MN488 Credit and Risk Management

Course Review

Subject Name: Credit and Risk Management

Academic Year: 2010-2014

I.True/False Questions

1.Employee fraud is a type of operational risk to financial institution

2.Credit risk stems from non-repayment or delays in repayment of either principal or interest on FI

assets.

3.Foreign exchange risk is that value of assets and liabilities may change because of changes in the

level of interest relates.

4.The maturity gap model estimates the difference between the interests earned and paid out during a

given period of time.

5. A bank with a negative reprising (or funding) gap faces reinvestment risk.

6.Credit scoring models are advantageous because of their ability to sort borrowers into different

default risk classes.

7.Core deposits represent a relatively short-term source of funds.

8.Purchased liquidity risk management usually involves purchased funds such as fed funds,

repurchase agreement and CDs.

9.Capital is the primary protection for and FI against the risk of insolvency and failure.

10.A bank must be ready to pay out all demand deposit liabilities on any given day.

11.Foreign exchange risk is that the value of assets and liabilities may change because of changes in

the foreign exchange rate between two countries.

12.Employee fraud is a type of operational risk to a financial institution.

13.Purchased liquidity risk management usually involves purchased funds such as fed funds,

repurchase agreements and CDs.

14.The risk that a computer system may malfunction during the processing of data is anexample of

operational risk.

15.Duration of a zero coupon bond is equal to the bond’s maturity.

16.Duration normally is less than the maturity for a fixed coupon asset.

17.Duration of a fixed-rate coupon bond will always be greater than one half of the maturity.

18.Core deposits represent a relatively short-term source of funds.

19.Bank runs occur because customers know that banks will be forced to liquidate assets at fire-sale

prices.

20.Foreign exchange risk includes interest rate risk and credit risk as well as changes in the foreign

exchange rate between two countries.

II.Multiple Choice Questions

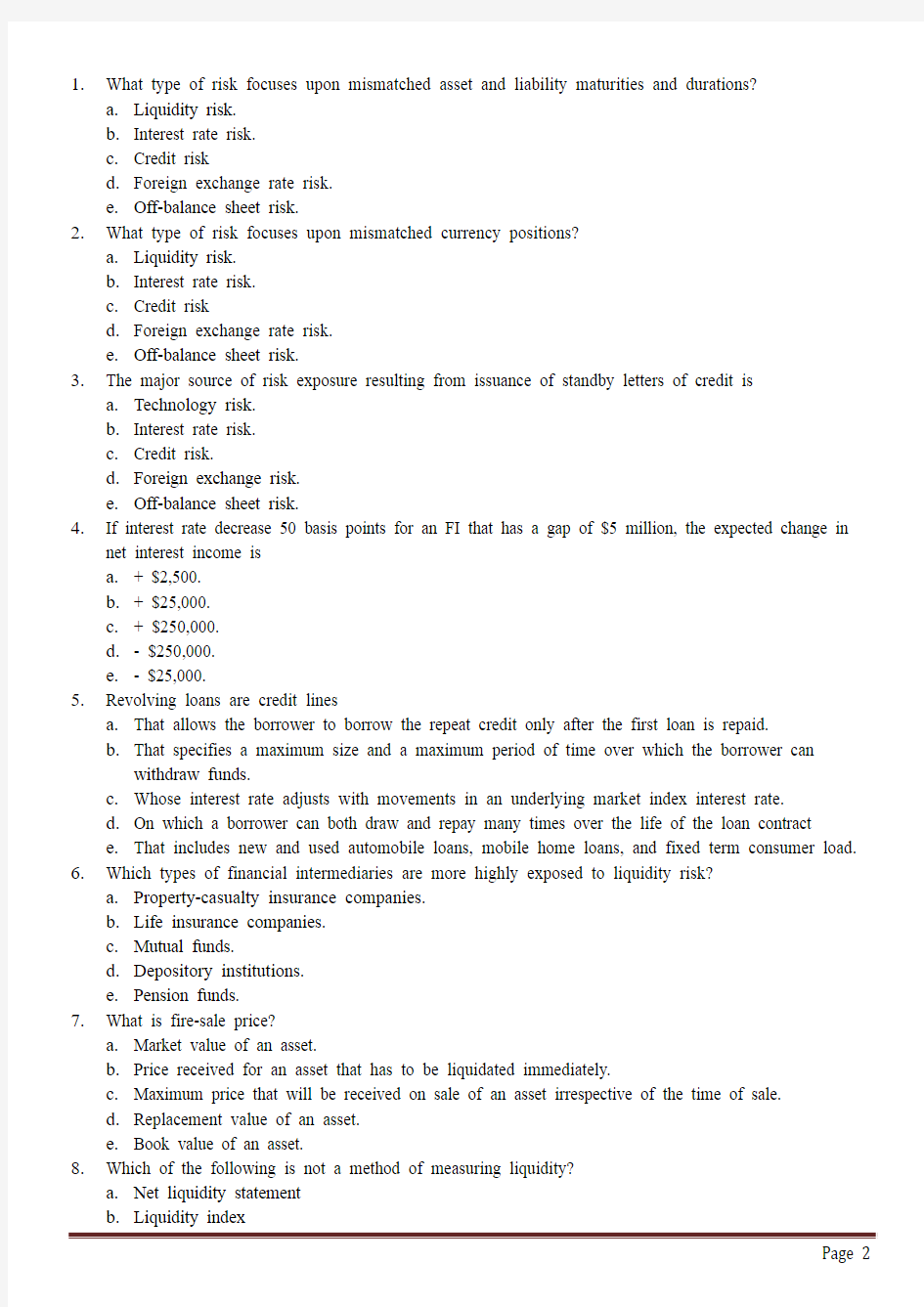

1.What type of risk focuses upon mismatched asset and liability maturities and durations?

a.Liquidity risk.

b.Interest rate risk.

c.Credit risk

d.Foreign exchange rate risk.

e.Off-balance sheet risk.

2.What type of risk focuses upon mismatched currency positions?

a.Liquidity risk.

b.Interest rate risk.

c.Credit risk

d.Foreign exchange rate risk.

e.Off-balance sheet risk.

3.The major source of risk exposure resulting from issuance of standby letters of credit is

a.Technology risk.

b.Interest rate risk.

c.Credit risk.

d.Foreign exchange risk.

e.Off-balance sheet risk.

4.If interest rate decrease 50 basis points for an FI that has a gap of $5 million, the expected change in

net interest income is

a.+ $2,500.

b.+ $25,000.

c.+ $250,000.

d.- $250,000.

e.- $25,000.

5.Revolving loans are credit lines

a.That allows the borrower to borrow the repeat credit only after the first loan is repaid.

b.That specifies a maximum size and a maximum period of time over which the borrower can

withdraw funds.

c.Whose interest rate adjusts with movements in an underlying market index interest rate.

d.On which a borrower can both draw and repay many times over the life of the loan contract

e.That includes new and used automobile loans, mobile home loans, and fixed term consumer load.

6.Which types of financial intermediaries are more highly exposed to liquidity risk?

a.Property-casualty insurance companies.

b.Life insurance companies.

c.Mutual funds.

d.Depository institutions.

e.Pension funds.

7.What is fire-sale price?

a.Market value of an asset.

b.Price received for an asset that has to be liquidated immediately.

c.Maximum price that will be received on sale of an asset irrespective of the time of sale.

d.Replacement value of an asset.

e.Book value of an asset.

8.Which of the following is not a method of measuring liquidity?

https://www.wendangku.net/doc/2012508999.html, liquidity statement

b.Liquidity index

c.Financing gap and financing requirement

d.Peer group ratio comparison

e.Current ratio

9.What information does the net liquidity statement provide?

a.Maturity ladder

b.Sources and uses of liquidity

https://www.wendangku.net/doc/2012508999.html, asset value

d.Liquidity index information

e.Peer group ration comparison

10. A bank’s net deposit drain

a.Is negative if deposits exceed withdrawals.

b.Is positive if deposits exceed withdraws.

c.Decreases during holiday and vacation periods.

d.In unaffected by holiday and vacation periods.

e.Fluctuates unpredictably on any given day.

11.Second Bank now offers web banking services. Last week a computer glitch posted all web deposit

transfers to the wrong accounts. This is an example of

a.Credit risk

b.Liquidity risk

c.Stupidity risk

d.Technological risk

e.Operational risk

12.Argentina’s refused to pay loans made to it by foreign institutions three times. This is an example of

a)Operational risk

b)Liquidity risk

c)Foreign exchange risk

d)Sovereign risk

e)Insolvency risk

13.Which of the following are potential causes of liquidity risk for a DI?

a. The decrease in the DI’s stock price caused by market factors.

b. Requests to fund large amounts of loan commitments.

c. Requests by depositors to withdraw large amounts of deposits.

d. All of the above will cause liquidity problems.

e. Only b and c above are considered causes of liquidity risk.

14.Which of the following is not a method of measuring liquidity?

a. Net liquidity statement

b. Liquidity index

c. Financing gap and financing requirement

d. Peer group ratio comparison

e. Current ratio

15.In estimating liquidity risk exposure, the financing gap is defined as the difference between average

loans and……..

a.Average total assets.

b.Average securities.

c.Potential borrowed funds.

d.Average demand deposits.

e.Average core deposits.

16.The difference between the weighted-average maturity of an FI's assets and liabilities is the…..

a.Rate sensitive assets.

b.Repricing gap.

c.Rate-sensitive liabilities.

d.Duration gap

e.Maturity gap.

17.According to the net liquidity statement, a DTI can obtain liquid funds from……..

a.Liquidating some of the assets.

b.Borrowing funds in the money/purchased funds market.

c.Any excess cash reserves available.

d.All of the abov

e.

e. a and b of the above.

18.Abnormal deposit drains may occur for which of the following reasons?

a.Sudden changes in investor preferences regarding holding nonbank financial assets relative to

deposits.

b.Concerns about a DTI's solvency relative to other DTIs.

c.Failure of a related DTI leading to increased concern about the solvency of other DTIs.

d.All of the abov

e.

e. b and c of the above.

19.Which of the following is not a primary source of liquidity?

a. Excess cash reserves over and above regulatory reserve requirements.

b. Borrowings in the money market.

c. Borrowings in the purchased funds market.

d. Capital notes and other long-term financing alternatives.

e. Cash-type assets that can be sold with little price risk and low transaction costs.

20.Perfect Bank has a repricing gap of -$400 million. Interest rates are expected to increase 1 percent.

What will be the impact on the bank's net interest income?

a.+$4,000,000.

b.-$2,000,000.

c.+$2,000,000.

d.-$4,000,000.

e.Can't tell because we don't know the amount of rate sensitive assets or rate sensitive liabilities.

21.The repricing gap approach calculates the gaps in each maturity bucket by subtracting the

a.Current assets from the current liabilities.

b.Long term liabilities from the fixed assets.

c.Rate sensitive assets from the total assets.

d.Rate sensitive liabilities from the rate sensitive assets.

e.Current liabilities from tangible assets.

22.Imperfect Bank has rate-sensitive asset of $100 and rate-sensitive liabilities of $120. What is the

repricing gap?

a.-$20.

b.+$20.

c.+$100.

d.+$220.

e.+$120.

23.If interest rates decrease 40 basis points (0.40 percent) for an FI that has a cumulative gap of -$25

million, the expected change in net interest income is

a.+$100,000.

b.-$100,000.

c.-$625,000.

d.-$625,000.

e.+$250,000.

24.What does a high ratio of loans to deposits indicate?

a. DI relies heavily on the short-term money market to fund loans.

b. High degree of loan commitments.

c. DI has large amounts of asset-side liquidity.

d. Liquidity concerns are at a bare minimum for the FI.

e. DI relies heavily on core deposits to fund loans.

25.What information does the net liquidity statement provide?

a. Maturity ladder

b. Sources and uses of liquidity

c. Net asset value

d. Liquidity index information

e. Peer group ration comparison

26.The price received for an asset that has to be liquidated immediately often is called …….

a.Auction sale.

b.Fire-sale price.

c.Premium.

d.Spot purchas

e.

e.Holiday special.

27.The difference between the dollar amount of assets whose interest rates will change and the dollar

amount of liabilities whose interest rates will change when market rates change in some given time window is the……..

a.Rate sensitive assets.

b.Repricing gap.

c.Rate-sensitive liabilities.

d.Duration gap.

e.Maturity gap.

The following information is for questions 28 - 31.

Cash Required Reserves $2 million Deposits $8 million

Loans $10 million Long-term Debt $2 million

Equity $2 million Total $12 million Total $12 million

The average interest earned on the loans is 6 percent and the average cost of deposits is 5 percent. Rising interest rates are expected to reduce the deposits by $3 million. Borrowing more debt will cost the bank 5.5 percent in the short term.

28.What will be the size of the bank if a stored liquidity management strategy is adopted?

a. $9 million

b. $11 million

c. $12 million

d. $14 million

e. $15 million

29.What will be the cost of using a strategy of reducing its asset base to meet the expected decline in

deposits? Assume that the bank intends to keep $2 million in cash as a liquidity precaution.

a. $10,000

b. $15,000

c. $30,000

d. $40,000

e. $50,000

30.What will be the cost of using a strategy of purchased liquidity management to meet theexpected

decline in deposits? Assume that the bank intends to keep $2 million in cash as a liquidity precaution.

a.$10,000

b.$15,000

c.$30,000

d.$40,000

e.$50,000

31.What will be the size of the bank if a purchased liquidity management strategy is adopted?

a. $9 million

b. $11 million

c. $12 million

d. $14 million

e. $15 million

Questions 32-37

refer to the following information on foreign currency positions for a U.S. FI.

Currency Assets Liabilities FX Bought FX Sold British pound 24,600 70,000 170,400 321,000

Yen 31,000 20,400 250,000 220,000

Swiss franc 10,200 9,800 8,000 10,800

32.What is the FI's net exposure in British pounds?

a. -45,400

b. -150,600

c. -196,000

d. +105,200

e. +196,000

33.What is the FI's net exposure in the Japanese yen?

a. +30,000

b. +40,600

c. -19,400

d. -40,600

e. +20,600

34.What is the FI's net exposure in the Swiss franc?

a. +2,400

b. +400

c. -2,800

d. -2,400

e. +3,200

35.How would you characterize the FI's risk exposure to fluctuations in the British pound to dollar

exchange rate?

a. The FI is net short in the British pound and therefore faces the risk that the British pound will rise in value against the U.S. dollar.

b. The FI is net short in the British pound and therefore faces the risk that the British pound will fall in value against the U.S. dollar.

c. The FI is net long in the British pound and therefore faces the risk that the British pound will fall in value against the U.S. dollar.

d. The FI is net long in the British pound and therefore faces the risk that the British pound will rise in value against the U.S. dollar.

e. The FI has a balanced position in the British pound.

36.How would you characterize the FI's risk exposure to fluctuations in the yen/dollar exchange rate?

a. The FI is net short in the yen and therefore faces the risk that the yen will rise in value against the U.S. dollar.

b. The FI is net short in the yen and therefore faces the risk that the yen will fall in value against the U.S. dollar.

c. The FI is net long in the yen and therefore faces the risk that the yen will fall in value against the U.S. dollar.

d. The FI is net long in the yen and therefore faces the risk that the yen will rise in value against the U.S. dollar.

e. The FI has a balanced position in the Japanese yen.

37.How would you characterize the FI's risk exposure to fluctuations in the Swiss franc/dollar exchange

rate?

a.The FI is net short in the franc and therefore faces the risk that the franc will rise in value against

the U.S. dollar.

b.The FI is net short in the franc and therefore faces the risk that the franc will fall in value against

the U.S. dollar.

c.The FI is net long in the franc and therefore faces the risk that the franc will fall in value against

the U.S. dollar.

d.The FI is net long in the franc and therefore faces the risk that the franc will rise in value against

the U.S. dollar.

e.The FI has a balanced position in the Swiss franc.

For questions 38-40, consider a one-year maturity, $100,000 face value bond that pays a 6 percent fixed coupon annually.

38.What is the price of the bond if market interest rates are 7 percent?

a. $99,050.15

b. $99,457.94

c. $99,249.62

d. $100,000.00

e. $99,065.42

39.What is the price of the bond if market interest rates are 5 percent?

a. $100,952.38

b. $101,238.10

c. $100,963.71

d. $100,000.00

e. $101,108.27

40.What is the percentage price change for the bond if interest rates increase 50basis points from the

original 6 percent?

a. -0.1033 percent

b. -0.4766 percent

c. -0.4695 percent

d. 0.0000 percent

e. -0.2907 percent

III.Questions

1. What is the primary function of an insurance company? How does this function compare with the primary function of a depository institution?

2. What is the adverse selection problem? How does adverse selection affect the profitable management

of an insurance company?

1.Explain how securities firms differ from investment banks. In what ways are they financial

intermediaries?

2.In what ways have changes in the investment banking industry mirrored changes in the commercial

banking industry?

3.What are the different types of firms in the securities industry, and how does each type differ from the

others?

4.What are the key activity areas for securities firms? How does each activity area assist in the

generation of profits, and what are the major risks for each area?

5.What is the difference between an IPO and a secondary issue?

6.One of the major activity areas of securities firms is trading.

a. W hat is the difference between pure arbitrage and risk arbitrage?

b.What is the difference between position trading and program trading?

7.What is the primary function of finance companies? How do finance companies differ from

commercial banks?

8.What are the three major types of finance companies? To which market segments do these companies

provide service?

9.What are the major types of consumer loans? Why are the rates charged by consumer finance

companies typically higher than those charged by commercial banks?

10.What advantages do finance companies have over commercial banks in offering services to small

business customers? What are the major subcategories of business loans? Which category is largest?

11.What have been the primary sources of financing for finance companies?

12.How do finance companies make money? What risks does this process entail? How do these risks

differ for a finance company versus a commercial bank?

13.What is the process of asset transformation performed by a financial institution? Why does this

process often lead to the creation of interest rate risk? What is interest rate risk?

14.What is refinancing risk? How is refinancing risk part of interest rate risk? If an FI funds long-term

fixed-rate assets with short-term liabilities, what will be the impact on earnings of an increase in the rate of interest? A decrease in the rate of interest?

15.What is economic or market value risk? In what manner is this risk adversely realized in the economic

performance of an FI?

16.What is the repricing gap? In using this model to evaluate interest rate risk, what is meant by rate

sensitivity? On what financial performance variable does the repricing model focus? Explain.

17.What is a maturity bucket in the repricing model? Why is the length of time selected for repricing

assets and liabilities important when using the repricing model?

18.What is the difference between book value accounting and market value accounting? How do interest

rate changes affect the value of bank assets and liabilities under the two methods? What is marking to market?

19.What is refinancing risk? How is refinancing risk part of interest rate risk?

20.What should a good written loan policy contain?

21.What should a good written loan policy contain?

22.Explain how economic transactions between household savers of funds and corporate users of funds

would occur in a world without financial intermediaries (FIs).

23.What is insolvency risk? How can liquidity risk and credit risk cause insolvency? What are the two

best protections against insolvency at a FI?

24.How do financial institutions help individual savers diversify their portfolio risks? Which type of

financial institution is best able to achieve this goal?

25.What is refinancing risk? How is refinancing risk part of interest rate risk? If an FI funds long-term

fixed-rate assets with short-term liabilities, what will be the impact on earnings of an increase in the rate of interest? A decrease in the rate of interest?

26.What is reinvestment risk? How is reinvestment risk part of interest rate risk? If an FI funds short-term

assets with long-term liabilities, what will be the impact on earnings of a decrease in the rate of

interest? An increase in the rate of interest?

27.Explain the purpose/benefits in adding a credit scoring model to evaluate a loan application.

28.For most business loans growing earnings are not a sufficient reason to grant a loan. Why?

29.Describe the credit analysis process for a mid-market corporate loan applicant.

30.A corporate loan applicant has had a growing cash account for the last three years but cash flow from

operations has been negative in every year. Would this concern you if you were the loan officer

charged with approving the loan? If so, why? If not, why not?

31.Why won't a loan officer usually approve a loan solely on the basis of collateral?

32.Explain what each ratio in the Altman credit model measures and explain why higher values of each of

the variables predicts lower default probability.

33.Explain the relationship between each of the following ratios and liquidity risk.

a) Loan to deposit ratio

b) Borrowed funds to total assets

c) Loan commitments to total assets

34.Does a positive or a negative financing gap indicate greater liquidity risk? Explain.

35.What are the tradeoffs involved between storing liquidity and purchasing liquidity as needed for a

bank?

IV.Problem

1.Refer the following balance sheet of XYZ Bank to answer questions. All figures in millions of US

Dollars.

Assets Liabilities

1.Short-term consumer loans $ 150 1. Equity capital (fixed) $120

(one-year maturity)

2.Long-term consumer loans 125 2. Demand deposits 40

(two-year maturity)

3.Three-month Treasury bills 130 3. Passbook savings 130

4.Six-moth Treasury notes 135 4. Three-month CDs 140

5.Three –year Treasury bonds 170 5. Three-month bankers acceptances 120

6.10-year, fixed-rate mortgages 120 6. Six-month commercial paper 160

7.30-year,floating-rats mortgages 7. One-year time deposits 120

(rate adjusted every nine months) 140 8. Two-year time deposits 40

$ 970 $ 970

a.What are the total one-year rate-sensitive assets?

b.What are the total one-year rate-sensitive liabilities?

c.What are the cumulative one-year repricing gap (CGAP) for the bank?

d.What is expected net interest income for a 2 percent increase in interest rates on both RSAs and

RSLs?

2. A corporate customer obtains a $2.5 million loan from a bank. The customer agrees to pay a 7.25%

interest rate and agrees to make compensating balance of 5.2% of the loan amount. These will be

held in non-interest bearing transactions deposits at the bank for two years. The bank charges a 2% loan origination fee on the amount borrowed. Reserve requirements are 10%. What is the expected rate of return to the bank?

https://www.wendangku.net/doc/2012508999.html,e the following balance sheet information All assets and liabilities are currently priced at par

And pay interest annually.

Assets ($ millions) Liabilities ($ millions)

1-year 7 percent coupon bonds $60 1-year 5 percent interest rate CD $50 10-year 12 percent loan $40 2-year 6 percent interest rate CD $40

Equity $10

$100 $100

a.What is the weighted average maturity of assets?

b. What is the weighted average maturity of liabilities?

c.What is this FI’s maturity gap?

d. What is market value of the ten-year loan if all interest rates increase by 2 percent?

4. A bank has $7.5 million in Treasury bills, $4 million in excess reserves at the Fed, $2.3 million in

vault cash, and a $9.2 million line of credit on the repo market. The bank has borrowed $5 million in Fed funds and $11.5 million in short term notes borrowed to finance loans. What is the net

liquidity position of the bank and what can you conclude from it?

https://www.wendangku.net/doc/2012508999.html,e the flowing information. Suppose that the financial rations of a potential borrowing firm took

the following values:

X1 = .3

X2 = 0

X3 = -0.30

X4 = 0.15

X5 = 2.1

a.What is the Altman discriminant function value for firm?

b.Should you approve MNO, In

c.’s application to your bank for a $500 capital expansion loan?

6. An FI has $5 million in cash reserves with the Fed in excess of its reserve requirements, $5 million

in T-Bills, and a credit line of $10 million to borrow in the repo market. It currently has lent $2

million in the Fed Funds market and borrowed $1 million from the Federal discount window to

meet its seasonal needs.

c.What are the bank’s total available sources of liq uidity?

d.What are the bank’s current total uses of liquidity?

e.What is the net liquidity of the bank?

7. A corporate customer obtains a $1.5 million loan from a bank. The customer agrees to pay a 6.25%

interest interest bearing transactions deposits at the bank for one year. The bank charges a 1% loan origination fee on the amount borrowed. Reserve requirements are 10%. What is the expected rate of return to the bank (k)?

8. A bank has $6 million in Treasury bills, $3 million in excess reserves at the Fed, $1 million in vault

funds and $12 million in short term notes borrowed to finance loans. What is the net liquidity

position of the bank and what can you conclude from it?

9. A bank has $150 million in 1 year loans earning a fixed rate equal to 4.75%. The assets are funded

by $150 million in liabilities that have a cost of 4.25% and a maturity of 3 years. If all interest rates ar e projected to fall 100 basis points by next year, by how much will the bank’s profits and loan NIM change in year 2? Does this bank face refinancing risk or reinvestment risk? Explain.

10. A bank has a base loan rate of 4.75% and for the loan under consideration would apply a 2% risk

premium. The bank also requires compensating balances (non-interest bearing) equal to 5% of the loan amount. The bank’s reserve requirements are 10%. The bank charges 1% of the loan amount as an origination fee. The borrower is asking for a $500,000 loan. Calculate the ROA on the loan.

11.Why is bank lending to large corporations more difficult than making loans to small or mid-size

firms? What additional factors are involved? Do banks have some additional tools to help in

assessing credit risk of large firms? What are some examples?

12.You have the following data for a bank (Mill $):

Calculate the net funding requirement for each period and the cumulative net funding requirement over the month. What does the plan reveal?

13.Explain how liquidity risk can lead to insolvency risk.

14. A bank has $6 million in Treasury bills, $3 million in excess reserves at the Fed, $1 million in vault

cash, and a $8 million line of credit on the repo market. The bank has borrowed $6 million in Fed funds and $12 million in short term notes borrowed to finance loans. What is the net liquidity

position of the bank and what can you conclude from it?

15. A financial intermediary has two assets in its investment portfolio. It has 35% of its security

portfolio invested in 1 month Treasury bills and 65% in real estate loans. If it liquidated the bills today, the bank would receive $98 per hundred of face value. If the real estate loans were sold

today they would be worth $85 per $100 of face value. In one month the real estate loans could be liquidated at $94 per 100 of face value. What is the intermediary’s one month liquidity index?

16.

17.Blue Moon National Bank holds assets and liabilities whose average durations and dollar

amounts are as shown in this table:

Asset and Liability

Avg.Duration(yrs) $ Amount

Items

Investment Grade Bonds 12.00 $65.00

Commercial Loans 4.00 $400.00

Consumer Loans 8.00 $250.00

Deposits 1.10 $600.00

Nondeposit Borrowings 0.25 $50.00

What is the weighted average duration of New Phase’s asset portfolio and liability portfolio? What is the leverage-adjusted duration gap?