金融题库

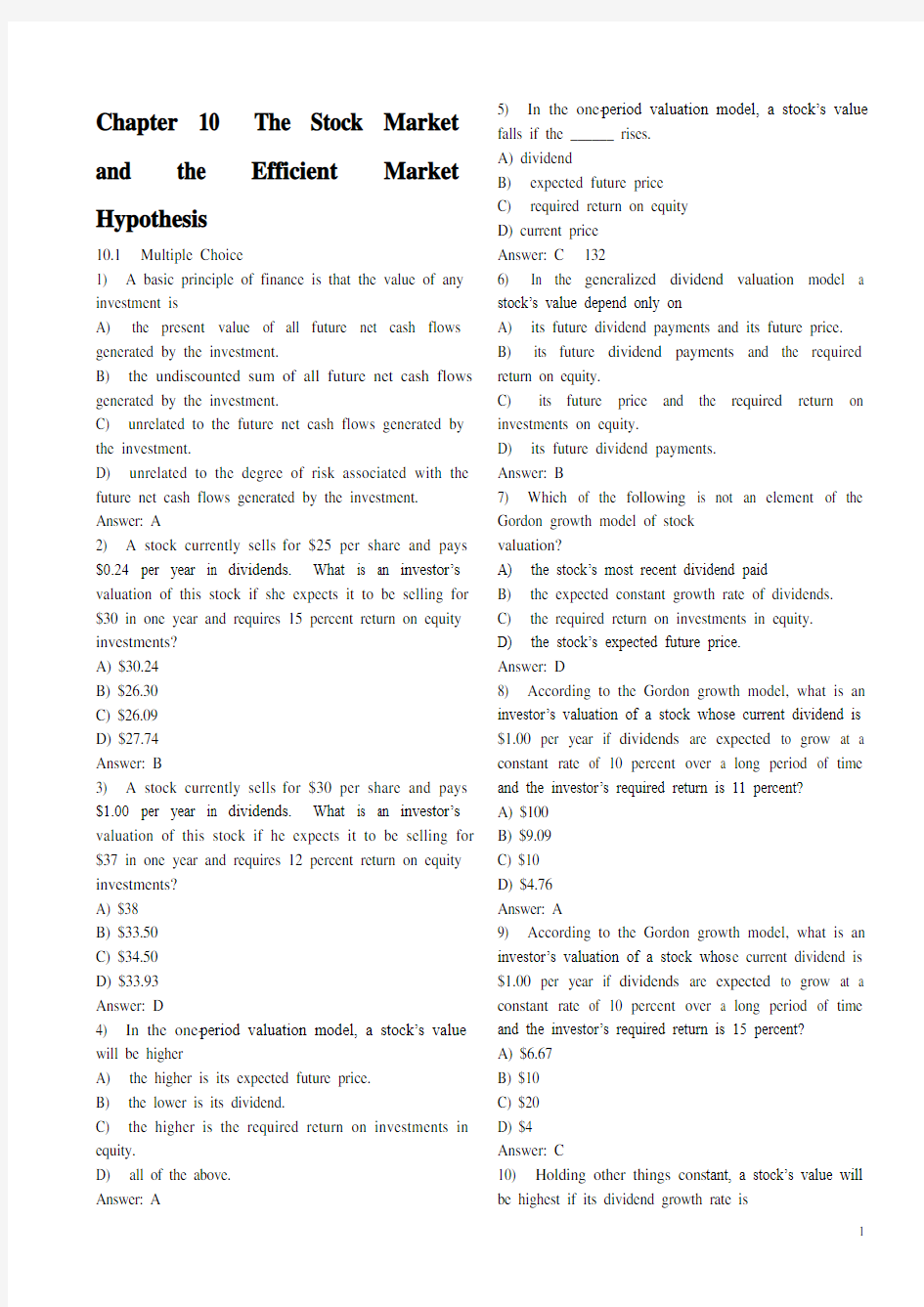

Chapter 10 The Stock Market and the Efficient Market Hypothesis

10.1 Multiple Choice

1) A basic principle of finance is that the value of any investment is

A) the present value of all future net cash flows generated by the investment.

B) the undiscounted sum of all future net cash flows generated by the investment.

C) unrelated to the future net cash flows generated by the investment.

D) unrelated to the degree of risk associated with the future net cash flows generated by the investment. Answer: A

2) A stock currently sells for $25 per share and pays $0.24 per year in dividends. What is an investor’s valuation of this stock if she expects it to be selling for $30 in one year and requires 15 percent return on equity investments?

A) $30.24

B) $26.30

C) $26.09

D) $27.74

Answer: B

3) A stock currently sells for $30 per share and pays $1.00 per year in dividends. What is an investor’s valuation of this stock if he expects it to be selling for $37 in one year and requires 12 percent return on equity investments?

A) $38

B) $33.50

C) $34.50

D) $33.93

Answer: D

4) In the one-period valuation model, a stock’s value will be higher

A) the higher is its expected future price.

B) the lower is its dividend.

C) the higher is the required return on investments in equity.

D) all of the above.

Answer: A 5) In the one-period valuation model, a stock’s value falls if the ______ rises.

A) dividend

B) expected future price

C) required return on equity

D) current price

Answer: C 132

6) In the generalized dividend valuation model a stock’s value depend only on

A) its future dividend payments and its future price.

B) its future dividend payments and the required return on equity.

C) its future price and the required return on investments on equity.

D) its future dividend payments.

Answer: B

7) Which of the following is not an element of the Gordon growth model of stock

valuation?

A) the stock’s most recent dividend paid

B) the expected constant growth rate of dividends.

C) the required return on investments in equity.

D) the stock’s expected future price.

Answer: D

8) According to the Gordon growth model, what is an investor’s valuation of a stock whose current dividend is $1.00 per year if dividends are expected to grow at a constant rate of 10 percent over a long period of time and the investor’s required return is 11 percent?

A) $100

B) $9.09

C) $10

D) $4.76

Answer: A

9) According to the Gordon growth model, what is an investor’s valuation of a stock whos e current dividend is $1.00 per year if dividends are expected to grow at a constant rate of 10 percent over a long period of time and the investor’s required return is 15 percent?

A) $6.67

B) $10

C) $20

D) $4

Answer: C

10) Holding other things cons tant, a stock’s value will be highest if its dividend growth rate is

A) 15 percent

B) 10 percent

C) 5 percent

D) 2 percent

Answer: A133

11) Holding other things constant, a stock’s value will be highest if its most recent dividend is

A) $2.00

B) $5.00

C) $0.50

D) $1.00

Answer: B

12) Holding other things constant, a stock’s value will be highest if the investor’s required return on investments in equity is

A) 20 percent

B) 15 percent

C) 10 percent

D) 5 percent

Answer: D

13) Suppose the average industry PE ratio for auto parts retailers is 20. What is the current price of Auto Zone stock if the retailer’s earnings per share are projected to be $1.85?

A) $21.85

B) $37

C) $10.81

D) $9.25

Answer: B

14) Which of the following is true regarding the Gordon growth model?

A) Dividends are assumed to grow at a constant rate forever.

B) The dividend growth rate is assumed to be greater than the required return on equity.

C) Both (A) and (B).

D) Neither (A) nor (B).

Answer: A

15) The PE ratio approach to valuing stock is especially useful for valuing

A) privately held firms.

B) firms that don’t pay dividends.

C) both (A) and (B).

D) neither (A) nor (B).

Answer: C

16) The PE ratio approach to valuing stock is especially useful for valuing

A) publicly held corporations.

B) firms that regularly pay dividends.

C) both (A) and (B).

D) neither (A) nor (B).

Answer: D 134

17) A weakness of he PE approach to valuing stock is that

A) it is difficult to estimate the constant growth rate of a firm’s dividends.

B) it is difficult to estimate the required return on equity.

C) it is difficult to predict how much a firm will pay in dividends.

D) it is based on industry averages rather than firm-specific factors.

Answer: D

18) A firm’s current dividend is $1.00 per year and is expected to grow at a constant rate of 4 percent over time. Some investors have required returns on investments in equity of 12 percent, some 10 percent, and some 8 percent. The market price of th is firm’s stock will be slightly above

A) $25

B) $12.50

C) $16.67

D) $18

Answer: C

19) The market price of a security represents the highest value any investor puts on the security. (II) Superior information about a security increases its value by reducing its risk.

A) (I) is true, I(I) is false.

B) (I) is false, I(I) is true.

C) Both are true.

D) Both are false.

Answer: B

20) The main cause of fluctuations in stock prices is changes in

A) tax laws.

B) errors in technical stock analysis.

C) daily trading volume in stock markets.

D) information available to investors.

E) total household wealth in the economy. Answer: C

21) Stock values computed by valuation models may

differ from actual market prices because

A) it is difficult to estimate future dividend growth rates.

B) it is difficult to estimate the risk of a stock.

C) it is difficult to forecast a stock’s future dividends.

D) all of the above are true.

Answer: D 135

22) According to the efficient market hypothesis, the current price of a financial security

A) is the discounted net present value of future interest payments.

B) is determined by the highest successful bidder.

C) fully reflects all available relevant information.

D) is a result of none of the above.

Answer: C

23) The efficient market hypothesis

A) is based on the assumption that prices of securities fully reflect all available information.

B) holds that the expected return on a security equals the equilibrium return.

C) both (A) and (B).

D) neither (A) nor (B).

Answer: C

24) If the optimal forecast of the return on a security exceeds the equilibrium return, then

A) the market is inefficient.

B) an unexploited profit opportunity exists.

C) the market is in equilibrium.

D) only (A) and (B) of the above are true.

E) only (B) and (C) of the above are true.

Answer: D

25) According to the efficient market hypothesis

A) one cannot expect to earn an abnormally high return by purchasing a security.

B) information in newspapers and in the published reports of financial analysts is already reflected in market prices.

C) unexploited profit opportunities abound, thereby explaining why so many people get rich by trading securities.

D) all of the above are true.

E) only (A) and (B) of the above are true.

Answer: E

26) Another way to state the efficient market condition is that in an efficient market,

A) unexploited profit opportunities will be quickly eliminated.

B) unexploited profit opportunities will never exist.

C) arbitrageurs guarantee that unexploited profit opportunities never exist.

D) both (A) and (C) of the above occur.

Answer: A136

27) Another way to state the efficient market hypothesis is that in an efficient market,

A) unexploited profit opportunities will never exist as market participants, such as arbitrageurs, ensure that they are instantaneously dissipated.

B) unexploited profit opportunities will not exist for long, as market participants will act quickly to eliminate them.

C) every financial market participant must be well informed about securities.

D) only (A) and (C) of the above.

Answer: B

28) A situation in which the price of an asset differs from its fundamental market value is called

A) an unexploited profit opportunity.

B) a bubble.

C) a correction.

D) a mean reversion.

Answer: B

29) A situation in which the price of an asset differs from its fundamental market value

A) indicates that unexploited profit opportunities exist.

B) indicates that unexploited profit opportunities do not exist.

C) need not indicate that unexploited profit opportunities exist.

D) indicates that the efficient market hypothesis is fundamentally flawed.

Answer: C

30) Studies of mutual fund performance indicate that mutual funds that outperformed the market in one time period

A) usually beat the market in the next time period.

B) usually beat the market in the next two subsequent time periods.

C) usually beat the market in the next three subsequent time periods.

D) usually do not beat the market in the next time period.

Answer: D

31) The efficient market hypothesis suggests that allocating your funds in the financial markets on the advice of a financial analyst

A) will certainly mean higher returns than if you had made selections by throwing darts at the financial page.

B) will always mean lower returns than if you had made selections by throwing darts at the financial page.

C) is not likely to prove superior to a strategy of making selections by throwing darts at the financial page.

D) is good for the economy.

Answer: C 137

32) Ivan Boesky, the most successful of the so-called arbs in the 1980s, was able to outperform the market on a consistent basis, indicating that

A) securities markets are not efficient.

B) unexploited profit opportunities were abundant.

C) investors can outperform the market with inside information.

D) only (B) and (C) of the above.

Answer: D

33) To say that stock prices follow a "random walk" is to argue that

A) stock prices rise, then fall.

B) stock prices rise, then fall in a predictable fashion.

C) stock prices tend to follow trends.

D) stock prices are, for all practical purposes, unpredictable.

Answer: D

34) To say that stock prices follow a "random walk" is to argue that

A) stock prices rise, then fall, then rise again.

B) stock prices rise, then fall in a predictable fashion.

C) stock prices tend to follow trends.

D) stock prices cannot be predicted based on past trends.

Answer: D

35) Rules used to predict movements in stock prices based on past patterns are, according to the efficient markets theory,

A) a waste of time

B) profitably employed by all financial analysts.

C) the most efficient rules to employ.

D) consistent with the random walk hypothesis. Answer: A 36) Tests used to rate the performance of rules developed in technical analysis conclude that

A) technical analysis outperforms the overall market.

B) technical analysis far outperforms the overall market, suggesting that stockbrokers provide valuable services.

C) technical analysis does not outperform the overall market.

D) technical analysis does not outperform the overall market, suggesting that stockbrokers do not provide services of any value.

Answer: C

37) Which of the following types of information will most likely enable the exploitation of a profit opportunity?

A) Financial analysts' published recommendations

B) Technical analysis

C) Hot tips from a stockbroker

D) Insider information

Answer: D 138

38) Which of the following types of information will most likely enable the exploitation of a profit opportunity?

A) Financial analysts' published recommendations

B) Technical analysis

C) Hot tips from a stockbroker

D) None of the above

Answer: D

39) The advantage of a "buy-and-hold strategy" is that

A) net profits will tend to be higher because there will be fewer brokerage commissions.

B) losses will eventually be eliminated.

C) the longer a stock is held, the higher will be its price.

D) only (B) and (C) of the above are true.

Answer: A

40) The efficient market hypothesis suggests that

A) investors should not try to outguess the market by constantly buying and selling securities.

B) investors do better on average if they adopt a "buy and hold" strategy.

C) buying into a mutual fund is a sensible strategy for a small investor.

D) all of the above are sensible strategies.

E) only (A) and (B) of the above are sensible strategies.

Answer: D

41) Sometimes one observes that the price of a company's stock falls after the announcement of favorable earnings. This phenomenon is

A) clearly inconsistent with the efficient market hypothesis.

B) consistent with the efficient market hypothesis if the earnings were not as high as anticipated.

C) consistent with the efficient market hypothesis if the earnings were not as low as anticipated.

D) the result of none of the above.

Answer: B

42) Important implications of the efficient market hypothesis include which of the following?

A) Future changes in stock prices should, for all practical purposes, be unpredictable.

B) Stock prices will respond to announcements only when the information in these announcements is new. C) Sometimes a stock price declines when good news is announced.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D 139

43) Although the verdict is not yet in, the available evidence indicates that, for many purposes, the efficient market hypothesis is

A) a good starting point for analyzing expectations.

B) not a good starting point for analyzing expectations.

C) too general to be a useful tool for analyzing expectations.

D) none of the above.

Answer: A

44) The efficient market hypothesis suggests that

A) investors should purchase no-load mutual funds which have low management fees.

B) investors can use the advice of technical analysts to outperform the market.

C) investors let too many unexploited profit opportunities go by if they adopt a "buy and hold" strategy.

D) only (A) and (B) of the above are sensible strategies.

Answer: A

10.2 True/False

1) Evidence that stock prices sometimes fall when a firm announces good news contradicts the efficient market hypothesis.

Answer: FALSE

2) If the security markets are truly efficient, there is no need to pay for help selecting securities.

Answer: TRUE

3) Evidence that a mutual fund has performed extraordinarily well in the past contradicts the efficient market hypothesis.

Answer: FALSE

4) In an efficient market, every stock is a good choice. Answer: TRUE

5) Technical analysts look at historical prices for information to project future prices.

Answer: TRUE

6) The evidence suggests technical analysts are not superior stock pickers.

Answer: TRUE

7) If the markets are efficient, the optimal investment strategy will be to buy and hold so as to minimize transaction costs.

Answer: TRUE 140

8) In an efficient market, abnormal returns are not possible even using inside information.

Answer: FALSE

9) It is probably a good use of an investor's time to watch as many shows featuring technical analysts as possible.

Answer: FALSE

10.3 Essay

1) How is it possible that a firm can announce a record breaking loss, yet its stock price rise when the announcement is made?

2) What is the optimal investment strategy according to the efficient market hypothesis? Why?

3) Explain what the market reaction will be in an efficient market if a firm announces a fully anticipated filing for bankruptcy.

4) Explain how the market's reaction to a mispriced security will lead to the correct pricing of all securities.

5) What is the role of the required return on investments in equity in stock valuation models?

Chapter 11 The Mortgage Markets

11.1 Multiple Choice

1) Which of the following are important ways in which mortgage markets differ from the stock and bond markets?

A) The usual borrowers in the capital markets are government entities and businesses, whereas the usual borrowers in the mortgage markets are individuals.

B) Most mortgages are secured by real estate, whereas the majority of capital market borrowing is unsecured.

C) Because mortgages are made for different amounts and different maturities, developing a secondary market has been more difficult.

D) All of the above are important differences.

E) Only (A) and (B) of the above are important differences.

Answer: D

2) Which of the following are important ways in which mortgage markets differ from stock and bond markets?

A) The usual borrowers in capital markets are government entities, whereas the usual borrowers in mortgage markets are small businesses.

B) The usual borrowers in capital markets are government entities and large businesses, whereas the usual borrowers in mortgage markets are small businesses.

C) The usual borrowers in capital markets are government entities and large businesses, whereas the usual borrowers in mortgage markets are small businesses and individuals.

D) The usual borrowers in capital markets are businesses and government entities, whereas the usual borrowers in mortgage markets are individuals. Answer: D

3) Which of the following are true of mortgages?

A) A mortgage is a long-term loan secured by real estate.

B) A borrower pays off a mortgage in a combination of principal and interest payments that result in full payment of the debt by maturity.

C) Over 80 percent of mortgage loans finance residential home purchases.

D) All of the above are true of mortgages.

E) Only (A) and (B) of the above are true of mortgages.

Answer: D 142

4) Which of the following are true of mortgages?

A) A mortgage is a long-term loan secured by real estate.

B) Borrowers pay off mortgages over time in some combination of principal and interest payments that result in full payment of the debt by maturity.

C) Less than 65 percent of mortgage loans finance residential home purchases.

D) All of the above are true of mortgages.

E) Only (A) and (B) of the above are true of mortgages.

Answer: E

5) Which of the following are true of mortgages?

A) Prior to the 1920s, U.S. banking legislation discouraged mortgage lending by banks.

B) In the 1920s, most mortgages were balloon loans, which required the borrower to pay the entire loan amount after three to five years.

C) Because mortgages are long-term loans secured by real estate, mortgage

lenders tended to fail when land prices declined, as was often the case during economic recessions.

D) All of the above are true.

E) Only (A) and (B) of the above are true. Answer: D

6) Which of the following is true of mortgage interest rates?

A) Interest rates on mortgage loans are determined by three factors: current long-term markets rates, the term of the mortgage, and the number of discount points paid.

B) Mortgage interest rates tend to track along with Treasury bond rates.

C) The interest rate on 15-year mortgages is lower than the rate on 30-year mortgages, all else the same.

D) All of the above are true.

E) Only (A) and (B) of the above are true. Answer: D

7) Which of the following are true of mortgages?

A) More than 80 percent of mortgage loans finance residential home purchases.

B) The National Banking Act of 1863 rewarded banks that increased mortgage lending.

C) Most mortgages during the 1920s and 1930s were

balloon loans.

D) All of the above are true.

E) Only (A) and (C) of the above are true. Answer: E 143

8) Which of the following is true of mortgage interest rates?

A) Longer-term mortgages have lower interest rates than shorter-term mortgages.

B) Mortgage rates are lower than Treasury bond rates, because of the tax-deductibility of mortgage interest rates.

C) In exchange for points, lenders reduce interest rates on mortgage loans.

D) All of the above are true.

E) Only (A) and (B) of the above are true. Answer: C

9) Which of the following is true of mortgage interest rates?

A) Longer-term mortgages have higher interest rates than shorter-term mortgages.

B) In exchange for points, lenders reduce interest rates on mortgage loans.

C) Mortgage rates are lower than Treasury bond rates because of the tax deductibility of mortgage interest payments.

D) All of the above are true.

E) Only (A) and (B) of the above are true. Answer: E

10) Which of the following reduces moral hazard for the mortgage borrower?

A) Collateral

B) Down payments

C) Private mortgage insurance

D) Borrower qualifications

Answer: B

11) Which of the following protects the mortgage lender’s right to sell property if the underlying loan defaults?

A) A lien

B) A down payment

C) Private mortgage insurance

D) Borrower qualification

E) Amortization

Answer: A

12) Which of the following is true of mortgage interest rates? A) Mortgage rates are closely tied to Treasury bond rates, but mortgage rates tend to stay below Treasury rates because mortgages are secured with collateral. B) Longer-term mortgages have higher interest rates than shorter-term mortgages.

C) Interest rates are higher on mortgage loans on which lenders charge points.

D) All of the above are true.

E) Only (A) and (B) of the above are true. Answer: B 144

13) During the early years of an amortizing mortgage loan, the lender applies

A) most of the monthly payment to the outstanding principal balance.

B) all of the monthly payment to the outstanding principal balance.

C) most of the monthly payment to interest on the loan.

D) all of the monthly payment to interest on the loan.

E) the monthly payment equally to interest on the loan and the outstanding principal balance.

Answer: C

14) During the last years of an amortizing mortgage loan, the lender applies

A) most of the monthly payment to the outstanding principal balance.

B) all of the monthly payment to the outstanding principal balance.

C) most of the monthly payment to interest on the loan.

D) all of the monthly payment to interest on the loan

E) the monthly payment equally to interest on the loan and the outstanding principal balance.

Answer: A

15) During the last years of a balloon mortgage loan, the lender applies

A) most of the monthly payment to the outstanding principal balance.

B) all of the monthly payment to the outstanding principal balance.

C) most of the monthly payment to interest on the loan.

D) all of the monthly payment to interest on the loan.

E) the monthly payment equally to interest on the loan and the outstanding principal balance.

Answer: D

16) During the early years of a balloon mortgage loan, the lender applies

A) most of the monthly payment to the outstanding principal balance.

B) all of the monthly payment to the outstanding principal balance.

C) most of the monthly payment to interest on the loan.

D) all of the monthly payment to interest on the loan.

E) the monthly payment equally to interest on the loan and the outstanding principal balance.

Answer: D

17) A borrower who qualifies for an FHA or V A loan enjoys the advantage that

A) the mortgage payment is much lower.

B) only a very low or zero down payment is required.

C) the cost of private mortgage insurance is lower.

D) the government holds the lien on the property. Answer: B 145

18) (I) Conventional mortgages are originated by private lending institutions, and FHA or V A loans are originated by the government. (II) Conventional mortgages are insured by private companies, and FHA or V A loans are insured by the government.

A) (I) is true, I(I) is false.

B) (I) is false, I(I) is true.

C) Both are true.

D) Both are false.

Answer: B

19) Borrowers tend to prefer ______ to ______, whereas lenders prefer ______

A) fixed-rate loans; ARMs; fixed-rate loans.

B) ARMs; fixed-rate loans; fixed-rate loans.

C) fixed-rate loans; ARMs; ARMs.

D) ARMs; fixed-rate loans; ARMs.

Answer: C

20) (I) ARMs offer lower initial rates and the rate may fall during the life of the loan.

(II) Conventional mortgages do not allow a borrower to take advantage of falling interest rates.

A) (I) is true, I(I) is false.

B) (I) is false, I(I) is true.

C) Both are true.

D) Both are false.

Answer: A

21) Growing-equity mortgages (GEMs) A) help the borrower pay off the loan in a shorter time.

B) have such low payments in the first few years that the principal balance increases.

C) offer borrowers payments that are initially lower than the payments on a conventional mortgage.

D) do all of the above.

E) do only (A) and (B) of the above.

Answer: A

22) A borrower with a 30-year loan can create a GEM by

A) simply increasing the monthly payments beyond what is required and designating that the excess be applied entirely to the principal.

B) converting his ARM into a conventional mortgage.

C) converting his conventional mortgage into an ARM.

D) converting his conventional mortgage into a GPM. Answer: A146

23) Which of the following are useful for home buyers who expect their income to rise in the future?

A) GPMs

B) RAMs

C) GEMs

D) (A) and (B)

E) (A) and (C)

Answer: E

24) Which of the following are useful for home buyers who expect their income to fall in the future?

A) GPMs

B) RAMs

C) GEMs

D) (A) and (B)

E) (A) and (C)

Answer: B

25) Retired people can live on the equity they have in their homes by using a

A) GEM.

B) GPM.

C) SAM.

D) RAM.

Answer: D

26) Second mortgages serve the following purposes

A) they give borrowers a way to use the equity they have in their homes as security for another loan.

B) they allow borrowers to get a tax deduction on

loans secured by their primary residence or vacation home.

C) they allow borrowers to convert their conventional mortgages into GEMs.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E

27) Which of the following is a disadvantage of a second mortgage compared to credit card debt?

A) The loans are secured by the borrower’s home.

B) The borrower gives up the tax deduction on the primary mortgage.

C) The borrower must pay points to get a second mortgage loan.

D) The borrower will find it more difficult to qualify for a second mortgage loan.

Answer: A147

28) The share of the mortgage market held by savings and loans is approximately

A) 50 percent.

B) 40 percent.

C) 20 percent.

D) 10 percent.

Answer: D

29) The share of the mortgage market held by commercial banks is approximately

A) 50 percent.

B) 25 percent.

C) 15 percent.

D) 5 percent.

Answer: B

30) A loan-servicing agent will

A) package the loan for an investor.

B) hold the loan in their investment portfolio.

C) collect payments from the borrower.

D) (A) and (C).

E) (B) and (C).

Answer: C

31) Distinct elements of a mortgage loan include

A) origination.

B) investment.

C) servicing.

D) all of the above.

E) only (B) and (C).

Answer: D

32) The Federal National Mortgage Association (Fannie Mae)

A) was set up to buy mortgages from thrifts so that these institutions could make more loans.

B) funds purchases of mortgages by selling bonds to the public.

C) provides insurance for certain mortgage contracts.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E

33) The Federal Housing Administration (FHA)

A) was set up to buy mortgages from thrifts so that these institutions could make more loans.

B) funds purchases of mortgages by selling bonds to the public.

C) provides insurance for certain mortgage contracts.

D) all of the above.

E) only (A) and (B) of the above.

Answer: C 148

34) _______ issues participation certificates, and ________ provides federal insurance for participation cert ificates.

A) Freddie Mac; Freddie Mac

B) Freddie Mac; Ginnie Mae

C) Ginnie Mae; Freddie Mac

D) Ginnie Mae; Ginnie Mae

E) Freddie Mac; no one

Answer: E

35) REMICs are most like

A) Freddie Mae pass-through securities.

B) Ginnie Mae pass-through securities.

C) participation certificates.

D) collateralized mortgage obligations.

Answer: D

36) Ginnie Mae

A) insures qualifying mortgages.

B) insures pass-through certificates.

C) insures collateralized mortgage obligations.

D) (A) and (B).

E) (B) and (C).

Answer: B

37) Mortgage-backed securities

A) have been growing in popularity in recent years as institutional investors look for attractive investment opportunities.

B) are securities collateralized by a pool of mortgages.

C) are securities collateralized by both insured and

uninsured mortgages.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D

38) The most common type of mortgage-backed security is

A) the mortgage pass-through, a security that has the borrower’s mortgage payments pass through the trust ee before being disbursed to the investors.

B) collateralized mortgage obligations, a security which reduces prepayment risk.

C) the participation certificate, a security which passes the borrower’s mortgage payments equally among all the owners of the certificates.

D) the securitized mortgage, a security which increases the liquidity of otherwise illiquid mortgages. Answer: A149

11.2 True/False

1) Down payments are designed to reduce the likelihood of default on mortgage loans.

Answer: TRUE

2) Discount points (or simply points) are interest payments made at the beginning of a loan. Answer: TRUE

3) Private mortgage insurance is a policy that guarantees to make up any discrepancy between the value of the property and the loan amount, should a default occur.

Answer: TRUE

4) During the early years of the loan, the lender applies most of the payment to the principal on the loan. Answer: FALSE

5) One important advantage to a borrower who qualifies for an FHA or V A loan is the very low interest rate on the mortgage.

Answer: FALSE

6) Adjustable-rate mortgages generally have lower initial interest rates than do fixed-rate mortgages. Answer: TRUE

7) Mortgage interest rates loosely track interest rates on three-month Treasury bills.

Answer: FALSE

8) An advantage of a graduated-payment mortgage is that borrowers will qualify for a larger loan than if they requested a conventional mortgage.

Answer: TRUE 9) Nearly half the funds for mortgage lending come from mortgage pools and trusts.

Answer: TRUE

10) Many institutions that make mortgage loans do not want to hold large portfolios of long-term securities, because it would subject them to unacceptably high interest-rate risk.

Answer: TRUE

11) A problem that initially hindered the marketability of mortgages in a secondary market was that they were not standardized.

Answer: TRUE 150

12) Mortgage-backed securities have declined in popularity in recent years as institutional investors have sought higher returns in other markets.

Answer: FALSE

13) Mortgage-backed securities are marketable securities collateralized by a pool of mortgages. Answer: TRUE

11.3 Essay

1) How has the modern mortgage market changed over recent years?

2) Explain the features of mortgage loans that are designed to reduce the likelihood of default.

3) What are points? What is their purpose?

4) How does an amortizing mortgage loan differ from

a balloon mortgage loan?

5) Evaluate the advantages and disadvantages, from both th e lender’s and the borrower’s perspectives, of fixed-rate and adjustable-rate mortgages.

Chapter 14 Theory of Financial Structure

14.1 Multiple Choice Questions

1) Of the following sources of external finance for American nonfinancial businesses, the least important is

A) loans from banks.

B) stocks.

C) bonds and commercial paper.

D) loans from other financial intermediaries. Answer: B

2) Of the following sources of external finance for

American nonfinancial businesses, the most important is

A) loans from banks.

B) stocks.

C) bonds and commercial paper.

D) loans from other financial intermediaries. Answer: A

3) Of the sources of external funds for nonfinancial businesses in the United States, corporate bonds and commercial paper account for approximately _____ of the total.

A) 35 percent

B) 10 percent

C) 50 percent

D) 5 percent

Answer: A

4) Of the sources of external funds for nonfinancial businesses in the United States, stocks account for approximately _____ of the total.

A) 10 percent

B) 20 percent

C) 30 percent

D) 40 percent

Answer: A188

5) With regard to external sources of financing for nonfinancial businesses in the United States, which of the following are accurate statements?

A) Marketable securities account for a larger share of external business financing in the United States than in most other countries.

B) Since 1970, less than 5 percent of newly issued corporate bonds and commercial paper have been sold directly to American households.

C) The stock market accounted for a sizeable fraction of the financing of American businesses in the 1970-1996 period.

D) All of the above.

E) Only (A) and (B) of the above.

Answer: E

6) With regard to external sources of financing for nonfinancial businesses in the United States, which of the following are accurate statements?

A) Direct finance is used in less than 5 percent of the external financing of American businesses.

B) Only large, well-established corporations have access to securities markets to finance their activities. C) Bank loans in the United States provide four times more financing of corporate activities than do stock markets.

D) All of the above.

E) Only (A) and (B) of the above.

Answer: D

7) (I) In the United States bank loans are the most important source of external funds for nonfinancial businesses. (II) In Germany and Japan, issuing stocks and bonds is the most important source of external for nonfinancial businesses.

A) (I) is true, (II) false.

B) (I) is false, (II) true.

C) Both are true.

D) Both are false.

Answer: A

8) Which of the following is not one of the eight basic facts about financial structure?

A) Debt contracts are typically extremely complicated legal documents that place substantial restrictions on the behavior of the borrower.

B) Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets.

C) Collateral is a prevalent feature of debt contracts for both households and business.

D) New security issues are the most important source of external funds to finance businesses.

Answer: D 189

9) Which of the following is not one of the eight basic facts about financial structure?

A) The financial system is among the most heavily regulated sectors of the economy.

B) Issuing marketable securities is the primary way businesses finance their operations.

C) Indirect finance, which involves the activities of financial intermediaries, is many times more important than direct finance, in which businesses raise funds directly from lenders in financial markets.

D) Banks are the most important source of external funds to finance businesses.

Answer: B

10) Because information is scarce,

A) equity contracts are used much more frequently to raise capital than are debt contracts.

B) monitoring managers gives rise to costly state verification.

C) government regulations, such as standard accounting principles, can help reduce moral hazard.

D) all of the above are true.

E) only (B) and (C) of the above are true.

Answer: E

11) Which of the following best explains the recent decline in the role of financial intermediaries?

A) Private production and sale of information

B) Government regulation to increase information

C) Improvements in information technology

D) None of the above can explain the recent decline Answer: C

12) If bad credit risks are the ones who most actively seek loans and, therefore, receive them from financial intermediaries, then financial intermediaries face the problem of

A) moral hazard.

B) adverse selection.

C) free-riding.

D) costly state verification.

Answer: B

13) If borrowers take on big risks after obtaining a loan, then lenders face the problem

of

A) moral hazard.

B) free-riding.

C) adverse selection.

D) costly state verification.

Answer: A190

14) Because of the lemons problem in the used car market, the average quality of the used cars offered for sale will be ______, which gives rise to the problem of ______.

A) low; moral hazard

B) low; adverse selection

C) high; moral hazard

D) high; adverse selection

Answer: B

15) In the used car market, asymmetric information leads to the lemons problem because the price that buyers are willing to pay will

A) reflect the highest quality of used cars in the market.

B) reflect the lowest quality of used cars in the market.

C) reflect the average quality of used cars in the market.

D) none of the above.

Answer: C

16) The problem created by asymmetric information before the transaction occurs is called _____, while the problem created after the transaction occurs is called _____

A) adverse selection; moral hazard.

B) moral hazard; adverse selection.

C) costly state verification; free-riding.

D) free-riding; costly state verification.

Answer: A

17) A borrower who takes out a loan usually has better information about the potential returns and risk of the investment projects he plans to undertake than does the lender. This inequality of information is called

A) moral hazard.

B) asymmetric information.

C) noncollateralized risk.

D) adverse selection.

Answer: B

18) Adverse selection is a problem associated with equity and debt contracts arising from

A) the lender’s relative lack of information about the borrower’s potential returns and risks of his investment activities.

B) the lender’s inability to legally require sufficient collateral to cover a 100 percent loss if the borrower defaults.

C) the borrower’s lack of incentive to seek a loan for highly risky investments.

D) none of the above.

Answer: A191

19) Moral hazard is a problem associated with debt and equity contracts arising from

A) the borrower’s incentive to take highly risky investments.

B) the owners’ inability to ensure that managers will act in the owners’ interest.

C) the difficulty lenders have in sorting out good credit risks from bad credit risks.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E

20) Because of the adverse selection problem,

A) lenders may make a disproportionate amount of loans to bad credit risks.

B) lenders may refuse loans to individuals with low net worth.

C) lenders are reluctant to make loans that are not secured by collateral.

D) all of the above.

Answer: D

21) Because of the adverse selection problem,

A) good credit risks are more likely to seek loans, causing lenders to make a disproportionate amount of loans to good credit risks.

B) lenders may refuse loans to individuals with high net worth, because of their greater proclivity to “skip town.”

C) lenders are reluctant to make loans that are not secured by collateral.

D) all of the above.

Answer: C

22) The problem of adverse selection helps to explain

A) why banks prefer to make loans secured by collateral.

B) why banks have a comparative advantage in raising funds for American businesses.

C) why borrowers are willing to offer collateral to secure their promises to repay loans.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D

23) The problem of adverse selection helps to explain

A) which firms are more likely to obtain funds from banks and other financial intermediaries, rather than from securities markets.

B) why collateral is an important feature of consumer, but not business, debt contracts.

C) why direct finance is more important than indirect finance as a source of business finance.

D) only (A) and (B) of the above.

Answer: A192

24) The concept of adverse selection helps to explain

A) why collateral is not a common feature of many debt contracts.

B) why large, well-established corporations find it so difficult to borrow funds in securities markets.

C) why financial markets are among the most heavily regulated sectors of the economy.

D) all of the above.

Answer: C

25) That most used cars are sold by intermediaries

(i.e., used car dealers) provides evidence that these intermediaries

A) have been afforded special government treatment, since used car dealers do not provide information that is valued by consumers of used cars.

B) are able to prevent potential competitors from free-riding off the information that they provide.

C) have failed to solve adverse selection problems in this market because “lemons” continue to be traded.

D) do all of the above.

Answer: B

26) That most used cars are sold by intermediaries

(i.e., used car dealers) provides evidence that these intermediaries

A) provide information that is valued by consumers of used cars.

B) are able to prevent others from free-riding off the information that they provide.

C) can profit by becoming experts in determining whether an automobile is a good car or a lemon.

D) do all of the above.

Answer: D

27) A key finding of the economic analysis of financial structure is that

A) the existence of the free-rider problem for traded securities helps to explain why banks play a predominant role in financing the activities of businesses.

B) while free-rider problems limit the extent to which securities markets finance some business activities, nevertheless the majority of funds going to businesses are channeled through securities markets.

C) given the great extent to which securities markets are regulated, free-rider problems are not of significant economic consequence in these markets.

D) economists do not have a very good explanation for why securities markets are so heavily regulated. Answer: A193

28) In the United States, the government agency requiring that firms, which sell securities in public markets, adhere to standard accounting principles and disclose information about their sales, assets, and

earnings is the

A) Federal Communications Commission.

B) Federal Trade Commission.

C) Securities and Exchange Commission.

D) U.S. Treasury Department.

E) Federal Reserve System.

Answer: C

29) The authors’ analysis of adverse selection indicates that financial intermediaries in general, and banks in particular because they hold a large fraction of non-traded loans,

A) have advantages in overcoming the free-rider problem, helping to explain why indirect finance is a more important source of business finance than is direct finance.

B) play a greater role in moving funds to corporations than do securities markets as a result of their ability to overcome the free-rider problem.

C) provide better-known and larger corporations a higher percentage of their external funds than they do to newer and smaller corporations, which rely to a greater extent on the new issues market for funds.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E

30) The authors’ analysis of adverse selection indicates that financial intermediaries

A) overcome free-rider problems by holding non-traded loans.

B) must buy securities from corporations to diversify the risk that results from holding non-tradable loans. C) have not been very successful in dealing with adverse selection problems in financial markets.

D) do all of the above.

E) do only (A) and (B) of the above.

Answer: A

31) Financial intermediaries and, particularly, banks have the ability to avoid the free-rider problem as long as they primarily

A) make private loans.

B) acquire a diversified portfolio of stocks.

C) buy junk bonds.

D) do a balanced combination of (A) and (B) of the above.

Answer: A194

32) Property that is pledged to the lender in the event that a borrower cannot make his or her debt payment is called

A) collateral.

B) points.

C) interest.

D) good faith money.

Answer: A

33) Collateral is

A) property that is pledged to the lender if a borrower cannot make his or her debt payments.

B) a prevalent feature of debt contracts for households.

C) a prevalent feature of debt contracts for business.

D) all of the above.

E) only (A) and (C) of the above.

Answer: D

34) The majority of household debt in the United States consists of

A) credit card debt.

B) consumer installment debt.

C) collateralized loans.

D) unsecured loans, such as student loans. Answer: C

35) Commercial and farm mortgages, in which property is pledged as collateral, account for

A) one-quarter of borrowing by nonfinancial businesses.

B) one-half of borrowing by nonfinancial businesses.

C) one-twentieth of borrowing by nonfinancial businesses.

D) two-thirds of borrowing by nonfinancial businesses.

Answer: A

36) Because of the moral hazard problem,

A) lenders will write debt contracts that restrict certain activities of borrowers.

B) lenders will more readily lend to borrowers with high net worth.

C) debt contracts are used less frequently to raise capital than are equity contracts.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E 195

37) Moral hazard in equity contracts is known as the _____ problem because the manager of the firm has fewer incentives to maximize profits than the

stockholders might ideally prefer.

A) principal-agent

B) adverse selection

C) free-rider

D) debt deflation

Answer: A

38) Because managers (_____) have less incentive to maximize profits than the stockholders-owners (_____) do, stockholders find it costly to monitor managers; thus, stockholders are reluctant to purchase equities.

A) principals; agents

B) principals; principals

C) agents; agents

D) agents; principals

Answer: D

39) The principal-agent problem

A) occurs when managers have more incentive to maximize profits than the stockholders-owners do.

B) would not arise if the owners of the firm had complete information about the activities of the managers.

C) in financial markets helps to explain why equity is a relatively important source of finance for American business.

D) all of the above.

E) only (A) and (B) of the above.

Answer: B

40) Solutions to the moral hazard problem include

A) high net worth.

B) monitoring and enforcement of restrictive covenants.

C) greater reliance on equity contracts and less on debt contracts.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E

41) One financial intermediary in our financ ial structure that helps to reduce the moral hazard from arising from the principal-agent problem is the

A) venture capital firm.

B) money market mutual fund.

C) pawn broker.

D) savings and loan association.

Answer: A196

42) A venture capital firm protects its equity investment from moral hazard through which of the following means?

A) It places people on the board of directors to better monitor the borrowing firm’s activities.

B) It writes contracts that prohibit the sale of an equity investment to anyone but the venture capital firm.

C) It prohibits the borrowing firm from replacing its management.

D) It does both (A) and (B) of the above.

E) It does both (A) and (C) of the above.

Answer: D

43) Debt contracts

A) are agreements by the borrowers to pay the lenders fixed dollar amounts at periodic intervals.

B) have an advantage over equity contracts in that they have a lower cost of state verification.

C) are used much more frequently to raise capital than are equity contracts.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D

44) Equity contracts account for a small fraction of external funds raised by American businesses because A) costly state verification makes the equity contract less desirable than the debt contract.

B) of the greater scope for moral hazard problems under equity contracts, as compared to debt contracts. C) equity contracts do not permit borrowing firms to raise additional funds by issuing debt.

D) of all of the above.

E) of both (A) and (B) of the above.

Answer: E

45) A debt contract is said to be incentive compatible if

A) the borrower’s net worth reduces the probability of moral hazard.

B) restrictive covenants limit the type of activities that can be undertaken by the borrower.

C) both (A) and (B) of the above occur.

D) neither (A) nor (B) of the above occur.

Answer: A197

46) A debt contract is more likely to be incentive compatible if

A) the company must follow standard accounting principles.

B) the funds are provided by a venture capital firm.

C) owners of the firm have more of their own money in the business.

D) all of the above.

E) only (B) and (C).

Answer: C

47) A clause in a mortgage loan contract requiring the borrower to purchase homeowner’s insurance is an example of

A) a restrictive covenant.

B) a collusive agreement between mortgage lenders and insurance companies.

C) both (A) and (B) of the above.

D) neither (A) and (B) of the above.

Answer: A

48) A debt contract that specifies that the company can only use the funds to finance certain activities

A) is a private loan.

B) contains a restrictive covenant.

C) increases the problem of adverse selection.

D) all of the above.

E) only (A) and (B).

Answer: B

49) Which of the following are accurate statements concerning the role that restrictive covenants play in reducing moral hazard in financial markets?

A) Covenants reduce moral hazard by restricting borrowers’ undesirable behavior.

B) Covenants require that borrowers keep collateral in good condition.

C) Covenants require periodic accounting statements and income reports.

D) All of the above.

E) Only (A) and (B) of the above.

Answer: D

50) Although restrictive covenants can potentially reduce moral hazard, a problem with restrictive covenants is that

A) borrowers may find loopholes that make the covenants ineffective.

B) they are costly to monitor and enforce.

C) too many resources may be devoted to monitoring and enforcing them, as debtholders duplicate others’ monitoring and enforcement efforts.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E 198 51) Governments in developing countries sometimes adopt policies that retard the efficient operation of their financial systems. These actions include policies that A) prevent lenders from foreclosing on borrowers with political clout.

B) nationalize banks and direct credit to politically-favored borrowers.

C) make it costly to collect payments and collateral from defaulting debtors.

D) do all of the above.

E) do only (A) and (B) of the above.

Answer: D

52) Financial crises

A) are major disruptions in financial markets that are characterized by sharp declines in asset prices and the failures of many financial and nonfinancial firms.

B) occur when adverse selection and moral hazard problems in financial markets become more significant.

C) frequently lead to sharp contractions in economic activity.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D

53) Financial crises

A) cause failures of financial intermediaries and leave only securities markets to channel funds from savers to borrowers.

B) are a recent phenomenon that occurs only in developing countries.

C) invariably lead to debt deflation.

D) all of the above.

E) none of the above.

Answer: E

54) Factors that lead to worsening conditions in financial markets include

A) increases in interest rates.

B) declining stock prices.

C) increasing uncertainty in financial markets.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D

55) Factors that lead to worsening conditions in financial markets include

A) declining interest rates.

B) unanticipated increases in the price level.

C) bank panics.

D) only (A) and (C) of the above.

E) only (B) and (C) of the above.

Answer: C 199

56) If the anatomy of a financial crisis is thought of as

a sequence of events, which of the following events would be least likely to be the initiating cause of the financial crisis?

A) Increase in interest rates

B) Bank panic

C) Stock market decline

D) Increase in uncertainty

Answer: B

57) An examination of past financial crises in the United States indicates that a bank panic has typically been

A) the one key factor that initiates a financial crisis.

B) a consequence of worsening conditions during a financial crisis.

C) the result of declining interest rates that raised adverse selection problems.

D) an event that is unrelated to episodes that have come to be recognized as financial panics.

Answer: B

58) Most financial crises in the United States have begun with

A) a steep stock market decline.

B) an increase in uncertainty resulting from the failure of a major firm.

C) a steep decline in interest rates.

D) all of the above.

E) only (A) and (B) of the above.

Answer: E

59) Most financial crises in the United States have begun with

A) a sharp rise in interest rates.

B) a steep stock market decline.

C) an increase in uncertainty resulting from the failure of a major firm.

D) all of the above.

E) only (A) and (B) of the above.

Answer: D

60) In addition to having a direct effect on increasing adverse selection problems, increases in interest rates also promote financial crises by _____ firms’ and households’ interest payments, thereby _____ their cash flow. A) increasing; increasing

B) increasing; decreasing

C) decreasing; increasing

D) decreasing; decreasing

Answer: B 200

61) Deterioration in a firm’s balance sheet and a decline in net worth, which increases adverse selection and moral hazard problems, can be caused by

A) a sharp drop in the price level.

B) a sharp increase in uncertainty.

C) a sharp depreciation of the domestic currency.

D) all of the above.

E) only (A) and (C).

Answer: E

62) Adverse selection and moral hazard problems increased in magnitude during the early years of the Great Depression as

A) stock prices declined to 10 percent of their level in 1929.

B) banks failed.

C) the aggregate price level declined.

D) a result of all of the above.

E) a result of (A) and (B) of the above.

Answer: D

63) Adverse selection and moral hazard problems increased in magnitude during the early years of the Great Depression as

A) stock prices declined to 10 percent of their level in 1929.

B) banks failed.

C) the aggregate price level rose.

D) a result of all of the above.

E) a result of (A) and (B) of the above.

Answer: E

64) Financial crises in the United States and Mexico

A) were similar in being precipitated by an increase in interest rates abroad.

B) were different because in Mexico speculative attacks in the foreign exchange market played a key role.

C) were similar in being preceded by stock market declines.

D) all of the above.

E) only (A) and (C).

Answer: D

65) Stock market declines preceded a full blown

financial crisis

A) in the United States in 1987.

B) in Thailand in 1997.

C) in Indonesia in 1997.

D) all of the above.

E) only (B) and (C).

Answer: B 201

66) Which of the following factors led up to the Mexican financial crisis of 1994?

A) Speculative attacks on the peso and a rise in actual and expected inflation.

B) A rise in domestic interest rates and a deterioration of in bank balance sheets.

C) A rise in foreign interest rates and domestic stock market declines.

D) all of the above.

E) only (B) and (C).

Answer: E

67) Institutional features of debt markets in Asia that propelled several countries into financial crisis include

A) debt contracts with long duration.

B) firms with debt denominated in U. S. dollars.

C) governments that could not intervene to protect depositors.

D) all of the above.

E) only (A) and (C).

Answer: B

14.2 True/False

1) American businesses get more funds from direct financing than from indirect financing.

Answer: FALSE

2) American businesses use stock to finance about 10 percent of their external financing.

Answer: TRUE

3) One reason why indirect financing is used is to minimize adverse selection problems.

Answer: TRUE

4) Issuing marketable securities is the primary way businesses finance their operations.

Answer: FALSE

5) Because of the adverse selection problem, lenders may refuse loans to individuals with low net worth. Answer: TRUE

6) The concept of adverse selection helps to explain why indirect finance is more important than direct finance as a source of business finance. Answer: TRUE

7) The problem of adverse selection helps to explain why direct finance is more important than indirect finance as a source of business finance.

Answer: FALSE 202

8) The concept of adverse selection helps explain why collateral is an important feature of many debt contracts.

Answer: TRUE

9) One way of describing the solution that high net worth provides to the moral hazard problem is to say that it makes debt contracts incentive compatible. Answer: TRUE

10) Factors that lead to worsening conditions in financial markets include increasing interest rates and unanticipated increases in the price level.

Answer: FALSE

11) The principal-agent problem is an example of the adverse selection problem that can result from asymmetric information.

Answer: FALSE

14.3 Essay

1) Explain how the “lemons” problem could cause financial markets to fail.

2) Distinguish between adverse selection and moral hazard.

3) What facts about financial structure can be explained by adverse selection?

4) What facts about financial structure can be explained by moral hazard?

5) What factors usually cause an increase in moral hazard and adverse selection?

6) What is the principal-agent problem?

7) Describe the sequence of events in a financial crisis and explain why they can cause economic activity to decline?

Chapter 15 The Banking Firm and Bank Management

15.1 Multiple Choice Questions

1) Which of the following statements are true?

A) A bank’s assets are its sources of funds.

B) A bank’s liabilities are its uses of funds.

C) A bank’s balan ce sheet shows that total assets equal total liabilities plus equity capital.

D) Each of the above.

Answer: C

2) Which of the following statements is true?

A) A bank’s assets are its uses of funds.

B) A bank’s assets are its sources of funds.

C) A bank’s liabilities are its uses of funds.

D) Only (B) and (C) of the above are true. Answer: A

3) Which of the following statements is false?

A) A bank’s assets are its uses of funds.

B) A bank issues liabilities to acquire funds.

C) The bank’s assets provide the bank with income.

D) Bank capital is an asset in the bank balance sheet. Answer: D

4) A bank’s balance sheet

A) shows that total assets equal total liabilities plus equity capital.

B) lists sources and uses of bank funds.

C) indicates whether or not the bank is profitable.

D) does all of the above.

E) does only (A) and (B) of the above.

Answer: E

5) Which of the following are reported as liabilities on

a bank’s balance sheet?

A) Reserves

B) Checkable deposits

C) Loans

D) Deposits with other banks

Answer: B 204

6) Which of the following are reported as liabilities on

a bank’s balance sheet?

A) Discount loans

B) Cash items in the process of collection

C) State government securities

D) All of the above

E) Only (A) and (B) of the above

Answer: A

7) The share of checkable deposits in total bank liabilities has

A) expanded moderately over time.

B) expanded dramatically over time.

C) shrunk over time.

D) remained virtually unchanged since 1960. Answer: C

8) Checkable deposits and money market deposit accounts are A) payable on demand.

B) liabilities of the banks.

C) assets of the banks.

D) only (A) and (B) of the above.

E) only (A) and (C) of the above.

Answer: D

9) Which of the following statements is false?

A) Checkable deposits are usually the lowest cost source of bank funds.

B) Checkable deposits are the primary source of bank funds.

C) Checkable deposits are payable on demand.

D) Checkable deposits include NOW accounts. Answer: B

10) In recent years, the interest paid on checkable and time deposits has accounted for around _____ of total bank operating expenses, while the costs involved in servicing accounts have been approximately _____ of operating expenses.

A) 35 percent; 55 percent

B) 55 percent; 35 percent

C) 45 percent; 50 percent

D) 30 percent; 45 percent

Answer: C

11) Because checking accounts are _____ liquid for the depositor than passbook savings, they earn _____ interest rates.

A) less; higher

B) less; lower

C) more; higher

D) more; lower

Answer: D 205

12) Because passbook savings are _____ liquid for the depositor than checking accounts, they earn _____ interest rates.

A) less; higher

B) less; lower

C) more; higher

D) more; lower

Answer: A

13) Which of the following are transaction deposits?

A) Savings accounts

B) Small-denomination time deposits

C) Money market deposit accounts

D) Certificates of deposit

Answer: C

14) Which of the following are nontransaction deposits?

A) Savings accounts

B) Small-denomination time deposits

C) Negotiable order of withdraw accounts

D) All of the above

E) Only (A) and (B) of the above

Answer: E

15) Which of the following are not nontransaction deposits?

A) Savings accounts

B) Small-denomination time deposits

C) Negotiable order of withdraw accounts

D) Certificates of deposit

Answer: C

16) Large-denomination CDs are _____, so that like a bond they can be resold in a _____ market before they mature.

A) nonnegotiable; secondary

B) nonnegotiable; primary

C) negotiable; secondary

D) negotiable; primary

Answer: C

17) Bank loans from the Federal Reserve are called _____ and represent a _____ of funds.

A) discount loans; use

B) discount loans; source

C) fed funds; use

D) fed funds; source

Answer: B 206

18) Which of the following would substitute for discount loans?

A) Loans to businesses

B) Repurchase agreements

C) Investing in Eurodollars

D) Loans to bank holding companies

E) Reverse repurchase agreements

Answer: B

19) Loan loss reserves are listed on the _____ side of the bank’s balance sheet, indicating that they represent a _____ of funds.

A) liability; use

B) liability; source

C) asset; use

D) asset; source

Answer: B 20) When a bank decides that a $1 million loan will not be paid back and formally writes it off,

A) the loan loss reserve account will drop by $1 million.

B) the loan loss reserve account will rise by $1 million.

C) the bank’s assets are lowered by $1 million.

D) both (A) and (C) of the above occur.

E) both (B) and (C) of the above occur.

Answer: D

21) Which of the following are reported as assets on a bank’s balance sheet?

A) Discount loans from the Fed

B) Loans

C) Borrowings

D) Only (A) and (B) of the above

Answer: B

22) Which of the following are reported as assets on a bank’s balance sheet?

A) Cash items in the process of collection

B) Deposits with other banks

C) Checkable deposits

D) Bank capital

E) Only (A) and (B) of the above

Answer: E

23) Which of the following are reported as assets on a bank’s balance sheet?

A) Borrowings

B) Reserves

C) Savings deposits

D) Bank capital

E) Only (A) and (B) of the above

Answer: B 207

24) Which of the following are not reported as assets on a bank’s balance sheet?

A) Cash items in the process of collection

B) Deposits with other banks

C) U.S. Treasury securities

D) Checkable deposits

Answer: D

25) Which of the following are not reported as assets on a bank’s balance sheet?

A) Cash items in the process of collection

B) Borrowings

C) U.S. Treasury securities

D) Reserves

互联网金融复习题

《网络金融与电子支付》考试题型 一、单选 10*2分=20分 二、多选 5*2分 =10分 三、判断 10*1分=10分 四、简答 5*6分 =30分 五、分析题 2*15分=30分 1.网络决策是指一个决策者对()的决策,它被称为超边际决策,不同于 决定买卖量的边际决策。 A A. 与他人是否建立关系; B.计算机网络; C. 电脑; D.数字通信 2. EDI软件具有将用户数据库系统中的信息译成()的标准格式以供传输 交换的能力。 A A. EDI; B.文本文件; C.图形; D.脉冲电流 3.电子钱包(E-wallet)是一个可以由持卡人用来进行安全电子交易和储存 交易记录的(),就象生活中随身携带的钱包一样。B A.卡片; B. 软件; C.记事本; D.数据库 4.网上保险是电子商务环境中保险业()的产物。B A.衍生 B. 创新 C.改革 D.竞争 5.保险电子商务的最终目标是实现(),即通过网络实现投保、核保、理 赔、给付。A A. 电子交易; B. 实现投保; C. 实现理赔; D. 实现支付 6.电子钱包是一种便利、安全、多功能的支付工具,是电子货币的一种主 要()形式。B A.支付; B. 实现; C.管理; D.分配 7.网上银行的其他风险有:()D A.流动性风险; B.利率风险; C.市场风险。 D.以上全是 8. 网上银行还面临()等其他方面的法律风险.D A.洗钱; B.客户隐私权; C.网络交易; D.以上全是。 9. “表示客户提交的订单采用的是在线支付、邮局汇款、银行电汇、预付款支付等结算方式,货款已到,订单处理员已将其视为有效订单,进入配货流程”,

金融学试题库有答案版

第一章货币与货币制度 二、单项选择题 (每题1分,共15题) 1.货币的产生是_C_。 A由金银的天然属性决定的 B 国家发明创造的 C商品交换过程中商品内在矛盾发展的产物 D人们相互协商的结果 2.货币在_D_时执行价值尺度职能。 A 商品买卖 B 缴纳租金 C 支付工资 D 给商品标价时 3.货币在_D_时执行价值贮藏职能。 A 支付水电费 B 购买商品 C 表现和衡量商品价值 D 准备用于明年的购买 4.货币执行支付手段职能的特点是_D_。 A 货币是商品交换的媒介 B 货币运动伴随商品运动 C 货币是一般等价物 D 货币作为价值的独立形式进行单方面转移 5.在金属货币流通条件下,货币在执行贮藏手段职能时,能自发的调节_B_。 A 货币流通 B 货币必要量 C 生产规模 D 投资规模 6.中国工商银行发行的电子货币是__。 A 牡丹卡 B VISA卡 C 长城卡 D 金穗卡 7.货币单位规定有含金量,但国内流通银行券,无铸币流通,无金块可供兑换,银行券可兑换外币汇票是(C )。 A 金块本位制 B 金铸币本位制 C 金汇兑本位制 D 银行券制 8.目前世界各国实行的是_D_。 A 银本位制 B 金本位制 C 金、银复本位制 D 不兑现信用货币制度 9.金银复本位制中,金银两种货币比价均各按其市场价值决定的货币制度是__。 A平行本位制 B双本位制 C跛行本位制 D单本位制 10.金币本位制的特点是_B_。 A货币单位规定有含金量,但不铸造、不流通金币 B金币可以自由铸造和熔化 C 纸币仍是金单位 D金银铸币同时流通 11.劣币驱逐良币规律中所谓的劣币是指_B_。 A名义价值高于实际价值的货币 B名义价值低于实际价值的货币 C没有名义价值的货币 D没有实际价值的货币 12.与本位币相比,辅币具有如下特点_A_。 A为有限法偿货币 B为不足值货币 C国家垄断铸造 D币材多为贱金属 13.我国货币制度规定,人民币具有以下特点_B_。 A人民币与黄金有直接联系B人民币是可兑现的银行券 C人民币与黄金没有直接联系D人民币不与任何外币确定正式联系 14.弗里德曼将货币定义为B A 流动性 B M2 C 商业银行储蓄 D购买力的暂息所 15.__指出货币和资本作为每一个新开办的企业的第一推动力和持续的动力。 A.凯恩斯B.马克思 C.弗里德曼 D.卢卡斯 三、判断题 (共10题,每题1分) 1.凯恩斯是个典型名目主义者,他认为货币是用于债务支付和商品交换的一种符号。对 2.商品交换必须具备两个前提条件:分工与货币。错 3.市场是交换关系的总和,货币是交换的媒介和桥梁。对 4.马克思的货币本质观认为,货币是固定地充当一般等价物的特殊商品。对 5.金融资产的流动性也称作“货币性”,它反映了金融资产的盈利能力。错

银行金融基础知识考试题库完整

银行金融基础知识考试题库 1.【4952】下列商业银行的管理理论主动进取特点最明显的是()。 A.资产管理 B.负债管理 C.资产负债综合管理 D.资产负债比例管理 【答案】: B 2.【4954】某固定利率债券为到期一次还本付息,余期一年,以102元的价格买入并持有到期,到期收益率为10%;若其它条件均相同,但余期为2年,买入并持有到期,则到期收益率( )。 A. >10% B. <10% C. =10% D.不能确定 【答案】: A 3.【4967】银行提供的储蓄服务的基本形式是()。 A.柜台服务 B.银行卡服务

C.网上银行服务 D.电话银行服务 【答案】: A 4.【4975】我国代表国家制定和执行货币政策的是()。 A.政策性银行 B.财政部 C.银监会 D.中国人民银行 【答案】: D 5.【4976】承担我国农业政策性贷款任务的政策性银行是()。A.中国农业发展银行 B.中国农业银行 C.中国工商银行 D.中国国家开发银行 【答案】: A

6.【4978】在我国目前工资制度下,在工资的发放中货币发挥着()的职能。 A.价值尺度 B.流通手段 C.支付手段 D.贮藏手段 【答案】: C 7.【4980】目前国内最大的寿险公司是()。 A.中国人寿 B.中国平安 C.新华人寿 D.泰康人寿 【答案】: A 8.【4987】最基本的个人金融业务是()。 A.储蓄业务 B.贷款业务 C.保险业务 D.信用卡业务

【答案】: A 9.【4988】保险人和投保人之间订立的正式保险合同的正式书面文件称为()。 A.保险单 B.保险凭证 C.投保单 D.批单 【答案】: A 10.【4989】通常人们到银行办业务时会说"存定期",这个"存定期"一般指()。 A.整存整取 B.零存整取 C.存本取息 D.定活两便存款 【答案】: A 11.【4990】财务公司属于()。 A.银行金融机构 B.非银行金融机构 C.证券公司

《互联网金融》P模拟试题及答案

单选 1、P2P模式主要是指由平台开发借款人,通过审核、协定借款利率和借款金额后,将借款信息发布在平台上,然后由投资人投标完成借款,平台收取服务费。其中P2P的含义是() A、Peer to Peer B、Person to Person C、People to People D、Pool to Poo 2、网贷平台的特点不包括?() A、交易的目的是牟利 B、出借人不需要进行信用甄别 C、资金可以实现风险分散 D、投资门槛低 3、在国外,属于单纯平台中介模式的P2P平台上()。 A、prosper B、zopa C、lending club D、kabbage 4、( )平台的特点在于划分信用等级、强制按月还款、雇用代理机构追债等。 A、England Lending B、Prosper C、ZOPA D、Lending Club 5、天猫属于电商互联网借贷中的()模式 A、B2B B、B2C C、C2C D、P2P 6、关于互联网金融的法律风险,说法错误的是() A、无法可依 B、违法成本低 C、公民守法意识强 D、金融立法的层级较低 7、京东推出的支持个人消费贷款的产品是() A、京东白条 B、京东欠条 C、京东随心贷 D、京东随意贷 8、拍拍贷对于借款在6个月以下的收取成交服务费为本金的() A、0.005 B、0.01 C、0.015 D、0.02 9、P2P网贷是指个人或法人通过()第三方网络平台相互借贷。 A、独立的 B、依靠银行的 C、依靠政府的 D、民间的 10、被联想集团收购和控股的P2P平台“翼龙贷”,主要运营模式为() A、P2P(个人对个人的借贷) B、P2B(个人对企业的借贷) C、P2N(个人对小贷公司或担贷机构的借款) D、P2S(个人对债券的投资) 11、P2P网贷的鼻祖为英国的一家P2P网贷,它的名称是() A、England Lending B、Prosper C、ZOPA D、Lending Club 12、阿里金融定位为通过互联网数据化运营模式,为阿里巴巴、淘宝网、天猫网等电子商务平台上

2017尔雅国际金融最全题库

国际金融 汪洋刘兴华杨玉凤李英江西财经大学 建议ctrl+f搜索查找!! 1开放经济下的国民收入和国际收支 1.1 前言 1 【单选题】 从国内经济核算角度看,一国经济核算不包括下列哪个方面 A、国内生产总值 B、投入产出 C、国际收支 D、货币供应量 2 【单选题】 下列说法错误的是 A、GDP是一个产出概念 B、GNI是一个收入概念 C、GNI=GDP+生产要素净收入 D、GNDI=GDP+净经常转移 3 【单选题】 下列属于中国非居民的是 A、在美国留学三年的留学生 B、亚洲投资银行 C、中国驻美国大使馆的中国大使 D、中国境内的外资企业 4【判断题】 在本国国内居住满一年以及一年以上的个人就是本国居民。(错)5【判断题】 住户的居民属性取决于其住所所在地,而不是工作所在地。(对)1.2 封闭经济下的国民收入恒等式(上) 1 【单选题】 下列活动不应计入GDP的是 A、企业自己制造的生产用机器设备 B、农民生产出供自己消费的粮食

C、家庭主妇每天在家里带孩子 D、某家庭请了一个保姆每天照看孩子 2 【单选题】 固定资产与存货的差异为 A、空间上的“位置”是否固定 B、时间上是否有耐久性 C、是否可以在较长时间内反复或者连续用于生产 D、体积的大小 3 【单选题】 下列说法错误的是 A、本期生产出来的产品是否销售出去与本期GDP规模无关 B、以前年度生产出来的产品在本期销售也与本期GDP规模无关 C、野生果实、原始森林的自然生长,公海中鱼类数量的自然增长计入GDP D、加总生产过程各个环节的增加值(value added)得到 4【判断题】 房产中介小王将手中的1套二手房以100万价格卖出,因此本年GDP增加80万元。(错)5【判断题】 房产中介小王将手中的1套二手房以100万价格卖出,所获提成为1万,该笔收入应计入GDP。(对) 1.3 封闭经济下的国民经济恒等式(下) 1 【单选题】 下列说法错误的是 A、生产税包括产品税、销售税、营业税 B、生产补贴包括对企业的价格补贴和出口退税以及消费目的的补贴 C、营业盈余体现了资本所得 D、营业盈余是企业从事生产经营活动所获得的利润 2 【单选题】 在封闭经济环境下,下列等式错误的是 A、Sg=T-TR-INT-G B、PDI=GDP+TR-T C、S=GDP-C-G-I D、Sp=GDP+TR+INT-T-C 3 【单选题】 下列说法错误的是 A、政府部门的可支配收入等于政府的税收收入T减去转移支付TR B、政府的转移支付(Transfer Payment),包括各种形式的失业救济金、养老金等

互联网金融互联网保险模拟试题及答案

互联网保险 1.[单选题]在网上证券交易中,下列哪一项更接近于金融互联网() A.证券投资信息提供 B.网上客户投资咨询 C.网上客户互动 D.网上资金转账 2.[单选题]智能理财的本质是() A.以销售为中心 B.以客户为中心 C.以交易为中心 D.以客户为中心 3.[单选题]“中国保险网”属于哪一种互联网保险销售模式() A.第三方网络平台模式电子商务模式C.专业网络媒介模式D.广电通信终端销售模式 4.[单选题]互联网保险业务目前存在的问题不包括() A.法律环境不够成熟 B.对象受限 C.产品过于丰富 D.承包技术有局限 5.[单选题]互联网基金的特性不包括() A.交易门槛高 B.操作便捷 C.信息对称 D.成本低 6.[单选题]“淘宝保险”中的“淘宝专供”保险产品不包括() A.淘车保 B.淘保包 C.意外险 D.货到付款拒签险 7.[单选题]招商银行的“小企业e家”属于() A.资金清算服务 B.账户管理服务 C.智能理财服务 D.贷款服务 8.[单选题]以下哪些证券公司可以网上开户( ) A.广发证券 B.国信证券 C.浙商证券 D.以上都是 9.[单选题]以下哪个银行开通了智能理财服务?() A.中国工商银行 B.中国建设银行 C.浦发银行 D.以上都是 10.[单选题]余额宝在工作日15:00后转入的资金将会延至工作日() +0 +1 +2 +3 11.[单选题]“微众银行”由哪家公司主要筹建?() A.阿里巴巴 B.百度 C.腾讯 D.中国平安 12.[单选题]互联网保险销售特点不包括() A.上架成本低 B.与用户直接交流,方便推广业务 C.数据管理可以更深入 D.透明度高 13.[单选题]如何描述我国互联网证券的发展现状() A.与互联网公司合作最好的办法 B.证券业务均可在网上实现 C.业务模式比较单一 D.业务模式遍地开花 14.[单选题]“网商银行”由哪家公司主要筹建?() A.阿里巴巴 B.百度 C.腾讯 D.中国平安 15.[单选题]>2013年6月5日,支付宝联合()宣布推出名为“余额宝”的余额增值服务,截至2014年1月15日,客户数已经超过4900万,规模超过2500亿元。 A.网商银行 B.天鸿基金 C.招商银行 D.天弘基金 16.[单选题]余额宝背后的基金公司是?( ) A.华夏基金 B.天弘基金 C.易方达基金 D.南方基金 17.[单选题]互联网基金涉及的直接主体不包括( ) A.互联网平台公司 B.基金公司 C.监管部门 D.互联网客户 18.[单选题]( )年,中国保险信息网为新华人寿公司促成的国内第一份网络保单。 19.[单选题]中国第一家互联网保险公司是( ) A.太平洋保险 B 众安保险 C.淘宝保险 D.掌上人保

金融知识题库及答案

1. 我国人民币地主币是: A 元 B 角 C 分 D 厘 (答案:A ) 2. 按复利计算,年利率为5%地100元贷款,经过两年后产生地利息是: A 5元 B 10元 C 10.25元 D 20元 (答案:C ) 3. 以下关于汇率地说法中错误地是: A 汇率是两种货币之间地相对价格 B 汇率地直接标价法可以表示为1单位外币等于多少本币 C 我国地汇率报价一般采用直接标价法 D 我国地汇率报价一般采用间接标价法 (答案:D ) 4. 香港联系汇率制度是将香港本地货币与哪种货币挂钩? A 英镑 B 日元 C 美元 D 欧元 (答案:C ) 5.我国地三家政策性银行是: A 中国人民银行国家开发银行中国农业发展银行 B 中国进出口银行国家开发银行中国农业发展银行 C 国家开发银行中国农业银行中国进出口银行 D 中国农业发展银行国家开发银行中国邮政储蓄银行 (答案:B ) 6. 下列哪一项不属于商业银行地“三性”原则? A 安全性 B流动性 C 盈利性 D政策性 (答案:D ) 7. 以下不属于金融衍生品地是: A 股票 B 远期 C 期货 D 期权 (答案:A ) 8. 下列哪家机构不属于我国成立地金融资产管理公司? A 东方 B信达 C华融 D光大 (答案:D ) 9. 我国于2003年初组建地银行业监管机构是: A 中国人民银行 B 中国银监会 C 中国证监会 D 中国保监会 (答案:B ) 10. 在国际银行监管史上有重要意义地1988年《巴塞尔协议》规定,银行地总资本充足率不能低于:A 4% B 6% C 8% D 10% (答案:C ) 11. 目前世界上最大地证券交易所是: A 纽约股票交易所 B 伦敦股票交易所 C 东京股票交易所 D香港股票交易所 (答案:A ) 12. 股票市场上常常会被提到地“IPO”地意思是: A 首次公开发行,即公司第一次公募股票 B 公司第一次私募股票 C 已有股票地公司再次公募股票 D 已有股票地公司再次私募股票 (答案:A ) 13. H股是指: A 在我国国内发行、供国内投资者用人民币购买地普通股票 B 在我国国内发行、以外币买卖地特种普通股票

金融知识竞赛试题题库完整

金融知识竞赛(选择题) 四选一: 1.高校助学贷款到期还款日为(B )。 A、贷款期限最后1年的1月1日 B、贷款期限最后1年的8月31日 C、以还款确认书上每笔贷款具体时间为准 D、贷款期限最后1年的12月31日 2.我国对存贷款利率的结息规则中规定,城乡居民活期存款的结息日为(C )。 A、每月20日 B、每月末 C、每季末月20日 D、每季末 3.长期贷款展期期限累计不得超过(C )。 A、1年 B、2年 C、3年 D、4年 4.根据《国务院关于农村金融体制改革的决定》规定,我国农村信用社与农业银行脱钩是哪一年?(C ) A、1994年 B、1995年 C、1996年 D、1997年 5.按照有关部门规定,国家助学贷款的最高金额是每人每学年:( C ) A 4000 元 B 5000 元 C6000 元 D7000 元 6.国家助学贷款每年固定的结息日是哪一天?( B ) A.12月10日 B.12月20日 C.11月10日 D.11月20日 7.开发银行助学贷款系统学生在线系统不具有以下哪项功能( C)。 A、提前还款申请 B、给县学生资助管理中心发送消息 C、贷款网上申请 D、修改个人信息 8.办理生源地信用助学贷款时生成的支付宝账户密码忘记怎么办?(C ) A、登陆支付宝使用密码找回功能找回或咨询支付宝

B、询问县资助中心 C、询问国家开发银行 D、询问高校资助中心 9.个人作为信用报告主体的基本权利是( D)。 A、向个人信用信息基础数据库提供信用信息 B、查询自己的信用报告 C、查询配偶的信用报告 D、向银行提供自己的信用报告 10.采集国家助学贷款是商业银行等金融机构按照国家政策,向经济困难的大学生发放的个人信用贷款,自( D)起,商业银行等金融机构就将助学贷款及还款情况等相关信息报送到个人信用信息基础数据库。 A、大学生还款之日 B、贷款发放之日 C、大学生毕业进入还款期日 D、申请贷 款日 11.以下关于提前还款申请说确的是( B) A、提前还款申请分为一次性还清和部分还清 B、借款学生可在学生在线系统提交提前还款申请 C、学生需向县学生资助管理中心提交提前还款申请书 D、2010年之前发放的贷款如需提前还款,只能通过代理行模式进行,学生不能通过支付宝提前还款 12.通过什么途径可以知道自己的生源地信用助学贷款的详细情况( B) A、国家开发银行助学贷款学生在线系统 B、支付宝 C、咨询受理贷款的学生资助中心 D、A 或C 13.(B)是指个人对信用报告中的错误信息存在异议并经正常程序处理仍未得到满意解决可向法院提出起诉用法律手段维护自身的个人权益。 A、知情权 B、异议权 C、纠错权 D、司法救济权 14.采集国家助学贷款是商业银行等金融机构按照国家政策向经济困难的大学生发放的个人信用贷款自 (B) 起商业银行等金融机构就将助学贷款及还款情况等相关信息报送到个人信用信息基础数据库。 A.大学生还款之日 B.贷款发放之日 C.大学生毕业进入还款期日 D申请贷款日

金融基础知识试题与答案

《金融基础知识》试题 一、填空题 1.根据马克思对货币的历史考证和逻辑推断,货币产生于,是商品发展的必然结果。 2.价值尺度与流通手段是货币的两个最基本的,突出反映了货币的。 3.信用以为条件的单方面的转移。 4.在整个借贷期间利率固定不变,不随借贷资金的供求状况而波动的利率,称为。而利率随着的波动而定期调整变化的利率,称为浮动利率。 5.金融市场的组织形式主要有和两种方式。 6.我国的金融监管机构主要有、和保监会。 7.我国《商业银行法》规定,商业银行的资本充足率不得低于。 8.保险在经营中应坚持的原则是:、、补偿原则和近因原则。 9.我国的货币政策目标是保持,并以此促进经济增长。 10.外汇是以外币表示的支付手段和资产,其目的是用于。 二、单项选择题 1.金融理论研究的对象是() A.货币 B.商品 C.信用 D.银行 2.商业信用的典型形式是() A.委托代销 B.商品赊销 C.延期付款 D.预付货款 3.在现代市场经济中,在整个利率体系中处于主导作用的利率,是() A.市场利率 B.浮动利率 C.官方利率 D.固定利率 4.金融市场最基本的功能是() A.资源配置 B.融通资金 C.宏观调控 D.经济反映 5.为国家重点项目、重点产品和基础产业提供金融支持的银行是() A.中国进出口银行 B.国家开发银行

C.中国农业银行 D.中国工商银行 6.商业银行对最大十家客户发放贷款不得超过银行资本总额的() A.10% B.50% C.8% D.5%—7% 7.以各种形态的财产作为保险标的的保险,是() A.社会保险 B.财产保险 C.责任保险 D.人身保险() 8.针对货币供应总量或信用总量进行调节和控制的货币政策工具,属于() A.选择性货币政策工具 B.直接信用控制 C.间接信用控制 D.一般性货币政策工具 9.国际支付令绝大多数采用电信方式传递,故()是外汇市场的基准利率。 A.信汇汇率 B.中间汇率 C.票汇汇率 D.电汇汇率 10.()贷款是解决成员国中小型私营企业的资金需要。 A.国际货币基金组织 B.国际金融公司 C.亚洲开发银行 D.国际开发协会 三、多项选择题 1.纵观世界各国货币制度的演变过程,货币制度的类型有() A.银本位制 B.金本位制 C.金银复本位制 D.纸币制度 2.中央银行可以运用()手段达到调节经济的目的 A.法定准备金制度 B.公开市场业务 C.转贴现业务 D.利率调整 3.决定证券行市最基本的因素是() A.证券实际收益 B.市场利率 C.通货膨胀率 D.供求关系 4.下列银行中属于股份制商业银行的是() A.中国民生银行 B.深圳发展银行 C.中信实业银行 D.中国光大银行 5.商业银行经营管理的原则是() A.盈利性 B.安全性

(完整word版)互联网金融》系统性风险仿真模拟试题及答案.,推荐文档

基础知识——系统性风险仿真 一、单选(1-15) 1.有关互联网金融市场的企业准入标准、运作方式的合法性、()的身份认证、电子合同和电子签名的有效性确认等方面,尚无详细明确的法律规范。 A.从业者 B.管理者 C.开发者 D.交易者 2. 信用风险是指互联网金融交易者在合约到期日()其义务的风险。 A.不履行 B.不完整履行 C.不完全履行 D.选择性履行 3.有关信用风险,以下说法错误的是() A.目前我国征信体系已经比较完善 B.借款人的资料和信息很容易造假 C.p2p平台能够获取的信息非常有限 D.可以通过大数据等方式获取信用数据 4.关于互联网金融的法律与制度风险,说法正确的是() A.主体地位和经营范围尚不明确 B.监管体系尚不健全 C,交易主体权益保护机制缺失 D.以上都是 5.可能涉嫌非法吸收公众存款行为的主要模式是() A.p2p平台 B.p2p的债权转让模式 C.p2p的纯中介模式 D.p2p引入担保公司模式 6.法律规定,当互联网金融平台因为破产、兼并等情况退出时,消费者的资金怎么办?() A.全额退回 B.暂无相关具体规定 C.清算后看情况退回 D.不退回 7.通过扫描未知来源的二维码而丢失银行卡内资金的风险,属于() A.信息数据风险 B.技术风险 C.支付的风险 D.系统性风险 8.非法集资有非法性、公开性、()、社会性的四个基本特征。 A.隐蔽性 B.利诱性 C.集资性 D.传播性 9.以下不属于互联网金融市场风险的是() A.流动性风险 B.利率风险 C.法律风险 D.信用风险 10.以下不属于防范信息安全风险的方法的是() A.数据加密 B.加强投资人教育 C.数据备份 D.完善网络完全体系建设 11.导致互联网金融模式风险的原因有() A.模式创新过度 B.盈利模式模糊不定 C.模式扭曲 D.以上都是 12.以下不属于非法集资的特征的是() A.私密性 B.非法性 C.利诱性 D.社会性 13.流动性风险是指互联网金融机构在某个时点没有足够的资金满足客户()需求的风险。 A.投资 B.提现 C.存款 D.贷款 14.以下属于互联网金融市场风险的是()

公司金融学题库