TAXBACKCOM_Montana

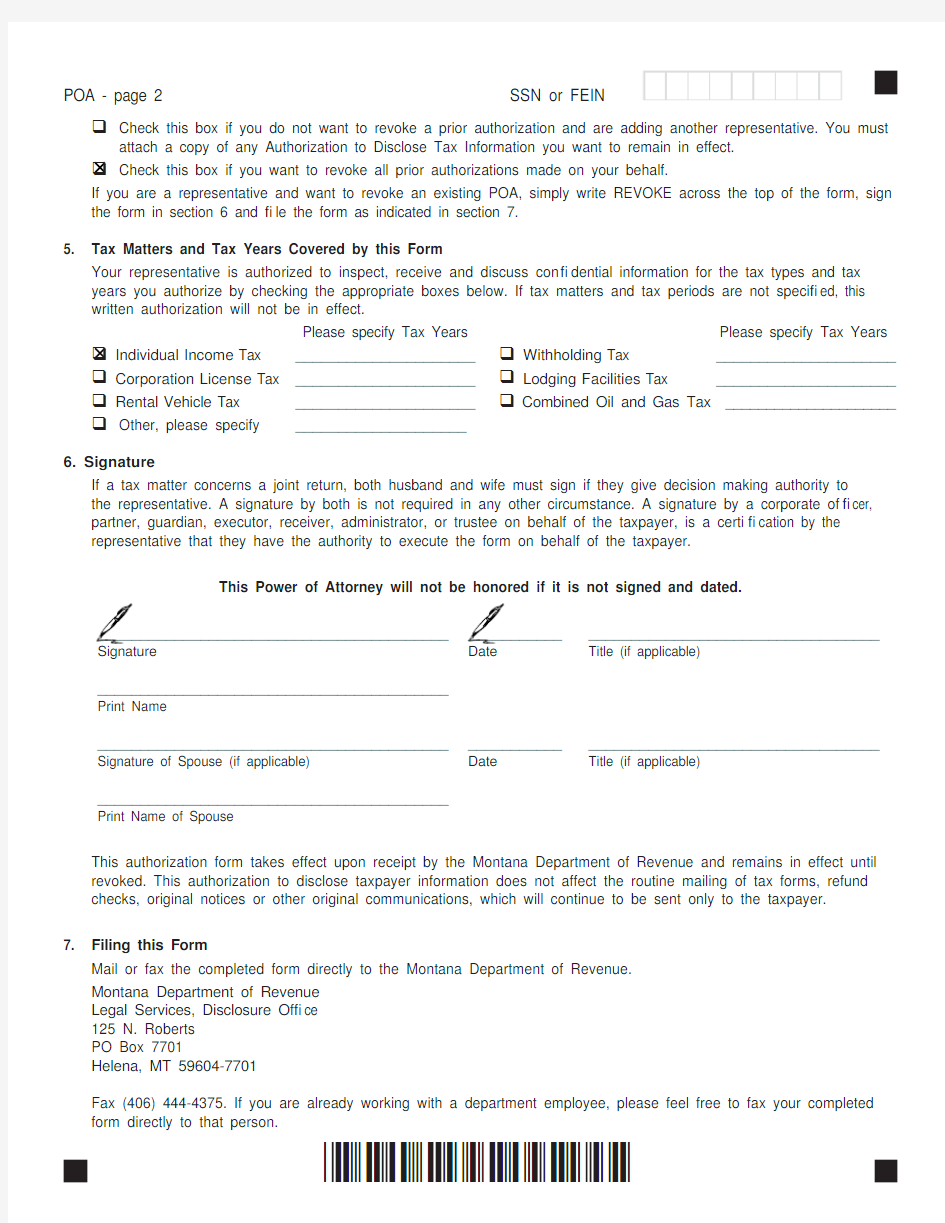

POA - page 2 SSN or FEIN

?Check this box if you do not want to revoke a prior authorization and are adding another representative. You must

attach a copy of any Authorization to Disclose Tax Information you want to remain in effect.

?Check this box if you want to revoke all prior authorizations made on your behalf.

If you are a representative and want to revoke an existing POA, simply write REVOKE across the top of the form, sign the form in section 6 and ? le the form as indicated in section 7.

5. Tax Matters and Tax Years Covered by this Form

Your representative is authorized to inspect, receive and discuss con? dential information for the tax types and tax years you authorize by checking the appropriate boxes below. If tax matters and tax periods are not speci? ed, this written authorization will not be in effect.

Please specify Tax Years Please specify Tax Years ? Individual Income Tax _____________________? Withholding Tax _____________________? Corporation License Tax _____________________? Lodging Facilities Tax _____________________? Rental Vehicle Tax _____________________?Combined Oil and Gas Tax _____________________?Other, please specify ____________________

6. Signature

If a tax matter concerns a joint return, both husband and wife must sign if they give decision making authority to the representative. A signature by both is not required in any other circumstance. A signature by a corporate of? cer, partner, guardian, executor, receiver, administrator, or trustee on behalf of the taxpayer, is a certi? cation by the representative that they have the authority to execute the form on behalf of the taxpayer.

This Power of Attorney will not be honored if it is not signed and dated.

______________________________________________________________________________________ Signature Date Title (if applicable)

_________________________________________

Print Name

______________________________________________________________________________________ Signature of Spouse (if applicable)Date Title (if applicable)

_________________________________________

Print Name of Spouse

This authorization form takes effect upon receipt by the Montana Department of Revenue and remains in effect until revoked. This authorization to disclose taxpayer information does not affect the routine mailing of tax forms, refund checks, original notices or other original communications, which will continue to be sent only to the taxpayer.

7. Filing this Form

Mail or fax the completed form directly to the Montana Department of Revenue.

Montana Department of Revenue

Legal Services, Disclosure Of? ce

125 N. Roberts

PO Box 7701

Helena, MT 59604-7701

Fax (406) 444-4375. If you are already working with a department employee, please feel free to fax your completed form directly to that person.

*06010201*