Notes to the Financial Statements

28

15

15

11

34

34

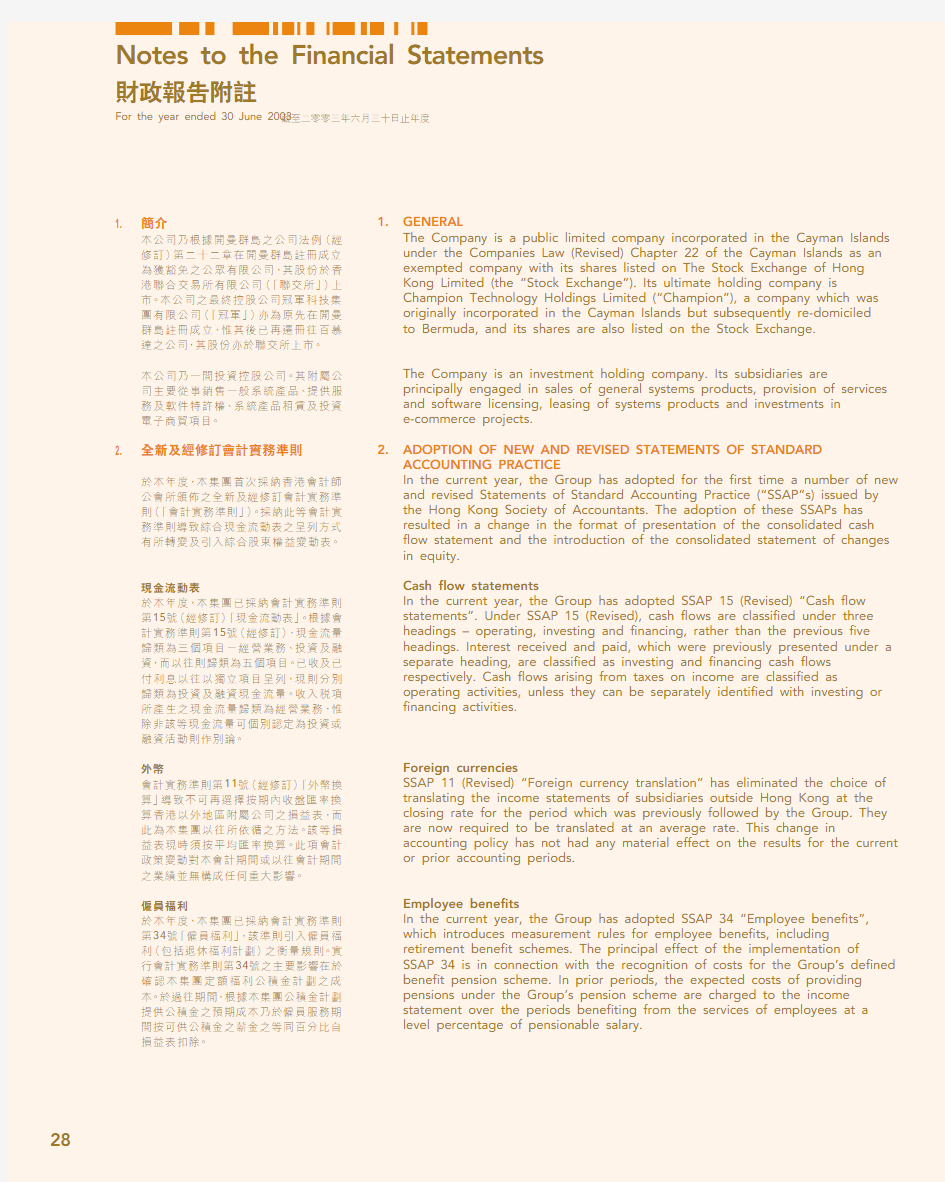

1.GENERAL

The Company is a public limited company incorporated in the Cayman Islands

under the Companies Law (Revised) Chapter 22 of the Cayman Islands as an

exempted company with its shares listed on The Stock Exchange of Hong

Kong Limited (the “Stock Exchange”). Its ultimate holding company is

Champion Technology Holdings Limited (“Champion”), a company which was

originally incorporated in the Cayman Islands but subsequently re-domiciled

to Bermuda, and its shares are also listed on the Stock Exchange.

The Company is an investment holding company. Its subsidiaries are

principally engaged in sales of general systems products, provision of services

and software licensing, leasing of systems products and investments in

e-commerce projects.

2.ADOPTION OF NEW AND REVISED STATEMENTS OF STANDARD

ACCOUNTING PRACTICE

In the current year, the Group has adopted for the first time a number of new

and revised Statements of Standard Accounting Practice (“SSAP”s) issued by

the Hong Kong Society of Accountants. The adoption of these SSAPs has

resulted in a change in the format of presentation of the consolidated cash

flow statement and the introduction of the consolidated statement of changes

in equity.

Cash flow statements

In the current year, the Group has adopted SSAP 15 (Revised) “Cash flow

statements”. Under SSAP 15 (Revised), cash flows are classified under three

headings – operating, investing and financing, rather than the previous five

headings. Interest received and paid, which were previously presented under a

separate heading, are classified as investing and financing cash flows

respectively. Cash flows arising from taxes on income are classified as

operating activities, unless they can be separately identified with investing or

financing activities.

Foreign currencies

SSAP 11 (Revised) “Foreign currency translation” has eliminated the choice of

translating the income statements of subsidiaries outside Hong Kong at the

closing rate for the period which was previously followed by the Group. They

are now required to be translated at an average rate. This change in

accounting policy has not had any material effect on the results for the current

or prior accounting periods.

Employee benefits

In the current year, the Group has adopted SSAP 34 “Employee benefits”,

which introduces measurement rules for employee benefits, including

retirement benefit schemes. The principal effect of the implementation of

SSAP 34 is in connection with the recognition of costs for the Group’s defined

benefit pension scheme. In prior periods, the expected costs of providing

pensions under the Group’s pension scheme are charged to the income

statement over the periods benefiting from the services of employees at a

level percentage of pensionable salary.

For the year ended 30 June 2003

Notes to the Financial Statements

29

Kantone Holdings Limited Annual Report 2003

2.

ADOPTION OF NEW AND REVISED STATEMENTS OF STANDARD ACCOUNTING PRACTICE – Continued Employee benefits – Continued

Under SSAP 34, the cost of providing retirement benefits under the Group’s defined benefit retirement benefit plan is determined using the projected unit credit method, with actuarial valuation being carried out annually. Actuarial gains and losses which exceed 10% of the greater of the present value of the Group’s pension obligations and fair value of plan assets are amortised over the expected average remaining working lives of the employees participating in the plan. Past service cost is recognised immediately to the extent that the benefits are already vested.

As a result of the changes described above, the Group has determined the transitional liability for its defined benefit plan at the date of adoption of SSAP 34 was HK$71,879,000 (of which HK$66,306,000 arose in prior year) more than the liability that would have been recognised at the same date using the previous accounting policy. This amount has been recognised immediately,with an adjustment of approximately HK$71,413,000 and HK$466,000 to the opening balances of accumulated profits and translation reserve at 1 July 2002respectively. The change in policy has resulted in a decrease in the net profit for the year ended 30 June 2002 amounted to HK$65,840,000.

3.

SIGNIFICANT ACCOUNTING POLICIES

The financial statements have been prepared under the historical cost

convention and in accordance with accounting principles generally accepted in Hong Kong. The principal accounting policies adopted are as follows:Basis of consolidation

The consolidated financial statements incorporate the financial statements of the Group made up to 30 June each year.

The results of subsidiaries acquired or disposed of during the year are included in the consolidated income statement from the effective dates of acquisition or up to the effective date of disposal, as appropriate.

All significant inter-company transactions and balances within the Group have been eliminated on consolidation.

Goodwill

Goodwill represents the excess of the cost of acquisition over the Group’s interest in the fair value of the identifiable assets and liabilities of a subsidiary at the date of acquisition.

Goodwill arising on acquisition prior to 1 July 2001 continues to be held in reserves and will be charged to the income statement at the time of disposal of the relevant subsidiary, or at such time as the goodwill is determined to be impaired.

Goodwill arising on acquisition after 1 July 2001 is capitalised and amortised on a straight line basis over its economic useful life. Goodwill arising on the acquisition of subsidiaries is presented separately in the balance sheet.

34 10%

34 71,879,000 66,306,000 71,413,000 466,000 65,840,000

30For the year ended 30 June 2003

Notes to the Financial Statements

3.SIGNIFICANT ACCOUNTING POLICIES – Continued

Revenue recognition

Sales of goods are recognised when goods are delivered and title has been

passed.

Service income is recognised when the services are rendered.

Income from licensing is recognised when the relevant licensing agreements

are formally concluded.

Rental income, including rental invoiced in advance from assets under

operating leases, is recognised on a straight line basis over the relevant lease

term.

Income from certain e-commerce projects where the Group is contracted to

receive a pre-determined minimum sum over the period of the projects is

allocated to accounting periods so as to reflect a constant periodic rate of

return on the net investment in these e-commerce projects. Income from other

e-commerce projects are recognised when the Group’s right to receive the

distributions has been established.

Interest income is accrued on a time basis by reference to the principal

outstanding and at the interest rate applicable.

Dividend income is recognised when the Group’s right to receive payment has

been established.

Property, plant and equipment

Property, plant and equipment are stated at cost less depreciation and

amortisation and any accumulated impairment losses.

Depreciation and amortisation are provided to write off the cost of property,

plant and equipment over their estimated useful lives, using the straight line

method, at the following rates per annum:

Freehold land Nil

Leasehold land and buildings Over the shorter of the remaining

unexpired terms of the

relevant leases or 50 years

Plant and machinery and10% – 50%

telecommunications networks

Assets held under finance leases are depreciated over their estimated useful

lives on the same basis as owned assets, or the terms of the leases, where

shorter.

The gain or loss arising from disposal or retirement of an asset is determined

as the difference between the sale proceeds and the carrying amount of the

asset and is recognised in the income statement.

50

10%-50%

31

Kantone Holdings Limited Annual Report 2003

3.

SIGNIFICANT ACCOUNTING POLICIES – Continued

Leases

Leases are classified as finance leases when the terms of the lease transfer substantially all the risks and rewards of ownership of the assets concerned to the Group. Assets held under finance leases are capitalised at their fair values at the date of acquisition. The corresponding liability to the lessor, net of

interest charges, is included in the balance sheet as a finance lease obligation of the Group. The finance costs, which represent the difference between the total leasing commitments and the fair value of the assets acquired, are

charged to the income statement over the period of the relevant lease so as to produce a constant periodic rate of charge on the remaining balance of the obligations for each accounting period.

All other leases are classified as operating leases and the rentals payable are charged to the income statement on a straight line basis over the relevant lease term.

Investments in subsidiaries

Investments in subsidiaries are included in the balance sheet of the Company at carrying value, less any identified impairment loss. Results of subsidiaries are accounted for by the Company on the basis of dividends received or receivable during the year.

Systems and networks

Systems and networks are stated at cost less amortisation and any accumulated impairment losses.

Systems and networks represent all direct costs incurred by the Group in setting up systems and networks, including the cost of equipment,development cost and subcontracting expenditure. Such assets are recognised only if all of the following conditions are met:–an asset is created that can be identified (such as software and new processes);

–it is probable that the asset created will generate future economic benefits; and

–

the development cost of the asset can be measured reliably.

Development cost that cannot fullfil the above conditions is recognised as an

expense in the period in which it is incurred. Systems and networks that fullfil the above conditions are amortised on a straight line basis over their estimated useful lives, subject to a maximum of five years.

32For the year ended 30 June 2003

Notes to the Financial Statements

3.SIGNIFICANT ACCOUNTING POLICIES – Continued

Investments in e-commerce projects

Investments in e-commerce projects are stated at cost less amortisation and

any accumulated impairment losses.

Investments in e-commerce projects represent the Group’s investment costs

incurred on internet-based business projects over which the Group receives

distributions from these projects based on an agreed percentage of the net

revenue of each project or a pre-determined guaranteed return over a fixed

period of time. Payments receivables each year for projects with pre-

determined guaranteed return are apportioned between income and

reduction of the carrying value of the investments so as to reflect a constant

periodic rate of return on the net investment in these e-commerce projects.

The investment costs of other projects are written off using the straight line

method over the estimated life of the individual project from the date of

commencement of commercial operations subject to a maximum of five years.

Where the estimated recoverable amount of these investments falls below

their carrying amount, the carrying amount of the investments, to the extent

that it is considered to be irrecoverable, is written off immediately to the

income statement.

Investments in securities

Investments in securities are recognised on a trade-date basis and are initially

measured at cost.

Investments other than held-to-maturity debt securities are classified as

investment securities and other investments.

Investment securities, which are securities held for an identified long term

strategic purpose, are measured at subsequent reporting dates at cost, as

reduced by any identified impairment loss.

Other investments are measured at fair value, with unrealised gains and losses

included in the net profit or loss for the year.

Inventories

Inventories are stated at the lower of cost and net realisable value. Cost is

calculated using the first-in, first-out method.

Taxation

The charge for taxation is based on the results for the year after adjusting for

items which are non-assessable or disallowed. Certain items of income and

expense are recognised for tax purposes in a different accounting period from

that in which they are recognised in the financial statements. The tax effect of

the resulting timing differences, computed using the liability method, is

recognised as deferred taxation in the financial statements to the extent that it

is probable that a liability or an asset will crystallise in the foreseeable future.

Impairment

At each balance sheet date, the Group reviews the carrying amounts of its

assets to determine whether there is any indication that those assets have

suffered an impairment loss. If the recoverable amount of an asset is estimated

to be less than its carrying amount, the carrying amount of the asset is

reduced to its recoverable amount. An impairment loss is recognised as an

expense immediately.

33

Kantone Holdings Limited Annual Report 2003

3.

SIGNIFICANT ACCOUNTING POLICIES – Continued Impairment – Continued

Where an impairment loss subsequently reverses, the carrying amount of the asset is increased to the revised estimate of its recoverable amount, so that the increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised for the asset in prior years. A reversal of an impairment loss is recognised as income immediately.

Research and development costs

Research costs are charged to the income statement in the year in which they are incurred. Development costs are charged to the income statement in the year in which it is incurred except where a major project is undertaken and it is reasonably anticipated that development costs will be recovered through future commercial activity. Such development costs are deferred and written off over the life of the project from the date of commencement of commercial operation subject to a maximum of five years.

Foreign currencies

Transactions in foreign currencies are translated at the approximate rates ruling on the dates of the transactions. Monetary assets and liabilities

denominated in foreign currencies are re-translated at the rates ruling on the balance sheet date. Gains and losses arising on exchange are dealt with in the income statement.

In preparing the consolidated financial statements, the results of operations outside Hong Kong are translated using the average exchange rates for the year. The assets and liabilities of the operations outside Hong Kong are

translated using the rates ruling on the balance sheet date. On consolidation,any differences arising on translation of operations outside Hong Kong are dealt with in the translation reserve.

Retirement benefit cost

Payments to the Group’s defined contribution retirement benefit schemes are charged as expenses as they fall due.

For the Group’s defined benefit retirement benefit schemes, the cost of

providing benefits is determined using the projected unit credit method, with actuarial valuation being carried out at each balance sheet date. Actuarial gains and losses which exceed 10% of the greater of the present value of the Group’s pension obligations and the fair value of scheme assets are amortised over the expected average remaining working lives of the participating

employees. Past service cost is recognised immediately to the extent that the benefits are already vested, and otherwise is amortised on a straight line basis over the average period until the amended benefits become vested.The amount recognised in the balance sheet represents the present value of the defined benefit obligation as adjusted for unrecognised actuarial gains and losses and unrecognised past service cost, and as reduced by the fair value of scheme assets.

4.

TURNOVER AND SEGMENT INFORMATION

Turnover represents the net amounts received and receivable for goods sold and services provided by the Group to outside customers and distributions received and receivable from the Group’s investments in e-commerce projects during the year.

10%

34

For the year ended 30 June 2003

Notes to the Financial Statements

4.

TURNOVER AND SEGMENT INFORMATION – Continued (a)Business segments

For management purposes, the Group is currently organised into four main operating business – sales of general systems products, provision of services and software licensing, leasing of systems products and

investments in e-commerce projects. These businesses are the basis on which the Group reports its primary segment information.

Sales of Provision of Investments

general services and Leasing of in

systems software systems e-commerce

products licensing

products projects Consolidated

HK$’000

HK$’000HK$’000

HK$’000

HK$’000

Year ended 30 June 2003 TURNOVER

External and total revenue 618,906

171,980

17,609

6,240

814,735

RESULTS Segment result

39,826

72,401

11,084

(2,661)

120,650

Interest income

3,875 Unallocated corporate expenses (177)

Profit from operations

124,348

Gain on disposal of subsidiaries 156 Finance costs (13,493) Profit before taxation 111,011

Taxation

(661) Profit before minority interests 110,350

Minority interests (10)

Net profit for the year 110,340

As at 30 June 2003

ASSETS

Segment assets

282,322

490,946

13,038

154,747

941,053 Unallocated corporate assets 81,619 Consolidated total assets 1,022,672 LIABILITIES

Segment liabilities

104,083

24,824

11,866

–

140,773 Unallocated corporate liabilities 189,733 Consolidated total liabilities 330,506

OTHER INFORMATION

Capital additions of property, plant and equipment

3,763

9381,287

–5,988 Capital additions of deposits –39,000––39,000 Capital additions of systems and networks

–78,000––78,000

Depreciation and amortisation 19,394

59,032

5,986

27,173

111,585

Gain on disposal of property, plant and equipment

2–––2 Gain on disposal of interest in e-commerce projects

–––33,72333,723 Impairment loss recognised for

interest in e-commerce projects

–

–

–

15,345

15,345

35

Kantone Holdings Limited Annual Report 2003

4.

TURNOVER AND SEGMENT INFORMATION – Continued (a)Business segments – Continued

Sales of Provision of Investments

general services and Leasing of in

systems software systems e-commerce

products

licensing

products

projects Consolidated

HK$’000

HK$’000

HK$’000

HK$’000

HK$’000

(restated)

(restated)

(restated)

(restated)

Year ended 30 June 2002 TURNOVER

External and total revenue 632,380

42,048

41,867

6,065

722,360

RESULTS Segment result

53,925

(13,684)

(20,002)

(9,807)

10,432

Interest income

3,735 Unallocated corporate expenses (2,121) Profit from operations 12,046 Finance costs (14,552) Loss before taxation (2,506)

Taxation

(72) Net loss for the year (2,578)

As at 30 June 2002

ASSETS

Segment assets

236,875

323,170

43,345

182,263

785,653 Unallocated corporate assets 141,756 Consolidated total assets 927,409 LIABILITIES

Segment liabilities

88,590

19,416

30,304

50

138,360 Unallocated corporate liabilities 200,190 Consolidated total liabilities 338,550

OTHER INFORMATION

Capital additions of property, plant and equipment

7,469

1,6382,472

–11,579 Capital additions of deposits –83,797––83,797

Depreciation and amortisation 22,827

20,561

6,25429,644

79,286 Loss on disposal of property, plant and equipment

––209–209 Impairment loss recognised for investments in securities –––3,8873,887 Gain on disposal of interest in

e-commerce projects

–

–

–

17,922

17,922

36

For the year ended 30 June 2003

Notes to the Financial Statements

4.

TURNOVER AND SEGMENT INFORMATION – Continued

(b)Geographical segments

(i)The following table provides an analysis of the Group ’s revenue by

geographical market, irrespective of the origin of the goods/services:

(i)

Revenue by

Profit (loss)geographical segment

from operations

Year ended 30 June

Year ended 30 June

2003

2002

2003

2002

HK$’000

HK$’000

HK$’000

HK$’000

(restated)

People ’s Republic of China, including Hong Kong and Macau 526,450457,89572,24499,103 Europe 240,270222,36916,070(75,111) Others

48,01542,09636,034(11,946) Consolidated total

814,735

722,360

124,348

12,046

(ii)The following is an analysis of the carrying amount of segment assets,

and capital additions to property, plant and equipment, systems and networks, and interest in e-commerce projects, analysed by the geographical location to which the assets are located:

Carrying amount of segment assets

Capital additions

At 30 June

At 30 June

2003

2002

2003

2002

HK$’000

HK$’000

HK$’000

HK$’000

People ’s Republic of China, including Hong Kong and Macau 728,135595,82278,01083,819 Europe 141,293176,8624,58110,338 Others

153,244154,72540,3971,219

Consolidated total

1,022,672

927,409

122,988

95,376

(ii)

5.

OTHER OPERATING INCOME

Included in other operating income is interest income of HK$3,875,000 (2002:HK$3,735,000).

3,875,000 3,735,000

37

Kantone Holdings Limited Annual Report 2003

6.PROFIT FROM OPERATIONS

2003

2002

HK$’000HK$’000

(restated)

Profit from operations has been arrived at after charging: Directors ’ remuneration (Note)1,8082,449

Staff costs

77,984

87,954 Actuarial losses recognised

–66,472 Retirement benefit scheme contribution 5,5043,845

Total staff costs

85,296160,720 Amortisation of investments in e-commerce projects 27,17329,644 Amortisation of systems and networks

55,28116,554 Depreciation and amortisation of property, plant and equipment

Owned assets

27,98532,093 Assets under finance leases 1,146995

Total depreciation and amortisation

111,58579,286

Auditors ’ remuneration

1,4871,704

Cost of inventories recognised

367,635

469,827

Loss on disposal of property, plant and equipment –209 Minimum lease payments paid under operating leases in respect of: Rented premises

2,0542,127 Machinery and equipment 5,451

6,191

and after crediting:

Rental income from leasing of machinery and equipment 17,609

41,867

Gain on disposal of property, plant and equipment

2–

Note:

Information regarding directors ’ and employees ’ emoluments

2003

2002

HK$’000

HK$’000

Directors

Fees to independent non-executive directors 4044 Other emoluments to executive directors: Salaries and other benefits

1,4081,802

Retirement benefit scheme contribution

3606031,808

2,449

38

For the year ended 30 June 2003

Notes to the Financial Statements

6.PROFIT FROM OPERATIONS – Continued

Note: – Continued

Information regarding directors ’ and employees ’ emoluments – Continued Emoluments of the directors were within the following bands:

Number of director(s)

2003

2002

1,000,000

Nil – HK$1,000,000

781,500,001 2,000,000 HK$1,500,001 – HK$2,000,0001–2,000,001 2,500,000

HK$2,000,001 – HK$2,500,000–1

Employees

The five highest paid individuals of the Group included one (2002: one) director of the Company, details of whose emoluments are set out above. The emoluments of the

remaining four (2002: four) highest paid employees of the Group, not being directors of the Company, are as follows:

2003

2002

HK$’000

HK$’000

Salaries and other benefits

4,023

3,677 Performance related incentive payments 9390

Retirement benefit scheme contribution 1672634,283

4,030

7.FINANCE COSTS

2003

2002

HK$’000

HK$’000

Interest on

Bank and other borrowings

– wholly repayable within five years 13,09314,001 – not wholly repayable within five years 190227

Finance charges on finance leases

21032413,493

14,552

Emoluments of these employees were within the following band:

Number of employee(s)

2003

2002

1,000,000

Nil – HK$1,000,000

121,000,001 1,500,000

HK$1,000,001 – HK$1,500,00032

39

Kantone Holdings Limited Annual Report 2003

8.TAXATION

2003

2002

HK$’000

HK$’000

The charge comprises:

Hong Kong Profits Tax

– current year

36113 – underprovision in prior years 2–

Taxation in other jurisdictions

475(44)51369 29 Deferred taxation (note 29)

1483661

72

Hong Kong Profits Tax is calculated at 17.5% (2002: 16%) on the estimated assessable profits derived from Hong Kong. Taxation in other jurisdictions is calculated at the rates prevailing in the respective jurisdictions.

The low effective tax rate is attributable to the fact that a substantial portion of the Group ’s profit neither arises in, nor is derived from, Hong Kong and is accordingly not subject to Hong Kong Profits Tax and such profit is also not subject to taxation in any other jurisdictions.

Details of deferred taxation for the year are set out in note 29.9.

DIVIDEND

2003

2002

HK$’000

HK$’000

Final dividend proposed in scrip form equivalent to

0.60 HK0.60 cents (2002: nil) per share,

with a cash option

13,326–

The proposed final dividend for 2003 is based on 2,220,961,752 shares in issue at 30 June 2003.

10.EARNINGS (LOSS) PER SHARE

The calculation of the earnings (loss) per share is based on the net profit for the year of HK$110,340,000 (2002 (restated): net loss of HK$2,578,000) and on the weighted average of 2,220,961,752 (2002: 2,220,961,752) shares in issue throughout the year.

The loss per share for the previous year has been adjusted to reflect the retrospective application of the changes in the Group ’s policy for retirement benefit costs.

There was no dilution effect on earnings (loss) per share as there were no dilutive potential ordinary shares in issue in both years.

17.5% 16%

29

2,220,961,752

110,340,000 2,578,000 2,220,961,752 2,220,961,752

40

For the year ended 30 June 2003

Notes to the Financial Statements

11.PROPERTY, PLANT AND EQUIPMENT

Plant and

machinery and tele-Land and communications

THE GROUP

buildings

networks

Total

HK$’000HK$’000

HK$’000

COST

At 1 July 2002

18,874293,511312,385 Currency realignment 1,501

24,56426,065 Additions –5,9885,988

Disposals –(9,275)(9,275) At 30 June 2003

20,375314,788335,163

DEPRECIATION AND AMORTISATION At 1 July 2002

3,847232,708236,555 Currency realignment 30819,35719,665 Provided for the year 38928,74229,131

Eliminated on disposals –(9,029)(9,029) At 30 June 20034,544271,778276,322

NET BOOK VALUES At 30 June 200315,83143,01058,841

At 30 June 2002

15,027

60,803

75,830

THE GROUP

2003

2002

HK$’000HK$’000

The net book values of the Group ’s property interests comprise: Freehold properties held outside Hong Kong 14,67113,917

Properties held outside Hong Kong under long leases

1,1601,11015,831

15,027

Net book value of plant and machinery and

telecommunications networks held under finance leases 1,021

1,978

The Group leases equipment to customers on operating lease terms. The net book value of such equipment, which is included in plant and machinery and telecommunications networks, is as follows: Customer equipment at cost 112,91799,035 Less: Accumulated depreciation 100,72980,893

Net book value

12,188

18,142

At 30 June 2003, certain land and buildings of the Group with a net book value of HK$9,524,000 (2002: HK$8,952,000) were pledged to a bank as security for banking facilities granted to the Group.

9,524,000 8,952,000

41

Kantone Holdings Limited Annual Report 2003

12.INVESTMENTS IN SUBSIDIARIES

THE COMPANY

2003

2002

HK$’000HK$’000

Unlisted shares, at carrying value

232,890

232,890

The carrying value of the unlisted shares is based on the book values of the underlying net assets of the subsidiaries at the time they became members of the Group under the group reorganisation in 1996.

Details of the Company ’s principal subsidiaries at 30 June 2003 are set out in note 40.

13.AMOUNTS DUE FROM (TO) SUBSIDIARIES

The Company

The amounts are unsecured, interest-free and have no fixed repayment terms.

Included in amounts due from subsidiaries at 30 June 2003 is an amount of approximately HK$13,785,000 (2002: HK$6,371,000) which is subordinated to a bank which granted credit facilities of approximately HK$80,423,000 (2002:HK$68,480,000) to a subsidiary during the year.

14.SYSTEMS AND NETWORKS

THE GROUP

2003

2002

HK$’000HK$’000

COST

At beginning of the year 176,32846,500

Acquired during the year 78,000–

Transferred from deposits 162,692129,828 At end of the year 417,020176,328 AMORTISATION

At beginning of the year 16,554– Provided for the year 55,28116,554 At end of the year 71,83516,554 NET BOOK VALUE

At end of the year

345,185

159,774

Systems and networks include all direct costs incurred in setting up and

development of internet based knowledge systems and networks. The Group ’s systems and networks are amortised over the estimated economic lives of the projects from the date of commencement of commercial operations subject to a maximum of five years.

40

13,785,000 6,371,000 80,423,000 68,480,000

42

For the Year Ended 30 June 2003

Notes to the Financial Statements

15.INTEREST IN E-COMMERCE PROJECTS

THE GROUP

2003

2002

HK$’000

HK$’000

Unlisted investments in e-commerce projects: – with guaranteed return 55,713–

– others

55,994160,812111,707

160,812

The Group has entered into agreements with third parties to invest in

e-commerce projects. These agreements have contract terms of 20 years over which the Group has the right to receive distributions based on an agreed percentage of the net revenue of each of these projects.(a)With guaranteed return

20

THE GROUP

2003

2002

HK$’000

HK$’000

Unlisted investments, at cost 71,058–

Impairment loss recognised (15,345)–55,713

–

During the year, the Group assigned the interest in certain e-commerce projects with an aggregate carrying value of approximately

HK$71,058,000 to three investment holding companies and in return obtained certain equity interests in these investment holding companies.Under the terms of the sale and purchase agreements, the Group is contracted to receive pre-determined sums of not less than the original beneficial interest of the revenue sharing arrangement as stated in the original revenue sharing agreements for the e-commerce projects. The pre-determined sums will be received for a period of 5 years by half-yearly instalments as a return on the investments in accordance with the Group ’s sale and purchase agreements.

During the year, the directors of the Company reviewed the carrying amount of the interest in e-commerce projects in light of the current market condition with reference to the financial results and business

operated by the investees. The directors identified an impairment loss of HK$15,345,000 (2002: nil) on the interest in e-commerce projects,estimated by reference to the fair value of the investments, and the

amount has been recognised in the income statement accordingly. In the opinion of the directors, the underlying values of the above investments are at least equal to their carrying values.

71,058,000 5

15,345,000 :

43

Kantone Holdings Limited Annual Report 2003

15.INTEREST IN E-COMMERCE PROJECTS – Continued

(b)Others

THE GROUP

2003

2002

HK$’000

HK$’000

COST

At beginning of the year 210,800

148,219

Transferred from deposits

–65,875 Transferred to interest in e-commerce projects with guaranteed return (148,219)– Disposals

(6,587)(3,294)

At end of the year

55,994

210,800

AMORTISATION

At beginning of the year 49,98820,344

Provided for the year

27,17329,644

Eliminated upon transfer to interest in e-commerce projects with guaranteed return (77,161)

– At end of the year –49,988

NET BOOK VALUE

55,994

160,812

During the year, the Group disposed of the interest in certain e-commerce projects with an aggregate carrying amount of HK$6,587,000 to an independent third party for a total consideration of HK$40,310,000.

16.INVESTMENTS IN SECURITIES

40,310,000 6,587,000

THE GROUP

Investment securities

2003

2002

HK$’000

HK$’000

Unlisted equity shares, at cost 3,8873,887

Less: Impairment loss recognised (3,887)

(3,887)

–

–

44

For the Year Ended 30 June 2003

Notes to the Financial Statements

17.DEPOSITS

Deposits were paid in connection with projects relating to the following:

THE GROUP

2003

2002

HK$’000

HK$’000

Systems and networks

39,000162,692

18.INVENTORIES

THE GROUP

2003

2002

HK$’000

HK$’000

Raw materials 15,74726,042 Work in progress 4,7393,931

Finished goods 10,84615,43131,332

45,404

Included above are raw materials of HK$nil (2002: HK$76,516) which are

carried at net realisable value.

19.TRADE AND OTHER RECEIVABLES

At 30 June 2003, the balance of trade and other receivables included trade receivables of HK$283,919,000 (2002: HK$79,883,000). The aged analysis of trade receivables at the reporting date is as follows:

76,516

283,919,000 79,883,000

THE GROUP

2003

2002

HK$’000

HK$’000

0 60 0 – 60 days 142,95663,78061 90 61 – 90 days 28,70110,00691 180 91 – 180 days 96,8351,536> 180

> 180 days 15,4274,561283,919

79,883

The Group maintains a well-defined credit policy regarding its trade customers dependent on their credit worthiness, nature of services and products,

industry practice and condition of the market with credit period ranging from 30 to 180 days.

30 180

45

Kantone Holdings Limited Annual Report 2003

20.DEPOSITS, BANK BALANCES AND CASH

THE GROUP

THE COMPANY

2003

2002

2003

2002

HK$’000

HK$’000

HK$’000

HK$’000

Interest bearing deposits 71,693136,021––

Bank balances and cash 8,99823,52736680,691

159,548

36

6

21.TRADE AND OTHER PAYABLES

At 30 June 2003, the balance of trade and other payables included trade

payables of HK$10,623,000 (2002: HK$13,614,000). The aged analysis of trade payables at the reporting date is as follows:

10,623,000 13,614,000

THE GROUP

2003

2002

HK$’000

HK$’000

0 60 0 – 60 days 2,6976,48861 90 61 – 90 days 3,9672,56391 180 91 – 180 days 1,3243,754> 180

> 180 days 2,63580910,623

13,614

22.WARRANTY PROVISION

THE GROUP

2003

2002

HK$’000

HK$’000

At 1 July 2002

1,9591,669 Currency realignment 244217 Provided during the year 2,3183,588

Utilised during the year (2,463)(3,515)

At 30 June 2003

2,058

1,959

The warranty provision represents the management ’s best estimate of the

Group ’s liability under 12 month warranties granted on manufactured products, based on prior experience and industry average for defective products.

12

46

For the Year Ended 30 June 2003

Notes to the Financial Statements

23.RETIREMENT BENEFITS SCHEMES

Defined contribution scheme

Certain subsidiaries of the Group have a retirement benefit scheme covering a portion of their employees. The assets of the scheme are held separately from those of the Group in funds under the control of an independent trustee.

The retirement benefit scheme contributions charged to the income statement represent contributions payable to the funds by the Group at rates specified in the rules of the scheme. Where there are employees who leave the scheme prior to vesting fully in the contributions, the contribution payable by the Group is reduced by the amount of forfeited contributions.

Commencing from December 2000, the Group enrolled all eligible employees in Hong Kong into a mandatory provident fund (the “MPF ”) scheme. The retirement benefit cost of the MPF scheme charged to the consolidated

income statement represents contributions to the MPF scheme by the Group at rates specified in the rules of the MPF scheme.

During the year, retirement benefits scheme contributions paid for the above schemes, net of nil (2002: nil) forfeited contributions, amounted to HK$940,000 (2002: HK$580,000).

Defined benefit scheme

Certain subsidiaries of the Group operates a self-administered, funded pension scheme. The scheme provides defined pension benefits related to service, and final earnings and capital sums on death. Membership is optional for all staff paid monthly and aged over 21 years.

The contributions which are determined by a qualified actuary on the basis of triennial valuations using the projected unit credit method are charged to the income statement. Under the scheme, the employees are entitled to a pension between 1.67% and 2.50% of final salary for each year of pensionable service at a normal age of 65. No other post-retirement benefits are provided. The most recent actuarial valuations of scheme assets and the present value of the defined benefit obligations were carried out at 1 January 2002 by Mr. Mick O ’Loan, Fellow of the Institute of Actuaries, and was updated to 30 June 2003for the accounting reporting purpose. The assumptions which have the most significant effect on the results of the valuation are those relating to the rate of return on investments and the rates of increase in salaries, pensions and share dividends.

The main actuarial assumptions used were as follows:

940,000 580,000

21

65 1.67% 2.50% Mick O ’Loan

2003

2002

Discount rate

5.25% 5.75% Expected return on scheme assets

6.63% 6.76% Expected rate of salary increase 3.50% 4.25% Future pension increases 2.50% 2.75%

47

Kantone Holdings Limited Annual Report 2003

23.RETIREMENT BENEFITS SCHEMES – Continued

Defined benefit scheme – Continued

The actual valuation updated to 30 June 2003 showed that the market value of the scheme assets was HK$159,303,000 (2002: HK$161,483,000) and that the actuarial value of these assets represented 59% (2002: 69%) of the

benefits that had accrued to members. The shortfall of HK$4,289,000, which is the excess of net unrecognised actuarial losses over the greater of 10% of the fair value of scheme assets and 10% of the present value of funded

obligations, is to be cleared over the estimated remaining service period of current membership of 10 years.

Amounts recognised in the consolidated income statement in respect of the defined benefit pension scheme are as follows:

159,303,000 161,483,000 59% 69% 4,289,000 10% 10% 10

2003

2002

HK$’000

HK$’000

Current service cost 4,924

3,868

Interest cost

–11,757 Expected return on scheme assets –(12,354)

Net actuarial losses –66,4724,924

69,743

The charge for the year has been included in general and administrative expenses.

The amount included in the balance sheet arising from the Group ’s obligations in respect of its defined benefit pension scheme is as follows:

2003

2002

HK$’000

HK$’000

Fair value of scheme assets

159,303161,483 Present value of funded obligations (268,562)(233,362)

Unrecognised actuarial losses 31,145–(78,114)

(71,879)

Movements in the net liability in the both years were as follows:

2003

2002

HK$’000

HK$’000

At beginning of the year (71,879)(5,573)

Currency realignment

(6,487)(467) Amount charged to the consolidated income statement (4,924)(69,743) Contributions 5,1763,904

At end of the year

(78,114)

(71,879)