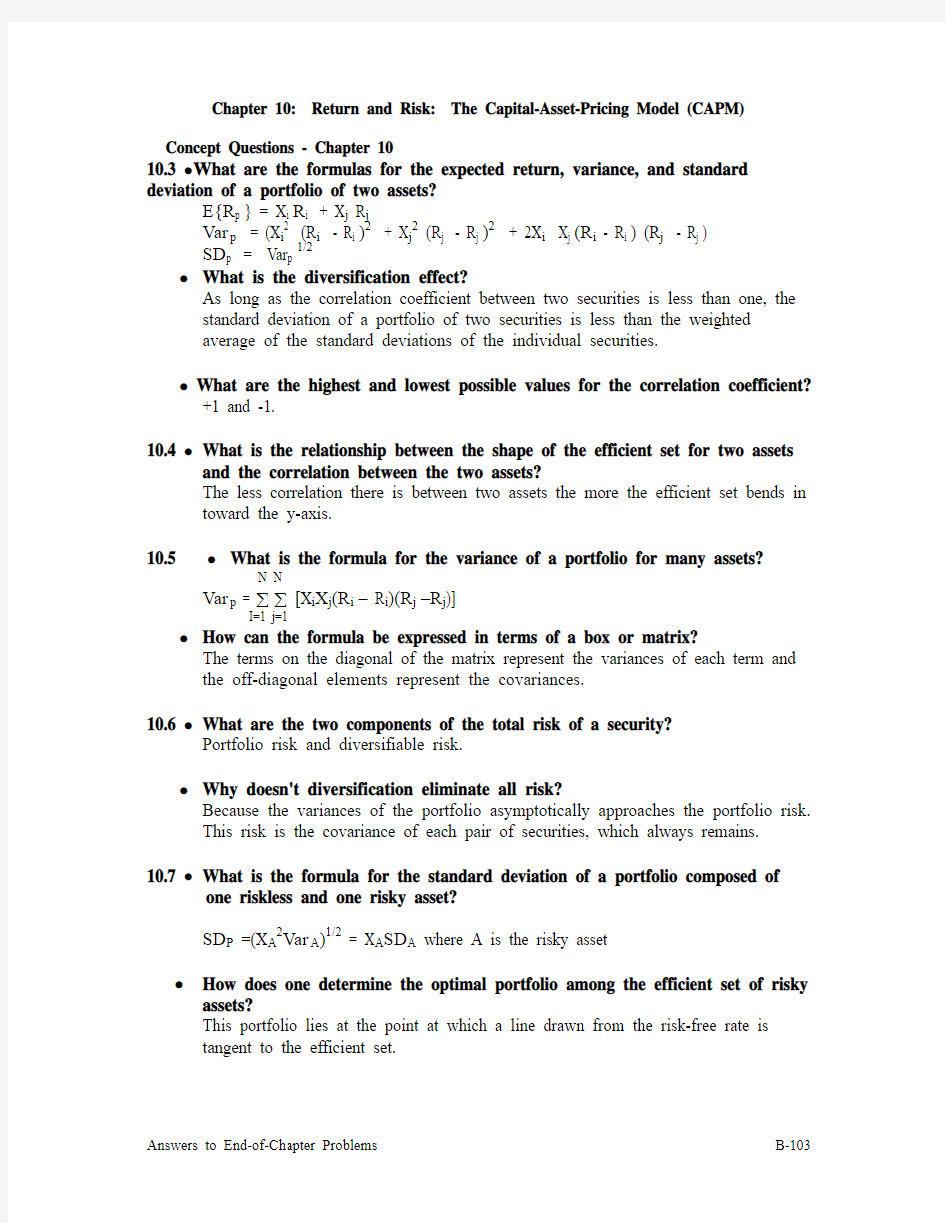

10.3 ?W hat are the formulas for the expected return, variance, and standard deviation of a portfolio of two assets?

E{R p } = X i R i + X j R j

Var p = (X i2 (R i - R i )2 + X j2 (R j - R j )2 + 2X i X j (R i - R i ) (R j - R j )

SD p = Var p 1/2

?What is the diversification effect?

As long as the correlation coefficient between two securities is less than one, the

standard deviation of a portfolio of two securities is less than the weighted

average of the standard deviations of the individual securities.

? What are the highest and lowest possible values for the correlation coefficient?

+1 and -1.

10.4 ?What is the relationship between the shape of the efficient set for two assets

and the correlation between the two assets?

The less correlation there is between two assets the more the efficient set bends in

toward the y-axis.

10.5 ?What is the formula for the variance of a portfolio for many assets?

N N

Var p = ∑∑ [X i X j(R i– R i)(R j–R j)]

I=1 j=1

?How can the formula be expressed in terms of a box or matrix?

The terms on the diagonal of the matrix represent the variances of each term and

the off-diagonal elements represent the covariances.

10.6 ?What are the two components of the total risk of a security?

Portfolio risk and diversifiable risk.

?Why doesn't diversification eliminate all risk?

Because the variances of the portfolio asymptotically approaches the portfolio risk.

This risk is the covariance of each pair of securities, which always remains.

10.7 ?What is the formula for the standard deviation of a portfolio composed of

one riskless and one risky asset?

SD P =(X A2Var A)1/2 = X A SD A where A is the risky asset

?How does one determine the optimal portfolio among the efficient set of risky assets?

This portfolio lies at the point at which a line drawn from the risk-free rate is

tangent to the efficient set.

10.8 ?If all investors have homogeneous expectations, what portfolio of risky assets

do they hold?

The market portfolio.

?What is the formula for beta?

B i = COV(R i R m)/Var(R m)

?Why is the beta the appropriate measure of risk for a single security in a large portfolio?

Because beta measures the contribution of that single security to the variance of

the portfolio.

10.9 ?Why is the SML a straight line?

Because investors could form homemade portfolios that dominate portfolios that don't lie on a straight line. Buying and selling of these portfolios would then

drive any outliers back to the line.

?What is the Capital-Asset-Pricing model?

The CAPM is a linear model that relates the expected return on an asset to its

systematic risk (beta).

?What are the differences between the capital market line and the security market line?

The SML relates expected return to beta, while the CML relates expected return

to the standard deviation. The SML holds both for all individual securities and

for all possible portfolios, whereas the CML holds only for efficient portfolios. Answers to End-of-Chapter Problems

10.1 a. R= 0.1 (– 4.5%) + 0.2 (4.4%) + 0.5 (12.0%) + 0.2 (20.7%)

= 10.57%

b. σ2= 0.1 (–0.045 – 0.1057)2 + 0.2 (0.044 – 0.1057)2 + 0.5 (0.12 – 0.1057)2

+ 0.2 (0.207 – 0.1057)2

= 0.0052

σ= (0.0052)1/2 = 0.072 = 7.20%

10.2 a. R A= (6.3 + 10.5 + 15.6) / 3 = 10.8%

R B= (-3.7 + 6.4 + 25.3) / 3 = 9.3%

b. σA2= {(0.063 – 0.108)2 + (0.105 – 0.108)2 +{(0.156 – 0.108)2} / 3

= 0.001446

σA= (0.001446)1/2 = 0.0380 = 3.80%

σB2= {(– 0.037 – 0.093)2 +(0.064 – 0.093)2 +(0.253 – 0.093)2} / 3

= 0.014447

σB= (0.014447)1/2 = 0.1202 = 12.02%

c. Cov(R A,R B) = [(.063 – .108) (– .037 – .093) + (.105 – .108) (.064 – .093)

+ (.156 – .108) (.253 – .093) ] / 3

= .013617 / 3 = .004539

Corr(R A,R B) = .004539 / (.0380 x .1202) = .9937

10.3 a. R HB= 0.25 (–2.0) + 0.60 (9.2) + 0.15 (15.4)

= 7.33%

R SB= 0.25 (5.0) + 0.60 (6.2) + 0.15 (7.4)

= 6.08%

b. σHB2= 0.25 (– 0.02 – 0.0733)2 + 0.60 (0.092 – 0.0733)2

+ 0.15 (0.154 – 0.0733)2

= 0.003363

σHB= (0.003363)1/2 = 0.05799 = 5.80%

σSB2= 0.25 (0.05 – 0.0608)2 + 0.60 (0.062 – 0.0608)2

+ 0.15 (0.074 – 0.0608)2

= 0.000056

σSB= (0.000056)1/2 = 0.00749 = 0.75%

c. Cov (R HB, R SB)

= 0.25 (– 0.02 – 0.0733) (0.05 – 0.0608)

+ 0.60 (0.092 – 0.0733) (0.062 – 0.0608)

+ 0.15 (0.154 – 0.0733) (0.074 – 0.0608)

= 0.000425286

Corr (R HB, R SB)

= 0.000425286 / (0.05799 ? 0.00749)

= 0.9791

10.4 Holdings of Atlas stock = 120 ? $50 = $6,000

Holdings of Babcock stock = 150 ? $20 = $3,000

Weight of Atlas stock = $6,000 / $9,000 = 2 / 3

Weight of Babcock stock = $3,000 / $9,000 = 1 / 3

10.5 a. R P= 0.3 (0.12) + 0.7 (0.18) = 0.162 = 16.2%

b. σP 2= 0.32 (0.09)2 + 0.72 (0.25)2 + 2 (0.3) (0.7) (0.09) (0.25) (0.2)

= 0.033244

σP= (0.033244)1/2 = 0.1823 = 18.23%

10.6 a. R P= 0.4 (0.15) + 0.6 (0.25) = 0.21 = 21%

σP 2= 0.42 (0.1)2 + 0.62 (0.2)2 + 2 (0.4) (0.6) (0.1) (0.2) (0.5)

= 0.0208

σP= (0.0208)1/2 = 0.1442 = 14.42%

b. σP 2= 0.42 (0.1)2 + 0.62 (0.2)2 + 2 (0.4) (0.6) (0.1) (0.2) (-0.5)

= 0.0112

σP= (0.0112)1/2 = 0.1058 = 10.58%

c. As the stocks are more negatively correlated, the standard deviation of the

portfolio decreases.

10.7 Macrosoft: 100 ? $80 = $8,000

Intelligent: 300 ? $40 = $12,000

Weight: M acrosoft: $8,000 / $20,000 = 0.4

Intelligent: $12,000 / $20,000 = 0.6

a. R P= 0.4 (0.15) + 0.6 (0.20) = 0.18 = 18%

σP 2= 0.42 (0.08)2 + 0.62 (0.2)2 + 2 (0.4) (0.6) (0.38) (0.08) (0.20)

= 0.0183424

σP= (0.0183424)1/2 = 0.1354 = 13.54%

b. New weight:

Macrosoft: $8,000 / $12,000 = 0.667

Intelligent: $4,000 / $12,000 = 0.333

R P= 0.667 (0.15) + 0.333 (0.20) = 0.1666 = 16.66%

σP 2= 0.6672 (0.08)2 + 0.3332 (0.2)2 + 2 (0.667) (0.333) (0.38) (0.08) (0.20)

= 0.009984

σP= (0.009984)1/2 = 0.09992 = 9.99%

10.8 a. R U= 7%

R V= 0.2 (-0.05) + 0.5 (0.10) + 0.3 (0.25) = 0.115 = 11.5%

σU2= σU = 0

σV2= 0.2 (-0.05 - 0.115)2 + 0.5 (0.10 - 0.115)2 + 0.3 (0.25 - 0.115)2

= 0.0110

σV= (0.0110)1/2 = 0.105 = 10.5%

b. Cov (R U, R V)

= 0.2 (-0.05 - 0.115) (0.07 - 0.07)

+ 0.5 (0.10 - 0.115) (0.07 - 0.07)

+ 0.3 (0.25 - 0.115) (0.07 - 0.07)

= 0

Corr (R U, R V) = 0

c. R P= 0.5 (0.115) + 0.5 (0.07) = 0.0925 = 9.25%

σP 2= 0.52 (0.0110) = 0.00275

σP= (0.00275)1/2 = 0.0524 = 5.24%

10.9 a. R P= 0.3 (0.10) + 0.7 (0.20) = 0.17 = 17.0%

σP 2= 0.32 (0.05)2 + 0.72 (0.15)2 = 0.01125

σP= (0.01125)1/2 = 0.10607 = 10.61%

b. R P= 0.9 (0.10) + 0.1 (0.20) = 0.11 = 11.0%

σP 2= 0.92 (0.05)2 + 0.12 (0.15)2 = 0.00225

σP= (0.00225)1/2 = 0.04743 = 4.74%

c. No, I would not hold 100% of stock A because the portfolio in b has higher

expected return but less standard deviation than stock A.

I may or may not hold 100% of stock B, depending on my preference.

10.10 The expected return on any portfolio must be less than or equal to the return on the stock

with the highest return. It cannot be greater than this stock’s return because all stocks

with lower returns will pull down the value of the weighted average return.

Similarly, the expected return on any portfolio must be greater than or equal to the return of the asset with the lowest return. The portfolio return cannot be less than the lowest

return in the portfolio because all higher earning stocks will pull up the value of the

weighted average.

10.11 a. R A= 0.4 (0.03) + 0.6 (0.15) = 0.102 = 10.2%

R B= 0.4 (0.065) + 0.6 (0.065) = 0.065 = 6.5%

σA2= 0.4 (0.03 - 0.102)2 + 0.6 (0.15 - 0.102)2

= 0.003456

σA= (0.003456)1/2 = 0.05878 = 5.88%

σB2 = σB = 0

b. X A= $2,500 / $6,000 = 0.417

X B= 1 - 0.417 = 0.583

R P= 0.417 (0.102) + 0.583 (0.065) = 0.0804 = 8.04%

σP 2= X A2 σA2 = 0.0006

σP= (0.0006)1/2 = 0.0245 = 2.45%

c. Amount borrowed = -40 ? $50 = -$2,000

X A = $8,000 / $6,000 = 4 / 3

X B = 1 - X A = -1 / 3

R P= (4 / 3) (0.102) + (-1 / 3) (0.065) = 0.1143 = 11.43%

σP 2= (4 / 3)2 (0.003456) = 0.006144

σP= (0.006144)1/2 = 0.07838 = 7.84%

10.12 The wide fluctuations in the price of oil stocks do not indicate that oil is a poor

investment. If oil is purchased as part of a portfolio, what matters is only its beta. Since the price captures beta plus idiosyncratic risks, observing price volatility is not an

adequate measure of the appropriateness of adding oil to a portfolio. Remember that total variability should not be used when deciding whether or not to put an asset into a large

portfolio.

10.13 a. R1= 0.1 (0.25) + 0.4 (0.20) + 0.4 (0.15) + 0.1 (0.10)

= 0.175 = 17.5%

R2= 0.1 (0.25) + 0.4 (0.15) + 0.4 (0.20) + 0.1 (0.10)

= 0.175 = 17.5%

R3= 0.1 (0.10) + 0.4 (0.15) + 0.4 (0.20) + 0.1 (0.25)

= 0.175 = 17.5%

R1 if

State occurs R

-R1(R1 -R1)2P ? (R1 -R1)2

1

0.25 0.075 0.005625 0.0005625

0.20 0.025 0.000625 0.0002500

0.15 -0.025 0.000625 0.0002500

0.10 -0.075 0.005625 0.0005625

Variance 0.0016250

Standard deviation = 0001625

.

= 0.0403

R2 if

State occurs R

-R2(R2 -R2)2P ? (R2 -R2)2

2

0.25 0.075 0.005625 0.0005625

0.15 -0.025 0.000625 0.0002500

0.20 0.025 0.000625 0.0002500

0.10 -0.075 0.005625 0.0005625

Variance 0.0016250

Standard deviation = 0001625

.

= 0.0403

R3 if

State occurs R

-R3(R3 -R3)2P ? (R3 -R3)2

3

0.10 -0.075 0.005625 0.0005625

0.15 -0.025 0.000625 0.0002500

0.20 0.025 0.000625 0.0002500

0.25 0.075 0.005625 0.0005625

Variance 0.0016250

Standard deviation = 0001625

.

= 0.0403

b. Cov(1,2) = .10 (.25 - .175) (.25 - .175) + .40 (.20 - .175) (.15 - .175) + .40 (.15 - .175)

(.20 - .175) + .10 (.10 - .175) (.10 - .175)

= 0.000625

Cov(1,3) = .10 (.25 - .175) (.10 - .175) + .40 (.20 - .175) (.15 - .175) + .40 (.15 - .175)

(.20 - .175) + .10 (.10 - .175) (.25 - .175)

= - 0.001625

Cov(2,3) = .10 (.25 - .175) (.10 - .175) + .40 (.15 - .175) (.15 - .175) + .40 (.20 - .175)

(.20 - .175) + .10 (.10 - .175) (.25 - .175)

= - 0.000625

Corr(1,2) = 0.000625 / (0.0403 x 0.0403) = 0.385

Corr(1,3) = - 0.001625 / (0.0403 x 0.0403) = - 1

Corr(2,3) = - 0.000625 / (0.0403 x 0.0403) = - 0.385

c. E(R) = .5 x .175 + .5 x .175 = .175

Var = .5 x .5 x .0403 x .0403 + .5 x .5 x .0403 x .0403 + 2 x .5 x .5 x .000625

= 0.0011245

σ = 0.0335

d. E(R) = .5 x .175 + .5 x .175 = .175

Var = .5 x .5 x .0403 x .0403 + .5 x .5 x .0403 x .0403 + 2 x .5 x .5 x (-.001625) = 0

σ = 0

e. E(R) = .5 x .175 + .5 x .175 = .175

Var = .5 x .5 x .0403 x .0403 + .5 x .5 x .0403 x .0403 + 2 x .5 x .5 x (-.000625) = 0.0004995

σ = 0.0224

f. Portfolio with negatively correlated stocks can achieve higher degree of

diversification than portfolio with positively correlated stocks, holding expected

return for each stock constant. Applying proper weights on perfectly negatively

correlated stocks can reduce portfolio variance to 0. As long as the correlation is

not 1, there is benefit of diversification.

10.14 a.

State Return on A Return on B Probability

1 15% 35% 0.4 ? 0.5 = 0.2

2 15% -5% 0.4 ? 0.5 = 0.2

3 10% 35% 0.6 ? 0.5 = 0.3

4 10% -5% 0.6 ? 0.

5 = 0.3

b. R P= 0.2 [0.5 (0.15) + 0.5 (0.35)] + 0.2[0.5 (0.15) + 0.5 (-0.05)]

+ 0.3 [0.5 (0.10) + 0.5 (0.35)] + 0.3 [0.5 (0.10) + 0.5 (-0.05)]

= 0.135

= 13.5%

10.15 a. R P= ∑R i/ N = {N (0.10)} / N = 0.10 = 10%

σP 2= ∑∑ Cov (R i, R j) / N2 + ∑σi2 / N2

= N (N - 1) (0.0064) / N2 + N (0.0144) / N2

= (0.0064) (N - 1) / N + (0.0144) / N

b. As N →∞, σP 2 → 0.0064 = Cov (R i, R j)

c. The covariance of the returns of the securities is the most important factor to

consider when placing securities in a well-diversified portfolio.

10.16 The statement is false. Once the stock is part of a well-diversified portfolio, the

important factor is the contribution of the stock to the variance of the portfolio. In a well-diversified portfolio, this contribution is the covariance of the stock with the rest of the portfolio.

10.17 The covariance is a more appropriate measure of risk in a well-diversified portfolio

because it reflects the effect of the security on the variance of the portfolio. Investors are concerned with the variance of their portfolios and not the variance of the individual

securities. Since covariance measures the impact of an individual security on the

variance of the portfolio, covariance is the appropriate measure of risk.

10.18 If we assume that the market has not stayed constant during the past three years, then the

low volatility of Southern Co.’s stock price only indicates that the stock has a beta that is very near to zero. The high volatility of Texas Instruments’ stock price does not imply

that the firm’s beta is high. Total volatility (the price fluctuation) is a function of both

systematic and unsystematic risk. The beta only reflects the systematic risk. Observing price volatility does not indicate whether it was due to systematic factors, or firm specific factors. Thus, if you observe a high price volatility like that of TI, you cannot claim that the beta of TI’s stock is high. All you know is that the total risk of TI is high.

10.19 Note: The solution to this problem requires calculus.

Specifically, the solution is found by minimizing a function subject to a constraint.

Calculus ability is not necessary to understand the principles behind a minimum variance portfolio.

Min { X A2 σA2 + X B2σB2 + 2 X A X B Cov(R A , R B)}

subject to X A + X B = 1

Let X A = 1 - X B. Then,

Min {(1 - X B)2σA2 + X B2σB2+ 2(1 - X B) X B Cov (R A, R B)}

Take a derivative with respect to X B.

d{?} / dX B = (2 X B - 2) σA2 + 2 X B σB2 + 2 Cov(R A, R B) - 4 X B Cov(R A, R B) Set the derivative equal to zero, cancel the common 2 and solve for X B.

X BσA2 - σA2 + X B σB2 + Cov(R A, R B) - 2 X B Cov(R A, R B) = 0

X B = {σA2 - Cov(R A, R B)} / {σA2 + σB2 - 2 Cov(R A, R B)}

and

X A = {σB2 - Cov(R A, R B)} / {σA2 + σB2 - 2 Cov(R A, R B)}

Using the data from the problem yields,

X A = 0.8125 and

X B = 0.1875.

a. Using the weights calculated above, the expected return on the minimum

variance portfolio is

E(R P) = 0.8125 E(R A) + 0.1875 E(R B)

= 0.8125 (5%) + 0.1875 (10%)

= 5.9375%

b. Using the formula derived above, the weights are

X A = 2 / 3 and

X B = 1 / 3

c. The variance of this portfolio is zero.

σP 2= X A2 σA2 + X B2σB2 + 2 X A X B Cov(R A , R B)

= (4 / 9) (0.01) + (1 / 9) (0.04) + 2 (2 / 3) (1 / 3) (-0.02)

= 0

This demonstrates that assets can be combined to form a risk-free portfolio.

10.20 The slope of the capital market line is (R M - R f ) / σM = (12 - 5) / 10 = 0.7

a.

R P = 5 + 0.7 (7) = 9.9% b. σP = (R P - R f ) / 0.7 = (20 - 5) / 0.7 = 21.4%

10.21 The slope of the characteristic line of Fuji is )

Bear (R )Bull (R )Bear (R )Bull (R M M Fuji Fuji -- = (12.8 - 3.4) / (16.3 - 2.5)

= 0.68

a. Beta = slope of the characteristic line = 0.68 The responsiveness to the market = 0.68

b.

Slope = 0.68 = {12.8 - R Bear Fuji ()} / {16.3 - (-4.0)}

Thus, R Bear Fuji () = 12.8 - 0.68 (16.3 + 4.0) = -1.00%

10.22 Polonius’ portfolio will be the market portfolio. He will have no borrowing or lending in

his portfolio.

10.23 a.

R P = (0.10 + 0.14 + 0.20) / 3 = 0.1467 = 14.67% b. βP = (0.7 + 1.2 + 1.8) / 3 = 1.23 c. To be in equilibrium, three securities should be located on a straight line (the

Security Market Line). Check the slopes. Slope between A & B = (0.14 - 0.10) / (1.2 - 0.7) = 0.08 Slope between B & C = (0.20 - 0.14) / (1.8 - 1.2) = 0.10 Since the slopes are different, these securities are not in equilibrium.

10.24 Expected Return For Alpha = 6% + 1.2?8.5% =16.2%

10.25 Expected return for Ross = 6% + (0.8?8.5%) = 12.8%

10.26 Expected Return in Jordan = 8% + (1.5?7%) =18.5%

10.27 14.2%= 3.7%+β(7.5%) ? β = 1.4

10.28 0.25 = R f + 1.4 [R M – R f ] (I) 0.14 = R f + 0.7 [R M – R f ] (II) (I) – (II)=0.11 = 0.7 [R M – R f ] (III) [R M – R f ]= 0.1571 Put (III) into (I) 0.25 = R f + 1.4[0.1571] R f = 3% [R M – R f ]= 0.1571 R M = 0.1571 + 0.03 = 18.71%

10.29 a. E(R A ) = (0.25)(-0.1) + (0.5)(0.1) + (0.25)(0.2) = 0.075 E(R B ) = (0.25)(-0.3) + (0.5)(0.05) + (0.25)(0.4)= 0.05 b. (I) E(R A ) = R f + βA [E(R M ) – R f ] = 0.075

(II) E(R B ) = R f + βB [E(R M ) – R f ] = 0.05 (I) – (II) = 0.025 = (βA - βB )[E(R M ) – R f ]

0.025 = 0.25[E(R M ) – R f ],

so the market risk premium = [E(R M ) – R f ]= 10%

10.30 a.

b.

i. See point B on the graph in part a.

ii.

There does exist a mis-pricing of the security. According to the SML, this asset should have a return of 2% [= 7% + (-1) (5%)]. Since the return is too high, the price of this asset must be too low. (Remember, asset prices and rates of r eturn are inversely related!) Since the asset is under-priced, you should buy it. c.

i. See point C on the graph in part a.

ii.

There does exist a mis-pricing of the security. According to the SML, this asset should have a return of 22% [= 7% + (3) (5%)]. Since the return is too low, the price of this asset must be too high. Since the asset is overpriced, you should sell it.

10.31 Expected return = 0.05 + 1.8 (0.08) = 0.194 = 19.4%

The analyst expects only 18%, so he is pessimistic.

10.32 a.

R = 6.4 + 1.2 (13.8 - 6.4) = 15.28% b.

R = 3.5 + 1.2 (13.8 - 3.5) = 15.86%

βi

C

E(R i ) = 7% + βi (5%)

20%

22%

3

1

-1

-1.4 B

4% 2% 12%

7% E(R)

10.33 Market excess return = E(R M) - R f

= 20% - 5% = 15%

Portfolio excess return = E(R E) - R f

= 25% - 5% = 20%

Portfolio beta = βE = 20% / 15% = 4 / 3

βE = {Corr(R E, R M) σ(R E)} / σ(R M)

Therefore,

4 / 3 = (1 ? 4%) / σ(R M)

σ(R M) = 3%

Note: Corr(R E, R M) = 1 because this portfolio is a combination of the riskless asset and the market portfolio.

For the security with Corr(R S, R M) = 0.5,

βS = {Corr(R S, R M) σ(R S)} / σ(R M)

= (0.5 ? 2%) / 3%

= 0.3333

Thus, E(R S) = 5% + βS (15%)

= 5% + (0.3333) (15%)

= 10%

10.34 a. The risk premium = R M - R f

Potpourri stock return:

16.7 = 7.6 + 1.7 (R M - R f)

R M - R f = (16.7 - 7.6) / 1.7 = 5.353%

b. R Mag = 7.6 + 0.8 (5.353) = 11.88%

c. X Pot βPot + X Mag βMag = 1.07

1.7 X Pot + 0.8 (1 - X Pot) = 1.07

0.9 X Pot = 0.27

X Pot = 0.3

X Mag = 0.7

Thus invest $3,000 in Potpourri stock and $7,000 in Magnolia.

R P = 7.6 + 1.07 (5.353) = 13.33%

Note: The other way to calculate R P is

R P = 0.3 (16.7) + 0.7 (11.88) = 13.33%

10.35 R Z= R f + βZ (R M - R f)

βZ= Cov(R Z, R M) / σM 2 = Corr(R Z, R M) σZ σM / σM 2

= Corr(R Z, R M) σZ / σM

σZ = (0.0169)1/2 = 0.13

σM = (0.0121)1/2 = 0.11

Thus, βZ = 0.45 (0.13) / 0.11 = 0.5318

R Z = 0.063 + 0.5318 (0.148 - 0.063)

= 0.1082

= 10.82%

10.36 a. R i = 4.9% + βi (9.4%)

b. βD = Cov(R D, R M) / σM 2 = 0.0635 / 0.04326 = 1.468

R D = 4.9 + 1.468 (9.4) = 18.70%

10.37 CAPM:

Johnson 19 = R f + 1.7 (R M - R f)

Williamson 14 = R f + 1.2 (R M - R f)

5 = 0.5 (R M - R f)

Thus (R M - R f) = 10%

19 = R f + 1.7 (10)

R f= 2%

R M = 12%

10.38 The statement is false. If a security has a negative beta, investors would want to hold the

asset to reduce the variability of their portfolios. Those assets will have expected returns that are lower than the risk free rate. To see this, examine the SML equation.

E(R i) = R f + βi {E(R M) - R f)}

If βi < 0, E(R i) < R f.

10.39 Weights:

X A = 5 / 30 = 0.1667

X B = 10 / 30 = 0.3333

X C = 8 / 30 = 0.2667

X D = 1 - X A - X B - X C = 0.2333

Beta of portfolio

= 0.1667 (0.75) + 0.3333 (1.10) + 0.2667 (1.36) + 0.2333 (1.88)

= 1.293

R P = 4 + 1.293 (15 - 4) = 18.22%

10.40 a. (i) βA= ρA,MσA / σM

ρA,M= βA σM / σA

= (0.9) (0.10) / 0.12

= 0.75

(ii) σB= βB σM / ρB,M

= (1.10) (0.10) / 0.40

= 0.275

(iii) βC= ρC,MσC / σM

= (0.75) (0.24) / 0.10

= 1.80

(iv) ρM,M= 1

(v) βM= 1

(vi) σf= 0

(vii) ρf,M= 0

(viii) βf= 0

b. SML:

E(R i) = R f + βi {E(R M) - R f}

= 0.05 + (0.10) βi

Security R

βi E(R i)

i

A 0.13 0.90 0.14

B 0.16 1.10 0.16

C 0.25 1.80 0.23

Security A performed worse than the market, while security C performed better

than the market. Security B is fairly priced.

c. According to the SML, security A is overpriced while security C is under-price

d.

Thus, you could invest in security C while sell security A (if you currently hold

it).

10.41 a. The typical risk-averse investor seeks high returns and low risks. To assess the

two stocks, find the risk and return profiles for each stock.

Returns:

State of economy Probability Return on A*

Recession 0.1 -0.20

Normal 0.8 0.10

Expansion 0.1 0.20

* Since security A pays no dividend, the return on A is simply (P1 / P0) - 1.

R A= 0.1 (-0.20) + 0.8 (0.10) + 0.1 (0.20)

= 0.08

R B= 0.09 This was given in the problem.

Risk:

R A -R A(R A -R A)2P ? (R A -R A)2

-0.28 0.0784 0.00784

0.02 0.0004 0.00032

0.12 0.0144 0.00144

Variance 0.00960

Standard deviation (R A) = 0.0980

βA = {Corr(R A, R M) σ(R A)} / σ(R M)

= 0.8 (0.0980) / 0.10

= 0.784

βB = {Corr(R B, R M) σ(R B)} / σ(R M)

= 0.2 (0.12) / 0.10

= 0.24

The return on stock B is higher than the return on stock A. The risk of stock B,

as measured by its beta, is lower than the risk of A. Thus, a typical risk-averse

investor will prefer stock B.

b. R P= (0.7) R A + (0.3) R B

= (0.7) (0.8) + (0.3) (0.09)

= 0.083

σP 2= 0.72 σA2 + 0.32σB2 + 2 (0.7) (0.3) Corr (R A , R B) σA σB

= (0.49) (0.0096) + (0.09) (0.0144) + (0.42) (0.6) (0.0980) (0.12)

= 0.0089635

σP= 00089635

.

= 0.0947

c. The beta of a portfolio is the weighted average of the betas of the components of

the portfolio.

βP= (0.7) βA + (0.3) βB

= (0.7) (0.784) + (0.3) (0.240)

= 0.621

罗斯《公司理财》(第11版)笔记和课后习题详解-第16~19章【圣才出品】

第16章资本结构:基本概念 16.1 复习笔记 资本结构是指企业资本的组成要素与比例关系,一般指公司资本中负债与股权所占的比例。总的来说,有众多的资本结构可供企业选择。企业可发行大量的或极少的债务,亦可发行优先股、认股权证、可转换债券、可赎回债券,还可计划租赁融资、债券互换及远期合约。 1.公司的价值 (1)公司价值的定义 公司价值是指公司全部资产的市场价值,即负债和所有者权益之和。它是以一定期间归属于投资者的现金流量,按照资本成本或投资机会成本贴现的现值表示的。公司价值不同于利润。利润只是新创造的价值的一部分,而公司价值不仅包含了新创造的价值,还包含了公司潜在的或预期的获利能力。根据定义,公司的价值V可以表示为: V≡B+S 其中,B为负债的市场价值,S为所有者权益的市场价值。 (2)公司价值最大化目标 公司价值最大化目标是指企业的股东关注整个企业价值的最大化,即企业的负债和所有者权益之和最大化,而并不偏爱仅仅使他们的利益最大化的策略。 这种观点的优点包括:①考虑了货币时间价值和投资风险价值,有利于选择投资方案,统筹安排长短期规划,有效筹措资金,合理制定股利政策;②反映了资产保值增值的要求; ③有利于克服管理上的片面性和短期行为。

这一目标存在的问题在于:①对非上市公司不能用股票价格来衡量其价值;②对上市公司,股价不一定能反映企业获利能力,股票价格受多种因素的影响。 (3)企业价值最大化与股东利益最大化 追求股东利益的最大化和追求企业价值最大化是企业财务管理的两大基本目标,是企业理财活动所希望实现的结果,是评价企业理财活动的基本标准。 ①股东利益最大化。股东利益最大化目标存在两种不同的表现形式:一是企业利润最大化;二是股东财富最大化。前者是企业所有权与经营权没有分离情况下,作为企业的出资人,从而又是企业经营者,所确定的追求财产使用价值最大化的财务管理目标。在企业所有者与经营权分离的情况下,利润最大化的财务目标转变成股东财富最大化。股东的财富一般表现为拥有企业股票的数量与股票价格的乘积。在股票数量一定时,股东财富就与股票价格成正比。因此,股东财富最大化实质上可以看作股票市场价格最大化。 ②企业价值最大化。企业价值最大化目标强调财务管理目标应与企业多个利益集团有关,追求的是企业各个利益相关者集体利益的最大化。 ③目标的选择。追求企业价值最大化与追求股东利益最大化具有本质上的不同,集体利益的最大化并不等于个体利益能够最大化,反之亦然。经济理论已经证明,集体理性与个体理性存在冲突,前者要求将“蛋糕”做大,后者可以在“蛋糕”大小不变的情况下,通过对“蛋糕”的不同分割,使得一部分利益集团在损害其它利益集团利益的基础上实现自身收益的最大化。因此,企业的财务管理目标必然是各个利益集团共同作用和相互妥协的结果。 当且仅当企业的价值提高时,资本结构的变化对股东有利;相反,当且仅当企业的价值减少时,资本结构的变化损害股东。并且,对于不同种类的资本结构变化,这个结论仍然成立。因此,管理者应该选择他们所认为的可使公司价值最高的资本结构,因为这样的资本结构将对公司的股东最有利。

(公司理财)公司理财答案

公司理财(11.04) 第一章公司理财概述 一、单项选择题 1、在筹资理财阶段,公司理财的重点内容是( B )。 A有效运用资金 B如何设法筹集到所需资金 C研究投资组合 D国际融资 二、多项选择题 1、公司财务活动的内容包括( ABCDE )。 A资金的筹集 B资金的运用 C资金的耗费 D资金的收回 E资金的分配 三、填空题 1、在内部控制理财阶段,公司理财的重点内容是如何有效地(运用资金)。 2、西方经济学家和企业家以往都以(利润最大化)作为公司的经营目标和理财目标。 3、现代公司理财的目标是(股东财富最大化)。 4、公司资产价值增加,生产经营能力提高,意味着公司具有持久的、强大的获利能力和(偿 债能力)。 5、当(股票价格)达到最高时,意味着股东财富达到最大化。 6、公司筹资的渠道主要有两大类,一是(自有资本)的筹集,二是(借入资本)的筹集。 四、简答题 1、为什么以股东财富最大化作为公司理财目标?P14 (1)考虑到了货币时间价值和风险价值;(2)体现了对公司资产保值增值的要求;(3)有利于克服公司经营上的短期行为,促使公司理财当局从长远战略角度进行财务决策,不断增加公司财富。 2、公司理财的具体内容是什么?P16-17 (1)筹资决策;(2)投资决策;(3)股利分配决策。 第二章财务报表分析 一、单项选择题 1、资产负债表为( B )。 A动态报表 B静态报表 C动态与静态相结合的报表 D既不是动态报表也不是静态报表 2、下列负债中属于长期负债的是( D )。 A应付账款 B应交税金 C预计负债 D应付债券 3、公司流动性最强的资产是()。A A货币资金 B短期投资 C应收账款 D存货 4、利润表中的收入是按( B )确认的。 A收付实现制 B权责发生制 C永续盘存制 D实地盘存制 5、下列各项费用中属于财务费用的是( C )。 A广告费 B劳动保险费 C利息支出 D坏账损失 6、反映公司所得与所费的比例关系的财务指标是()。D A销售利润率 B总资产周转率 C资产利润率 D成本费用利润率 二、多项选择题 1、与资产负债表中财务状况的计量直接联系的会计要素有( ABC )。 A资产 B负债 C所有者权益 D成本费用 E收入利润 2、与利润表中经营成果的计量有直接联系的会计要素有( BCD )。 A资产 B收入 C成本和费用 D利润 E所有者权益 3、反映偿债能力的财务指标主要有( ABCD )。 A资产负债率 B流动比率 C速动比率 D现金比率 E存货周转率 三、填空题 1、资产的实质是(经济资源)。 2、公司所有者权益的金额为(资产)减去(负债)后的余额。 3、公司的法定盈余公积在转增资本后,一般不得低于注册资金的(25% )。C 4、固定资产的计价标准有原始价值、重置价值和(净值)三种。

罗斯《公司理财》(第11版)考研真题(计算题)【圣才出品】

五、计算题 1.ABC公司是某杂志出版商,它发行的可转换债券目前在市场上的售价是950美元,面值为1000美元。如果持有者选择转换,则每1张债券可以交换100股股票,债券的利息为7%,逐年支付,债券将在10年后到期。ABC的债务属于BBB级,这个级别的债务的标价收益率为12%。ABC的股票正以每股7美元的价格交易。 (1)债券的转换比率是多少? (2)转换价格是多少? (3)债券的底线价值是多少? (4)期权价值是多少?[山东大学2017研] 答:(1)转换比率是指一份债券可以转换为多少股股份。由题干可知,每1张债券可以交换100股股票,即债券的转换比率为100。 (2)由于可转换债券的转换比率是用每份可转换债券所能交换的股份数,它等于可转换债券面值除以转换价格。 故转换价格=可转换债券面值/转换比率=1000/100=10(美元)。 (3)可转换债券的底线价值取决于纯粹债券价值和转换价值二者孰高。纯粹债券价值是指可转换债券如不具备可转换的特征,仅仅当作债券持有在市场上能销售的价值。转换价值是指如果可转换债券能以当前市价立即转换为普通股所取得的价值。转换价值等于将每份债券所能转换的普通股股票份数乘以普通股的当前价格。 纯粹债券的价值=1000×7%×(P/A,12%,10)+1000×(P/F,12%,10)=717.5(美元)。 转换价值=转换数量×可转换股票市价=100×7=700(美元),717.5美元>700美元。 故可转换债券的底线价值为717.5美元。

(4)由于可转换债券价值=可转换债券的底线价值﹢期权价值。故可转换债券的期权价值=950﹣717.5=232.5(美元)。 2.假定GT 公司可取得永续现金流EBIT=$100000,权益资本成本为25%,企业所得税税率40%,如果企业没有债务,根据MM 定理,这时的企业价值是多少?如果企业借入$500000的债务并回购相应数量的权益资本,债务资本成本为10%,根据MM 定理,企业价值是多少?[华中科技大学2017研] 答:若企业没有债务,则该企业是无杠杆公司。无杠杆公司的价值为: ()0(1)10(140%)2425% C U EBIT t V R ?-?-===万美元若企业借入50万美元的债务,那么该公司是杠杆公司,根据有税情况下的MM 定理: 0(1)C C B L U C B EBIT t t R B V V t B R R ?-=+=+则此时企业的价值为:V L =V U +t C B=24+40%×50=44(万美元)。 3.去年支付的股利为2美元,预计未来股利以10%的固定比率增长,股东要求的回报率为20%。求股票今天的价格。[西南财经大学2017研] 答:根据股利增长模型(DDM),股票当前的价格P 0=D 1/(R-g),其中D 1为股票1期后的预期股利,R 为股东要求的回报率,g 为股利增长率。 在本题中,R=20%,g=10%,D 1=2×(1+10%)=2.2(美元)。 因此,股票今天的价格=2.2/(20%-10%)=22(美元)。

公司理财资料

公司理财(财务治理) 第一章、公司理财概述 《财务与成本治理》教材一书共十五章、632页、44万字。其中前十章是讲财务治理,后四章是讲成本治理。财务治理与成本治理本是两门学科,没有内在的必定联系,实际上它是两门完全独立的学科。 《财务治理》的特点是公式专门多,有的公式需要死背硬记,有的在理解后就能记住。第一章是总论,这章的内容是财务治理内容的总纲,是理解各章内容的一个起点,对掌握各章之间的联系有重要意义。因此,学习这一章重点是掌握财务治理知识的体系,理解每一个财务指标、公式、名词的概念,掌握它,对以后各章在整个知识体系中的地位和作用有专门大关心。 第一节财务治理的目标 一、企业的财务目标 有四个问题:企业目标决定了财务治理目标;财务治理目标的三种主张及其理由和问题;讨论财务目标的重要意义;什么缘故要以利

润大小作为财务目标。这四个问题是财务治理中的差不多问题,是组织财务治理工作的动身点。 公司理财是指公司在市场经济条件下,如何低成本筹措所需要的资金并进行各种筹资方式的组合;如何高效率地投资,并进行资源的有效配置;如何制定利润分配政策,并合理地进行利润分配。公司理财确实是要研究筹资决策、投资决策及利润分配决策。 1、企业治理的目标 包括三个方面内容:一是生存,企业只有生存,才可能获利,企业 还到期债务的能力,减少破产的风险,使企业长期稳定地生存下去,是对公司理财的第一个要求;二是进展,企业是在进展中求得生存的。筹集企业进展所需的资金,是对公司理财的第二个要求;三是获利,企业必须获利,才有存在的价值。通过合理有效地使用资金使企业获利,是对公司理财的第三个要求。总之,企业的目标(企业治理的目标)确实是生存、进展和获利。 2、公司理财的目标 三种观点 ①、利润最大化

公司理财第二章

1. The financial statement showing a firm's accounting value on a particular date is the: A. income statement. B.balance sheet.资产负债表反应公司在某一特定日期的账面价值 C. statement of cash flows. D. tax reconciliation statement. E. shareholders' equity sheet. 2. A current asset is: A. an item currently owned by the firm. B. an item that the firm expects to own within the next year. C. an item currently owned by the firm that will convert to cash within the next 12 months.在一年内能够变现的资产 D. the amount of cash on hand the firm currently shows on its balance sheet. E. the market value of all items currently owned by the firm. 3. The long-term debts of a firm are liabilities: A. that come due within the next 12 months. B.that do not come due for at least 12 months.偿还期限在一年以上 C. owed to the firm's suppliers. D. owed to the firm's shareholders. E. the firm expects to incur within the next 12 months. 4. Net working capital is defined as: 经营运资本 A. total liabilities minus shareholders' equity. B. current liabilities minus shareholders' equity. C. fixed assets minus long-term liabilities. D. total assets minus total liabilities. E.current assets minus current liabilities.流动资产-流动负债 5. A(n) ____ asset is one which can be quickly converted into cash without significant loss in value. A. current B. fixed C. intangible D. liquid速动资产 E. long-term 6. The financial statement summarizing a firm's accounting performance over a period of time is the: A. income statement.利润表反应公司一段时间内的经营成果 B. balance sheet. C. statement of cash flows. D. tax reconciliation statement. E. shareholders' equity sheet. 7. Noncash items refer to: 非现金项目 A. the credit sales of a firm. B. the accounts payable of a firm. C. the costs incurred for the purchase of intangible fixed assets. D. expenses charged against revenues that do not directly affect cash flow.与收入像配比的费用,并不影响现金流量 E. all accounts on the balance sheet other than cash on hand. 8. Your _____ tax rate is the amount of tax payable on the next taxable dollar you earn. A. deductible B. residual C. total D. average E. marginal边际税率指多赚一美元需要多支付的税金 9. Your _____ tax rate is the total taxes you pay divided by your taxable income. A. deductible B. residual C. total D.average平均税率 E. marginal 10. _____ refers to the cash flow that results from the firm's ongoing, normal business activities. A.Cash flow from operating activities经营活动现金流 B. Capital spending C. Net working capital D. Cash flow from assets E. Cash flow to creditors 11. _____ refers to the changes in net capital assets. A. Operating cash flow B. Cash flow from investing投资活动产生的现金流 C. Net working capital D. Cash flow from assets E. Cash flow to creditors 12. _____ refers to the difference between a firm's current assets and its current liabilities. A. Operating cash flow B. Capital spending https://www.wendangku.net/doc/c38877641.html, working capital净营运资本是流动资产与流动负债之差 D. Cash flow from assets E. Cash flow to creditors 13. _____ is calculated by adding back noncash expenses to net income and adjusting for changes in current assets and liabilities. 非现金费用加净利润,根据流动资产和流动负债的变化做出调整 A. Operating cash flow B. Capital spending C. Net working capital D.Cash flow from operation s经营活动产生的现金流 E. Cash flow to creditors

《公司理财》课后习题与答案

《公司理财》考试范围:第3~7章,第13章,第16~19章,其中第16章和18章为较重点章节。书上例题比较重要,大家记得多多动手练练。PS:书中课后例题不出,大家可以当习题练练~ 考试题型:1.单选题10分 2.判断题10分 3.证明题10分 4.计算分析题60分 5.论述题10分 注:第13章没有答案 第一章 1.在所有权形式的公司中,股东是公司的所有者。股东选举公司的董事会,董事会任命该公司的管理层。企业的所有权和控制权分离的组织形式是导致的代理关系存在的主要原因。管理者可能追求自身或别人的利益最大化,而不是股东的利益最大化。在这种环境下,他们可能因为目标不一致而存在代理问题。 2.非营利公司经常追求社会或政治任务等各种目标。非营利公司财务管理的目标是获取并有效使用资金以最大限度地实现组织的社会使命。 3.这句话是不正确的。管理者实施财务管理的目标就是最大化现有股票的每股价值,当前的股票价值反映了短期和长期的风险、时间以及未来现金流量。 4.有两种结论。一种极端,在市场经济中所有的东西都被定价。因此所有目标都有一个最优水平,包括避免不道德或非法的行为,股票价值最大化。另一种极端,我们可以认为这是非经济现象,最好的处理方式是通过政治手段。一个经典的思考问题给出了这种争论的答案:公司估计提高某种产品安全性的成本是30美元万。然而,该公司认为提高产品的安全性只会节省20美元万。请问公司应该怎么做呢?” 5.财务管理的目标都是相同的,但实现目标的最好方式可能是不同的,因为不同的国家有不同的社会、政治环境和经济制度。 6.管理层的目标是最大化股东现有股票的每股价值。如果管理层认为能提高公司利润,使股价超过35美元,那么他们应该展开对恶意收购的斗争。如果管理层认为该投标人或其它未知的投标人将支付超过每股35美元的价格收购公司,那么他们也应该展开斗争。然而,如果管理层不能增加企业的价值,并且没有其他更高的投标价格,那么管理层不是在为股东的最大化权益行事。现在的管理层经常在公司面临这些恶意收购的情况时迷失自己的方向。 7.其他国家的代理问题并不严重,主要取决于其他国家的私人投资者占比重较小。较少的私人投资者能减少不同的企业目标。高比重的机构所有权导致高学历的股东和管理层讨

罗斯《公司理财》(第11版)笔记和课后习题详解-第9~11章【圣才出品】

第9章 股票估值 9.1 复习笔记 1.普通股估值 (1)股利与资本利得 ①股票价格等于下期股利与下期股价的折现值之和。 ②股票价格等于所有未来股利的折现值之和。 (2)不同类型股票的估值 ①零增长股利 股利不变时,股票的价格由下式给出: () 12 02 11Div Div Div P R R R = ++= ++ 在这里假定Div 1=Div 2=…=Div 。 ②固定增长率股利 如果股利以恒定的速率增长,那么一股股票的价格就为: ()()()()()() 23 023********Div g Div g Div g Div Div P R R g R R R +++=++++= +-+++ 式中,g 是增长率;Div 是第一期期末的股利。 ③变动增长率股利 分阶段进行折现,注意折现的时间点。

【例9.1】假设某企业每年净利润固定是4400万元,并且该企业每年将所有净利润都作为股息发放给投资者,该企业共发行了1100万股的股票,假设该企业股息对应的折现率是10%,并且股息从一年后开始第一次发放,那么该企业股票今天的价格是多少?()[清华大学2015金融硕士] A.4元 B.44元 C.400元 D.40元 【答案】D 【解析】该企业每年发放的固定股息为:4400÷1100=4(元/股),利用零增长股利模型,该企业股票今天的价格为:4÷10%=40(元)。 【例9.2】A公司普通股刚刚支付了每股2元的红利,股票价格当前为100元每股,可持续增长率为6%,则该公司普通股的资本成本为()。[中央财经大学2015金融硕士] A.6.4% B.7.3% C.8.1% D.8.8% 【答案】C 【解析】根据固定增长股票的价值模型:

公司理财知识点总结

第一章.公司理财导论 1.企业组织形态:单一业主制、合伙制、股份公司(所有权和管理相分离、相对容易转让 所有权、对企业债务负有限责任,使企业融资更加容易。企业寿命不受限制,但双重课税) 2.财务管理的目标:为了使现有股票的每股当前价值最大化。或使现有所有者权益的市场 价值最大化。 3.股东与管理层之间的关系成为代理关系。代理成本是股东与管理层之间的利益冲突的成 本。分直接和间接。 4.公司理财包括三个领域:资本预算、资本结构、营运资本管理 第二章. 1.在企业资本结构中利用负债成为“财务杠杆”。 2.净利润与现金股利的差额就是新增的留存收益。 3.来自资产的现金流量=经营现金流量(OCF)-净营运资本变动-资本性支出 4.OCF=EBIT+折旧-税 5.净资本性支出=期末固定资产净值-期初固定资产净值+折旧 6.流向债权人的现金流量=利息支出-新的借款净额 7.流向股东的现金流量=派发的股利-新筹集的净权益 第三章 1.现金来源:应付账款的增加、普通股本的增加、留存收益增加 现金运用:应收账款增加、存货增加、应付票据的减少、长期负债的减少 2.报表的标准化:同比报表、同基年度财报 3.ROE=边际利润(经营效率)X总资产周转率(资产使用效率)X权益乘数(财务杠杆) 4.为何评价财务报表: 内部:业绩评价。外部:评价供应商、短期和长期债权人和潜在投资者、信用评级机构。第四章. 1.制定财务计划的过程的两个维度:计划跨度和汇总。 2.一个财务计划制定的要件:销售预测、预计报表、资产需求、筹资需求、调剂、经济假设。 3.销售收入百分比法:

提纯率=再投资率=留存收益增加额/净利润=1-股利支付率 资本密集率=资产总额/销售收入 4.内部增长率=(ROAXb)/(1-ROAXb) 可持续增长率=ROE/(1-ROEXb):企业在保持固定的债务权益率同时没有任何外部权益筹资的情况下所能达到的最大的增长率。是企业在不增加财务杠杆时所能保持的最大的增长率。(如果实际增长率超过可持续增长率,管理层要考虑的问题就是从哪里筹集资金来支持增长。如果可持续增长率始终超过实际增长率,银行家最好准备讨论投资产品,因为管理层的问题是怎样处理所有的这些富余的现金。) 5.增长率的决定因素 利润率、股利政策(提纯率)、筹资政策(财务杠杆)、总资产周转率 6.如果企业不希望发售新权益,而且它的利润率、股利政策、筹资政策和总资产周转率(资 本密集率)是固定的,那么就只会有一个可能得增长率 7.如果销售收入的增长率超过了可持续增长率,企业就必须提高利润率,提高总资产周转 率,加大财务杠杆,提高提纯率或者发售新股。 第六章. 1.贷款的种类:纯折价贷款、纯利息贷款、分期偿还贷款 纯折价贷款:国库券(即求现值即可) 纯利息贷款:借款人必须逐期支付利息,然后在未来的某时点偿还全部本金。 如:三年期,利率为10%的1000美元纯利息贷款,第一年第二年要支付1000X0.1的利息,第三年末要支付1100元。 分期偿还贷款:每期偿还利息加上一个固定的金额。其中每期支付的利息是递减的,而且相等总付款额情况下的总利息费用较高。 第7章 1.市场对某一债券所要求的利率叫做该债券的到期收益率。 2.如果债券低于或高于面值的价格出售,则为折价债券或溢价债券。 折价:票面利率为8%,市场利率(到期收益率)为10% 溢价:票面利率为8%,市场利率为6%(投资者愿意多支付价款以获得额外的票年利息) 3.债券的价值=票面利息的现值+面值的现值(与利率呈相反变动) 4.利率风险:债券的利率风险的大小取决于该债券的价格对利率变动的敏感性。其他条件相同,到期期限越长,利率风险越大;其他条件相同,票面利率越低,利率风险越大。 5.债券的当期收益率是债券的年利息除以它的价格。折价债券中,当期收益率小于到期收益率,因为没有考虑你从债券折价中获取的利得。溢价相反。 6.公司发行的证券:权益性证券和债务证券。 7.权益代表一种所有权关系,而且是一种剩余索取权,对权益的支付在负债持有人后。拥有债务和拥有权益的风险和利率不一样。 8.债务性证券通常分为票据、信用债券和债券。长期债务的两种主要形式是公开发行和私下募集 9.债务和权益的差别: 1.债务并不代表公司的所有权的一部分。债权人通常不具有投票权。 2.公司对债务支付的利息属于经营成本,因此可以再税前列支,派发给股东的股利则不能抵税。 3.未偿还的债务是公司的负债。如果公司没有偿还,债权人对公司的资产就有合法的索取权。这种行为可能导致两种可能的破产:清算和重组。 4.债券合约是公司和债券人之间的书面协议,有时也叫做信用证书,里面列示了债券的各种

公司理财计算题公式总结及复习题标准答案out

112公司理财计算题 第二章:财务比率的计算 (一)反映偿债能力的指标 1、资产负债率= 资产总额负债总额×100% =所有者权益 负债长期负债 流动负债++×100%(资产=负债+所有者权益) 2、流动比率= 流动负债 流动资产 ×100% 3、速动比率= 流动负债速动资产×100% =流动负债待摊费用 存货预付账款流动资产---×100% 4、现金比率= 流动负债 短期投资短期有价证券货币资金现金) ()(+×100% (二) 反映资产周转情况的指标 1、应收账款周转率= 平均应收账款余额赊销收入净额=2 --÷+期末应收账款)(期初应收账款销售退回、折让、折扣 现销收入销售收入 2、存货周转率= 平均存货销货成本=2 ÷+期末存货)(期初存货销货成本 习题: 1、某公司20××年末有关财务资料如下:流动比率=200%、速动比率=100%、现金比率=50%、流动 负债 = 1000万元,该公司流动资产只包括货币资金、短期投资、应收账款和存货四个项目(其 中短期投资是货币资金的4倍)。要求:根据上述资料计算货币资金、短期投资、应收账款和存 货四个项目的金额。

2、某公司20××年末有关财务资料如下:流动比率=200%、速动比率=100%、现金比率=20%、资产负债率=50%、长期负债与所有者权益的比率为25%。要求:根据上述资料填列下面的资产负债表简表。 资产负债表(简) (单位:元) 3、某公司年初应收账款56万元、年末应收账款60万元,年初存货86 万元、年末存货90万元,本年度销售收入为680万元(其中现销收入480万元,没有销售退回、折让和折扣),销货成本为560万元。要求:根据上述资料计算应收账款周转率和存货周转率。 4、某公司20××年度全年销售收入为600万元,其中现销收入为260万元,没有销售退回、折让和 折扣,年初应收账款为30万元,年末应收账款比年初增加了20%,则应收账款周转率应该是多少? 5、某公司20××年度全年销货成本为400万元,年初存货为50万元,年末存货比年初增加了20%, 则存货周转率应该是多少?

公司理财第27章

Chapter 27: Short-Term Finance and Planning CONCEPT QUESTIONS – CHAPTER 27 27.2 ?What is the difference between net working capital and cash? Net working capital includes not only cash, but also other current assets minus current liabilities. ?Will net working capital always increase when cash increases? No. There are transactions such as collection of accounts receivable that increase cash but leave net working capital unchanged. Any transaction that will increase cash but produce a corresponding decrease in another current asset account or an increase in a current liability will have the same effect. ?List the potential uses of cash. 1.Acquisition of capital 2.Acquisition of marketable securities 3.Acquisition of working capital 4.Payment of dividends 5.Retirement of debt 6.Payment for labor, management and services rendered ?List the potential sources of cash. 1.Sale of services or merchandise 2.Collection of accounts receivable 3.Issuance of debt or stock 4.Sale of marketable securities 5.Sale of fixed assets 6.Short-term bank loans 7.Increased accrued expenses, wages, or taxes. 27.3?What does it mean to say that a firm has an inventory-turnover ratio of four? It means that on average the inventory is kept on hand for (365 days per year/4 times per year) = 91.25 days. Describe operating cycle and cash cycle. What are the differences between them? The operating cycle is the period of time from the acquisition of raw material until the collection of cash from sales. It includes conversion of raw materials into finished goods, inventories, sales and collection of accounts receivable. The cash cycle is the period of time from the cash payment for raw materials to the collection of cash. The difference between the two is the accounts payable stage,

罗斯《公司理财》(第11版)笔记和课后习题答案详解

精研学习>网>>>免费试用百分之20资料 全国547所院校视频及题库全收集 考研全套>视频资料>课后答案>历年真题>全收集 本书是罗斯的《公司理财》(第11版)(机械工业出版社)的学习辅导书。本书遵循该教材的章目编排,包括8篇,共分31章,每章由两部分组成:第一部分为复习笔记;第二部分为课(章)后习题详解。本书具有以下几个方面的特点: (1)浓缩内容精华,整理名校笔记。本书每章的复习笔记对本章的重难点进行了整理,并参考了国内名校名师讲授罗斯的《公司理财》的课堂笔记,因此,本书的内容几乎浓缩了经典教材的知识精华。 (2)精选考研真题,强化知识考点。部分考研涉及到的重点章节,选择经典真题,并对相关重要知识点进行了延伸和归纳。 (3)解析课后习题,提供详尽答案。国内外教材一般没有提供课(章)后习题答案或者答案很简单,本书参考国外教材的英文答案和相关资料对每章的习题进行了详细的分析。 (4)补充相关要点,强化专业知识。一般来说,国外英文教材的中译本不太符合中国学生的思维习惯,有些语言的表述不清或条理性不强而给学习带来了不便,因此,对每章复习笔记的一些重要知识点和一些习题的解答,我们在不违背原书原意的基础上结合其他相关经典教材进行了必要的整理和分析。 本书提供电子书及打印版,方便对照复习。 第1篇概论 第1章公司理财导论 1.1复习笔记 1.2课后习题详解 第2章会计报表与现金流量 2.1复习笔记 2.2课后习题详解 第3章财务报表分析与长期计划 3.1复习笔记 3.2课后习题详解 第2篇估值与资本预算 第4章折现现金流量估价 4.1复习笔记 4.2课后习题详解 第5章净现值和投资评价的其他方法 5.1复习笔记 5.2课后习题详解 第6章投资决策 6.1复习笔记

公司理财第十一版课后答案第一章

公司理财第十一版课后答案第一章 第1篇概论 第]章公司理财导论 1.1复习笔记 公司的首要目标——股东财富最大化决定了公司理财的目标。公司理财研究的是稀缺资金如何在企业和市场内进行有效配置,它是在股份有限公司已成为现代企业制度最主要组织形式的时代背景下,就公司经营过程中的资金运动进行预测、组织、协调、分析和控制的一种决策与管理活动。从决策角度来讲,公司理财的决策内容包括投资决策、筹资决策、股利决策和净流动资金决策;从管理角度来讲,公司理财的管理职能主要是指对资金筹集和资金投放的管理。公司理财的基本内容包括:投资决策(资本预算)、融资决策(资本结构)、短期财务管理(营运资本)。 1.资产负债表 资产负债表是总括反映企业某一特定日期财务状况的会计报表,它是根据资产、负债和所有者权益之间的相互关系,按照一定的分类标准和一定的顺序,把企业一定日期的资产、负债和所有者权益各项目予以适当排列,并对日常工作中形成的大量数据进行高度浓缩整理后编制而成的。资产负债表可以反映资本预算、资本支出、资本结构以及经营中的现金流量管理等方面的内容。 2.资本结构 资本结构是指企业各种资本的构成及其比例关系,它有广义和狭义之分。广义资本结构,亦称财务结构,指企业全部资本的构成,既包括长期资本,也包括短期资本(主要指短期债务资本)。狭义资本结构,主要指企业长期资本的构成,而不包括短期资本。通常人们将资本结构表示为债务资本与权益资本的比例关系(D/E)或债务资本在总资本中的构成(D/A)。准确地讲,企业的资本结构应定义为有偿负债与所有者权益的比例。 资本结构是由企业采用各种筹资方式筹集资本形成的。筹资方式的选择及组合决定着企业资本结构及其变化。资本结构是企业筹资决策的核心问题。企业应综合考虑影响资本结构的因素,运用适当方法优化资本结构,从而实现最佳资本结构。资本结构优化有利于降低资本成本,获取财务杠杆利益。 3.财务经理 财务经理是公司管理团队中的重要成员,其主要职责是通过资本预算、融资和资产流动性管理为公司创造价值。 【例1.1】公司财务经理的责任是增加()。[清华大学2014金融硕士] A.公司规模 B.公司增长速度 C.经理人的能力 D.股东权益价值 【答案】D 【解析】公司的财务经理为公司的股东做决策。财务经理通过增加股票价值的财务决策,最大限度地保护股东的利益。财务管理的目标是最大化现有股票的每股价值,因此财务经理的责任是增加股东权益价值。 4.公司制企业 企业有个人独资企业、合伙制企业和公司三种组织形式。公司制企业简称"公司”,即实行公司制的企业,以有限责任公司和股份有限公司为典型形式,是解决筹集大量资金的一种标准方法。 5.现金流的重要性 公司创造的现金流必须超过它所使用的现金流。公司支付给债权人和股东的现金流必须大于债权人和股东投入公司的现金流。当支付给债权人和股东的现金大于从金融市场上筹集的资金时,公司的价值就增加了。公司投资的价值取决于现金流量的时点。 6.财务管理的目标

公司理财第九版课后习题答案第二章

CHAPTER 2 FINANCIAL STATEMENTS AND CASH FLOW Answe rs to Concepts Review and Critical Thinking Questions 1. True. Every asset can be converted to cash at some price. However, when we are referring to a liquid asset, the added assumption that the asset can be quickly converted to cash at or near market value is important. 2. The recognition and matching principles in financial accounting call for revenues, and the costs associated with producing those revenues, to be ―booked‖when the revenue process is essentially complete, not necessarily when the cash is collected or bills are paid. Note that this way is not necessarily correct; it‘s the way accountants have chosen to do it. 3. The bottom line number shows the change in the ca sh balanc e on the balance sheet. As such, it is not a use ful number for analyzing a company. 4. The major difference is the treatment of interest expense. The accounting statement of cash flows treats interest as an operating ca sh flow, while the financial ca sh flows treat interest as a financing cash flow. The logic of the accounting statement of cash flows is that since interest appears on the income statement, which shows the operations for the period, it is an operating cash flow. In reality, interest is a financing expense, which results from the company‘s choice of debt and equity. We will have more to say about this in a later chapter. When compa ring the two c ash flow statements, the financial statement of cash flows is a more appropriate measure of the company‘s performa nce because of its treatment of interest. 5. Market values can never be negative. Imagine a share of stock selling for –$20. This would mean that if you placed an order for 100 shares, you would get the stock along with a check for $2,000. How ma ny shares do you want to buy? More generally, because of corpora te and individual bankruptcy laws, net worth for a person or a corporation cannot be negative, implying that liabilities cannot exceed assets in market value. 6. For a successful c ompany that is rapidly expanding, for example, capital outlays will be large, possibly leading to negative c ash flow from assets. In general, what matters is whether the money is spent wisely, not whe ther cash flow from assets is positive or negative. 7. It‘s probably not a good sign for an e stablished company to have negative cash flow from operations, but it would be fairly ordinary for a start-up, so it depends.