answerMSFATIIq4

MSFATIIq4

Student: ___________________________________________________________________________

1. Ontario Resources, a natural energy supplier, borrowed $80 million cash on November 1, 2013, to fund a geological survey. The loan was made by Quebec Banque under a short-term credit line. Ontario Resources issued a 9-month, 12% promissory note with interest payable at maturity. Ontario Resources' fiscal period is the calendar year.

Required:

1. Prepare the journal entry for the issuance of the note by Ontario Resources.

2. Prepare the appropriate adjusting entry for the note by Ontario Resources on December 31, 201

3. Show calculations.

3. Prepare the journal entry for the payment of the note at maturity. Show calculations.

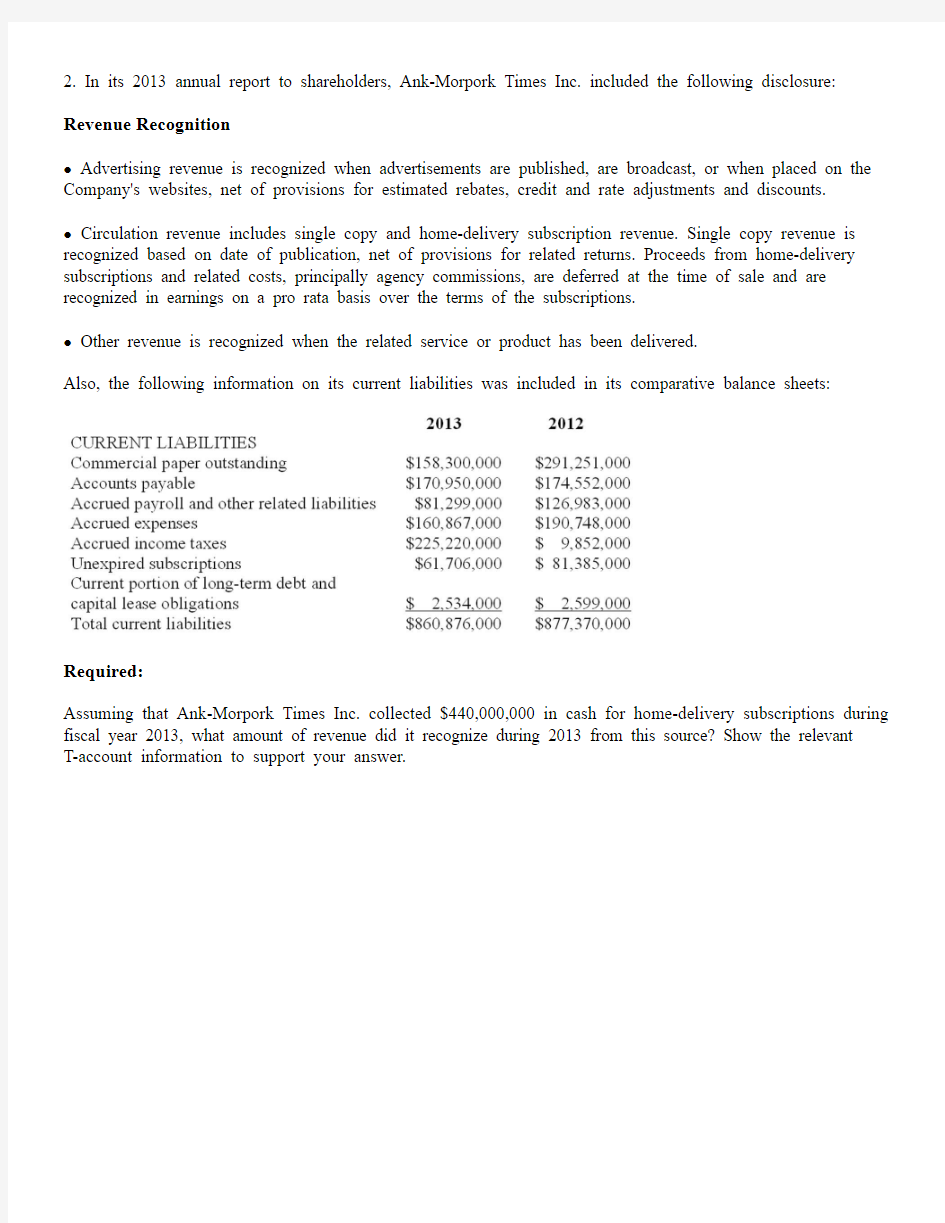

2. In its 2013 annual report to shareholders, Ank-Morpork Times Inc. included the following disclosure: Revenue Recognition

? Advertising revenue is recognized when advertisements are published, are broadcast, or when placed on the Company's websites, net of provisions for estimated rebates, credit and rate adjustments and discounts.

? Circulation revenue includes single copy and home-delivery subscription revenue. Single copy revenue is recognized based on date of publication, net of provisions for related returns. Proceeds from home-delivery subscriptions and related costs, principally agency commissions, are deferred at the time of sale and are recognized in earnings on a pro rata basis over the terms of the subscriptions.

? Other revenue is recognized when the related service or product has been delivered.

Also, the following information on its current liabilities was included in its comparative balance sheets:

Required:

Assuming that Ank-Morpork Times Inc. collected $440,000,000 in cash for home-delivery subscriptions during fiscal year 2013, what amount of revenue did it recognize during 2013 from this source? Show the relevant

T-account information to support your answer.

3. MullerB Company's employees earn vacation time at the rate of 1 hour per 40-hour work period. The vacation pay vests immediately, meaning an employee is entitled to the pay even if employment terminates. During 2013, total wages paid to employees equaled $808,000, including $8,000 for vacations actually taken in 2013, but not including vacations related to 2013 that will be taken in 201

4. All vacations earned before 2013 were taken before January 1, 2013. No accrual entries have been made for the vacations.

Required:

Prepare the appropriate adjusting entry for vacations earned but not taken in 2013.

4. The following facts relate to gift cards sold by Sunbru Coffee Company during 2013. Sunbru's fiscal year ends on December 31.

(a.) In October 2013, sold $3,000 of gift cards, and redeemed $500 of those gift cards.

(b.) In November 2013, sold $4,000 of gift cards, and redeemed $1,400 of October gift cards and $700 of November gift cards.

(c.) In December 2013, sold $3,000 of gift cards, and redeemed $200 of October gift cards, $2,000 of November gift cards, and $400 of December gift cards.

(d.) Sunbru views a gift card to be "broken" (with a remote probability of redemption) two months after the end of the month in which it is sold. Thus, an unredeemed gift card sold at any time during July would be viewed as broken as of September 30.

Required:

1. Prepare all journal entries appropriate to be recorded only during the month of December 2013 relevant to gift card sales, gift card redemptions, and gift card breakage.

2. Determine the balance of the unearned revenue liability to be reported in the December 31, 2013, balance sheet. Show the relevant T-account information to support your answer.

In its 2013 annual report to shareholders, the Goodday Chemical Company included the following disclosure note excerpts on CONTINGENCIES in its annual report to shareholders:

At December 31, 2013, Goodday had recorded liabilities aggregating $66.5 million for anticipated costs related to various environmental matters, primarily the remediation of numerous waste disposal sites and certain properties sold by Goodday. These costs include legal and consulting fees, site studies, the design and implementation of remediation plans, post-remediation monitoring and related activities and will be paid over several years. The amount of Goodday's ultimate liability in respect of these matters may be affected by several uncertainties, primarily the ultimate cost of required remediation and the extent to which other responsible parties contribute.

At December 31, 2013, Goodday had recorded liabilities aggregating $218.7 million for potential product liability and other tort claims, including related legal fees expected to be incurred, presently asserted against Goodday. The amount recorded was determined on the basis of an assessment of potential liability using an analysis of available information with respect to pending claims, historical experience, and, where available, current trends.

Goodday is a defendant in numerous lawsuits involving at December 31, 2013, approximately 63,000 claimants alleging various asbestos-related personal injuries purported to result from exposure to asbestos in certain rubber-coated products manufactured by Goodday in the past or in certain Goodday facilities. Typically, these lawsuits have been brought against multiple defendants in state and federal courts. In the past, Goodday has disposed of approximately 22,000 cases by defending and obtaining the dismissal thereof or by entering into a settlement. Goodday has policies and coverage-in-place agreements with certain of its insurance carriers that cover a substantial portion of estimated indemnity payments and legal fees in respect of the pending claims. At December 31, 2013, Goodday has recorded an asset in the amount it expects to collect under the policies and coverage-in-place agreements with certain carriers related to its estimated asbestos liability. Goodday has also commenced discussions with certain of its excess coverage insurance carriers to establish arrangements in respect of their policies.

Subject to the uncertainties referred to above, Goodday has concluded that in respect of any of the above described liabilities, it is not reasonably possible that it would incur a loss exceeding the amount recognized at December 31, 2013, with respect thereto which would be material relative to the consolidated financial position, results of operations, or liquidity of Goodday.

5. Briefly explain the GAAP requirement from which the costs/obligations for environmental cleanup and product liability/tort claim matters were accrued in the financial statements.

6. What is the point of the last paragraph of the Goodday disclosure? Explain in terms of authoritative GAAP.

7. Show the summary journal entry that Goodday recorded for the environmental cleanup and product

liability/tort claim matters, described in the footnote disclosure.

8. The following selected transactions relate to contingencies of Eastern Products Inc., which began operations in July 2013. Eastern's fiscal year ends on December 31. Financial statements are published in April 2014.

1. No customer accounts have been shown to be uncollectible as yet, but Eastern estimates that 3% of credit sales will eventually prove uncollectible. Sales were $300 million (all credit) for 2013.

2. Eastern offers a one-year warranty against manufacturer's defects for all its products. Industry experience indicates that warranty costs will approximate 2% of sales. Actual warranty expenditures were $

3.5 million in 2013 and were recorded as warranty expense when incurred.

3. In December 2013, Eastern became aware of an engineering flaw in a product that poses a potential risk of injury. As a result, a product recall appears inevitable. This move would likely cost the company $1.5 million.

4. In November 2013, the State of Vermont filed suit against Eastern, asking civil penalties and injunctive relief for violations of clean water laws. Eastern reached a settlement with state authorities to pay $4.2 million in penalties on February 3, 2014.

5. Eastern is the plaintiff in a $40 million lawsuit filed against a customer for costs and lost profits from contracts rejected in 2013. The lawsuit is in final appeal and attorneys advise that it is virtually certain that Eastern will be awarded $30 million.

Required:

Prepare the appropriate journal entries that should be recorded as a result of each of these contingencies. If no journal entry is indicated, state why.

9. In 2013, Cap City Inc. introduced a new line of televisions that carry a two-year warranty against manufacturer's defects. Based on past experience with similar products, warranty costs are expected to be approximately 1% of sales during the first year of the warranty and approximately an additional 3% of sales during the second year of the warranty. Sales were $6,000,000 for the first year of the product's life and actual warranty expenditures were $29,000. Assume that all sales are on credit.

Required:

1. Prepare journal entries to summarize the sales and any aspects of the warranty for 2013.

2. What amount should Cap City report as a liability at December 31, 2013?

MSFATIIq4 Key

1. Ontario Resources, a natural energy supplier, borrowed $80 million cash on November 1, 2013, to fund a geological survey. The loan was made by Quebec Banque under a short-term credit line. Ontario Resources issued a 9-month, 12% promissory note with interest payable at maturity. Ontario Resources' fiscal period is the calendar year.

Required:

1. Prepare the journal entry for the issuance of the note by Ontario Resources.

2. Prepare the appropriate adjusting entry for the note by Ontario Resources on December 31, 201

3. Show calculations.

3. Prepare the journal entry for the payment of the note at maturity. Show calculations.

AACSB: Analytic

AICPA FN: Measurement

Blooms: Apply

Difficulty: 2 Medium

Learning Objective: 13-02 Account for the issuance and payment of various forms of notes and record the interest on the notes.

Learning Objective: 13-03 Characterize accrued liabilities and liabilities from advance collection and describe when and how they should be recorded.

Spiceland - Chapter 13 #106

Topic: Accrued liabilities

Topic: Short-term notes payable

2. In its 2013 annual report to shareholders, Ank-Morpork Times Inc. included the following disclosure: Revenue Recognition

? Advertising revenue is recognized when advertisements are published, are broadcast, or when placed on the Company's websites, net of provisions for estimated rebates, credit and rate adjustments and discounts.

? Circulation revenue includes single copy and home-delivery subscription revenue. Single copy revenue is recognized based on date of publication, net of provisions for related returns. Proceeds from home-delivery subscriptions and related costs, principally agency commissions, are deferred at the time of sale and are recognized in earnings on a pro rata basis over the terms of the subscriptions.

? Other revenue is recognized when the related service or product has been delivered.

Also, the following information on its current liabilities was included in its comparative balance sheets:

Required:

Assuming that Ank-Morpork Times Inc. collected $440,000,000 in cash for home-delivery subscriptions during fiscal year 2013, what amount of revenue did it recognize during 2013 from this source? Show the relevant

T-account information to support your answer.

$459,679,000

AACSB: Analytic

AICPA FN: Measurement

Blooms: Analyze

Difficulty: 2 Medium

Learning Objective: 13-03 Characterize accrued liabilities and liabilities from advance collection and describe when and how they should be recorded.

Spiceland - Chapter 13 #119

Topic: Liabilities from advance collections

3. MullerB Company's employees earn vacation time at the rate of 1 hour per 40-hour work period. The vacation pay vests immediately, meaning an employee is entitled to the pay even if employment terminates. During 2013, total wages paid to employees equaled $808,000, including $8,000 for vacations actually taken in 2013, but not including vacations related to 2013 that will be taken in 201

4. All vacations earned before 2013 were taken before January 1, 2013. No accrual entries have been made for the vacations.

Required:

Prepare the appropriate adjusting entry for vacations earned but not taken in 2013.

AACSB: Analytic

AICPA FN: Measurement

Blooms: Apply

Difficulty: 3 Hard

Learning Objective: 13-03 Characterize accrued liabilities and liabilities from advance collection and describe when and how they should be recorded.

Spiceland - Chapter 13 #120

Topic: Accrued liabilities

4. The following facts relate to gift cards sold by Sunbru Coffee Company during 2013. Sunbru's fiscal year ends on December 31.

(a.) In October 2013, sold $3,000 of gift cards, and redeemed $500 of those gift cards.

(b.) In November 2013, sold $4,000 of gift cards, and redeemed $1,400 of October gift cards and $700 of November gift cards.

(c.) In December 2013, sold $3,000 of gift cards, and redeemed $200 of October gift cards, $2,000 of November gift cards, and $400 of December gift cards.

(d.) Sunbru views a gift card to be "broken" (with a remote probability of redemption) two months after the end of the month in which it is sold. Thus, an unredeemed gift card sold at any time during July would be viewed as broken as of September 30.

Required:

1. Prepare all journal entries appropriate to be recorded only during the month of December 2013 relevant to gift card sales, gift card redemptions, and gift card breakage.

2. Determine the balance of the unearned revenue liability to be reported in the December 31, 2013, balance sheet. Show the relevant T-account information to support your answer.

1.

2.

AACSB: Analytic

AICPA FN: Measurement

Blooms: Apply

Difficulty: 3 Hard

Learning Objective: 13-03 Characterize accrued liabilities and liabilities from advance collection and describe when and how they should be recorded.

Spiceland - Chapter 13 #121

Topic: Liabilities from advance collections

In its 2013 annual report to shareholders, the Goodday Chemical Company included the following disclosure note excerpts on CONTINGENCIES in its annual report to shareholders:

At December 31, 2013, Goodday had recorded liabilities aggregating $66.5 million for anticipated costs related to various environmental matters, primarily the remediation of numerous waste disposal sites and certain properties sold by Goodday. These costs include legal and consulting fees, site studies, the design and implementation of remediation plans, post-remediation monitoring and related activities and will be paid over several years. The amount of Goodday's ultimate liability in respect of these matters may be affected by several uncertainties, primarily the ultimate cost of required remediation and the extent to which other responsible parties contribute.

At December 31, 2013, Goodday had recorded liabilities aggregating $218.7 million for potential product liability and other tort claims, including related legal fees expected to be incurred, presently asserted against Goodday. The amount recorded was determined on the basis of an assessment of potential liability using an analysis of available information with respect to pending claims, historical experience, and, where available, current trends.

Goodday is a defendant in numerous lawsuits involving at December 31, 2013, approximately 63,000 claimants alleging various asbestos-related personal injuries purported to result from exposure to asbestos in certain rubber-coated products manufactured by Goodday in the past or in certain Goodday facilities. Typically, these lawsuits have been brought against multiple defendants in state and federal courts. In the past, Goodday has disposed of approximately 22,000 cases by defending and obtaining the dismissal thereof or by entering into a settlement. Goodday has policies and coverage-in-place agreements with certain of its insurance carriers that cover a substantial portion of estimated indemnity payments and legal fees in respect of the pending claims. At December 31, 2013, Goodday has recorded an asset in the amount it expects to collect under the policies and coverage-in-place agreements with certain carriers related to its estimated asbestos liability. Goodday has also commenced discussions with certain of its excess coverage insurance carriers to establish arrangements in respect of their policies.

Subject to the uncertainties referred to above, Goodday has concluded that in respect of any of the above described liabilities, it is not reasonably possible that it would incur a loss exceeding the amount recognized at December 31, 2013, with respect thereto which would be material relative to the consolidated financial position, results of operations, or liquidity of Goodday.

Spiceland - Chapter 13

5. Briefly explain the GAAP requirement from which the costs/obligations for environmental cleanup and product liability/tort claim matters were accrued in the financial statements.

GAAP regarding accounting for contingencies requires that contingent losses (and the corresponding obligations) be recorded (accrued) when the loss is both probable and the amount is known or reasonably estimable. Goodday based its analysis on pending claims, historical experience, and current trends, such as recent case verdicts with similar manufacturers.

AACSB: Analytic

AICPA FN: Measurement

Blooms: Analyze

Difficulty: 2 Medium

Learning Objective: 13-05 Identify situations that constitute contingencies and the circumstances under which they should be accrued.

Spiceland - Chapter 13 #126

Topic: Identify contingencies

6. What is the point of the last paragraph of the Goodday disclosure? Explain in terms of authoritative GAAP. GAAP regarding accounting for contingencies indicates that outcomes of contingent losses that are remote (i.e., less than reasonably possible) need not be accrued or disclosed in the financial statements and footnotes. This is a catchall statement by the company that any other possible losses not disclosed are excluded because of the remote probability assessed.

AACSB: Reflective Thinking

AICPA FN: Measurement

Blooms: Understand

Difficulty: 2 Medium

Learning Objective: 13-05 Identify situations that constitute contingencies and the circumstances under which they should be accrued.

Spiceland - Chapter 13 #127

Topic: Identify contingencies

7. Show the summary journal entry that Goodday recorded for the environmental cleanup and product

liability/tort claim matters, described in the footnote disclosure.

AACSB: Analytic

AICPA FN: Measurement

Blooms: Apply

Difficulty: 3 Hard

Learning Objective: 13-06 Demonstrate the appropriate accounting treatment for contingencies; including unasserted claims and assessments.

Spiceland - Chapter 13 #128

Topic: Accounting for contingencies

8. The following selected transactions relate to contingencies of Eastern Products Inc., which began operations in July 2013. Eastern's fiscal year ends on December 31. Financial statements are published in April 2014.

1. No customer accounts have been shown to be uncollectible as yet, but Eastern estimates that 3% of credit sales will eventually prove uncollectible. Sales were $300 million (all credit) for 2013.

2. Eastern offers a one-year warranty against manufacturer's defects for all its products. Industry experience indicates that warranty costs will approximate 2% of sales. Actual warranty expenditures were $

3.5 million in 2013 and were recorded as warranty expense when incurred.

3. In December 2013, Eastern became aware of an engineering flaw in a product that poses a potential risk of injury. As a result, a product recall appears inevitable. This move would likely cost the company $1.5 million.

4. In November 2013, the State of Vermont filed suit against Eastern, asking civil penalties and injunctive relief for violations of clean water laws. Eastern reached a settlement with state authorities to pay $4.2 million in penalties on February 3, 2014.

5. Eastern is the plaintiff in a $40 million lawsuit filed against a customer for costs and lost profits from contracts rejected in 2013. The lawsuit is in final appeal and attorneys advise that it is virtually certain that Eastern will be awarded $30 million.

Required:

Prepare the appropriate journal entries that should be recorded as a result of each of these contingencies. If no journal entry is indicated, state why.

Note: This is a loss contingency. Eastern can use the information occurring after the end of the year and before the financial statements are issued to determine appropriate disclosure. A disclosure note is also appropriate. 5. No entry. This is a gain contingency. Gain contingencies are not accrued even if the gain is probable and reasonably estimable. The gain should be recognized only when realized. A disclosure note is appropriate.

AACSB: Analytic

AICPA FN: Measurement

Blooms: Apply

Difficulty: 3 Hard

Learning Objective: 13-05 Identify situations that constitute contingencies and the circumstances under which they should be accrued.

Learning Objective: 13-06 Demonstrate the appropriate accounting treatment for contingencies; including unasserted claims and assessments.

Spiceland - Chapter 13 #129

Topic: Accounting for contingencies

Topic: Identify contingencies

9. In 2013, Cap City Inc. introduced a new line of televisions that carry a two-year warranty against manufacturer's defects. Based on past experience with similar products, warranty costs are expected to be approximately 1% of sales during the first year of the warranty and approximately an additional 3% of sales during the second year of the warranty. Sales were $6,000,000 for the first year of the product's life and actual warranty expenditures were $29,000. Assume that all sales are on credit.

Required:

1. Prepare journal entries to summarize the sales and any aspects of the warranty for 2013.

2. What amount should Cap City report as a liability at December 31, 2013?

AACSB: Analytic

AICPA FN: Measurement

Blooms: Apply

Difficulty: 2 Medium

Learning Objective: 13-06 Demonstrate the appropriate accounting treatment for contingencies; including unasserted claims and assessments.

Spiceland - Chapter 13 #137

Topic: Accounting for contingencies

MSFATIIq4 Summary

Category # of Questio

ns AACSB: Analytic 8 AACSB: Reflective Thinking 1 AICPA FN: Measurement 9 Blooms: Analyze 2 Blooms: Apply 6 Blooms: Understand 1 Difficulty: 2 Medium 5 Difficulty: 3 Hard 4 Learning Objective: 13-02 Account for the issuance and payment of various forms of notes and record the interest on the notes. 1

4 Learning Objective: 13-03 Characterize accrued liabilities and liabilities from advance collection and describe when and how they s

hould be recorded.

Learning Objective: 13-05 Identify situations that constitute contingencies and the circumstances under which they should be accru

3 ed.

3 Learning Objective: 13-06 Demonstrate the appropriate accounting treatment for contingencies; including unasserted claims and as sessments.

Spiceland - Chapter 13 10 Topic: Accounting for contingencies 3 Topic: Accrued liabilities 2 Topic: Identify contingencies 3 Topic: Liabilities from advance collections 2 Topic: Short-term notes payable 1